-

The investment managers new deal launches into a healthy aircraft market.

5h ago -

Many credit drivers are stable; agencies are being vigilant about several macroeconomic factors that might destabilize borrowers' ability to keep servicing their auto loan debt. One is student loan debt.

10h ago -

MBS buying has become the near-term focus but a 2026 offering is still possible, Federal Housing Finance Agency official Bill Pulte told Fox Business.

February 26 -

Senate Majority Leader John Thune, R-S.D., moved to consider the housing package next week, but it's not clear what version of the bill senators will be voting on as the House, Senate and White House are still negotiating priorities.

February 26 -

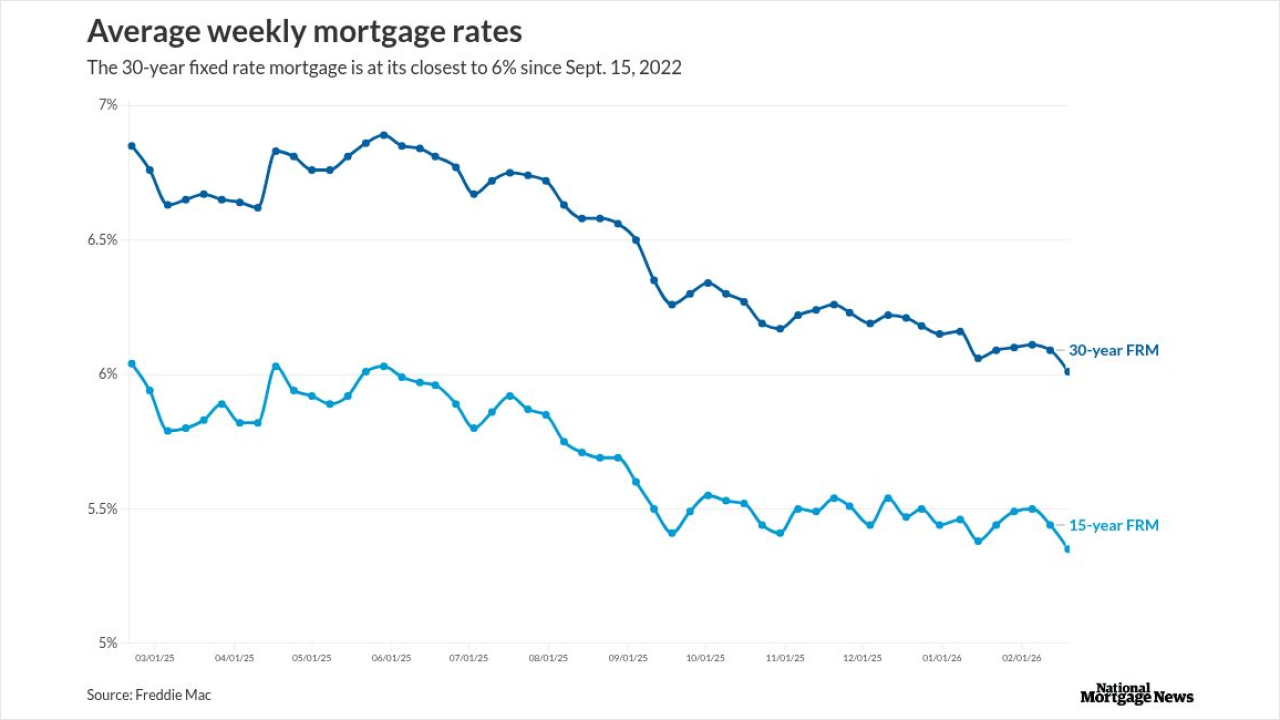

For the first time since early September 2022, the Freddie Mac Primary Mortgage Market Survey has the 30-year below 6%, but the 15-year gained this week.

February 26 -

First liens and junior liens account for 197 and 1,755 of the pool, respectively, DBRS said. They have unpaid balances of $30.5 million and $217 million, with FICO scores of 747 and 740 on a WA basis.

February 26 -

The Loan Store originated the largest portion of mortgages in the pool, 10.3%, according to Fitch, while an array of other lenders accounted for the rest.

February 25 -

After a long price correction in the art market, Bank of America is expanding its advisory services for collectors — and it's not alone.

February 25 -

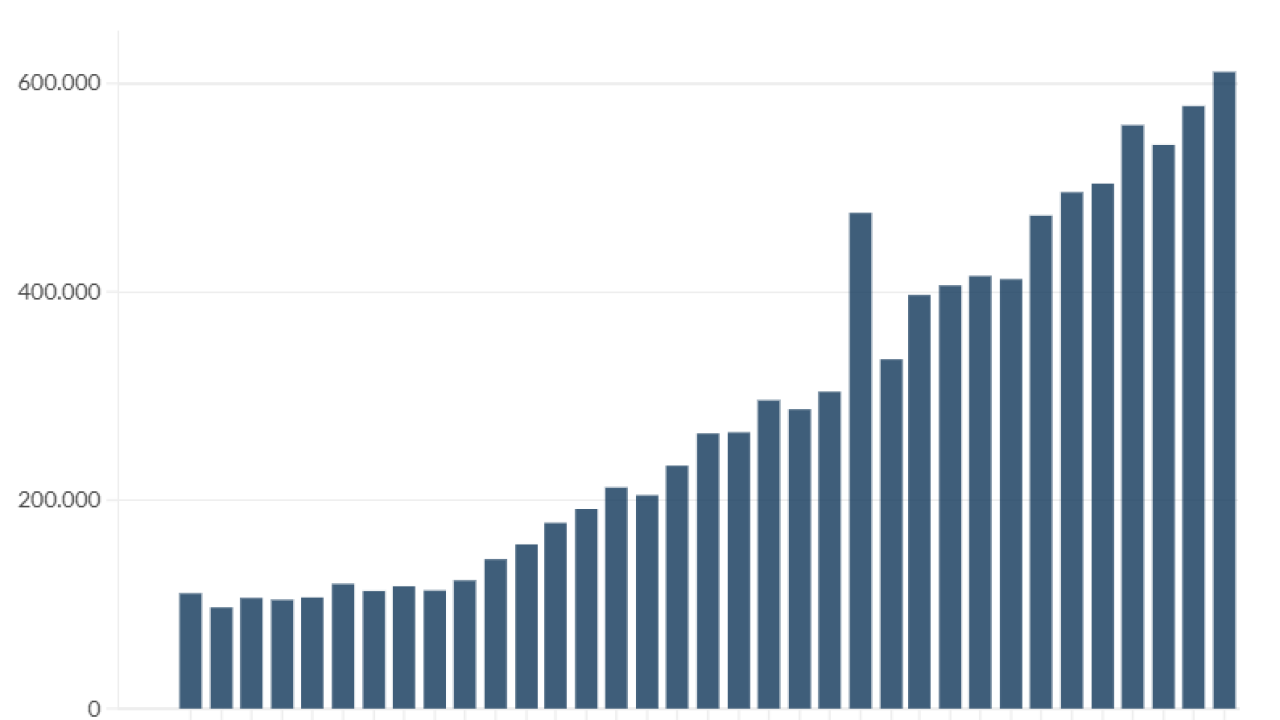

Total consumer debt in the United States hit $18.2 trillion by the end of last year, with $12.8 trillion attributed to first mortgages, according to Equifax.

February 25 -

Underwriting relied heavily on alternative documentation, led by debt-service coverage ratios (35.7%) and bank statements ranging from 12-23 months (28.2%) and longer than 24 months (4.6%).

February 25 -

Judges on the U.S. Court of Appeals for the District of Columbia struggled to find a resolution to an injunction issued last year that halted reductions-in-force by the Consumer Financial Protection Bureau.

February 24 -

At press time no injuries were reported, but exhibitors were relocated to satellite booths throughout the venue, the Aria Resort & Casino.

February 24 -

Federal Reserve Gov. Lisa Cook said AI could boost productivity, but warned the transition may raise unemployment and force difficult tradeoffs between inflation and jobs.

February 24 -

After closing, which is expected on February 27, coupons are expected to pay coupons of 4.83% on the notes rated AAA and 5.04% on the AAA-rated A1LCF.

February 24 -

The index will provide market professionals with consistent, transparent and dependable methods of evaluating performance and risk across the securitized credit markets.

February 23 -

Gatti will be based in the firm's Washington, D.C. office, where he focuses on structuring and executing asset-backed securities deals and other structured finance transactions.

February 23 -

Customers with a FICO of at least 700 accounted for about 75.3% of the PV systems by the aggregate discounted solar asset balance (ADSAB).

February 23 -

The CFPB is in an existential legal brawl against it's own acting director, Russell Vought, and President Donald Trump, whose confirmed goal is to kill the agency.

February 23 -

In a letter to regulators, the consortium of organizations recommended regulatory changes affecting a range of rules from risk weights to warehouse financing.

February 20 -

GSMBS 2026-PJ2's losses are based on a senior-subordinate, shifting-interest structure and Fitch expects a 10.3% final probability of default in the AAA rating stress.

February 20 -

The Buffalo-based bank didn't specify the size of potential losses from a suit that grew out of the collapse of subprime auto lender Tricolor Holdings. M&T said its trust subsidiary will "vigorously defend itself" against claims by investors who allege that it should have protected them from alleged fraud.

February 19 -

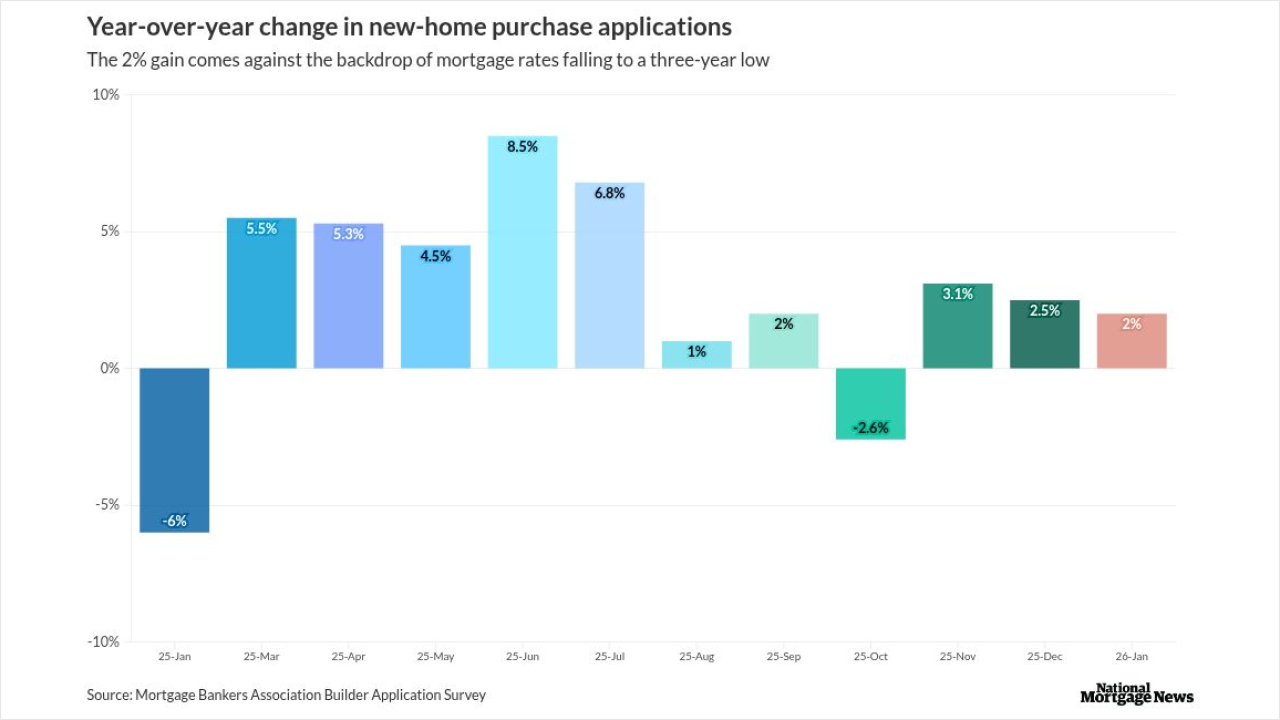

The increase in borrower activity came as housing starts ended 2025 on a high note, while mortgage rates were a percentage point lower year-over-year.

February 19 -

Interest payments on the class B notes might be deferred to allow the interest and principal on the class A notes if a sequential interest amortization period is in effect.

February 19 -

While the Freddie Mac survey recorded a weekly decline, the benchmark 10-year Treasury yield had moved back up by 6 basis points around midday on Thursday.

February 19 -

As finance chiefs feel the pressure to include AI in business models and work flows, the ABS industry is responding with leaner internal operations and reduced human errors.

February 19 -

Leverage is moderate on the assets, noting that the series A, B and C notes have loan-to-value (LTV) levels of 72.4%, 831% and 96.8%, respectively.

February 18 -

Federal Reserve Vice Chair for Supervision Michelle Bowman said in comments Wednesday that the central bank plans to publish its Basel III endgame capital proposal for public comment before the end of March.

February 18 -

A White House Council of Economic Advisers report published Tuesday found that the CFPB cost consumers between $237 and $369 billion since its creation, an analysis that consumer advocates and some financial academics say is flawed.

February 18 -

Bergman sees record-pace changes in capital markets, as reforms fuel securitization growth.

February 18 -

In a speech Tuesday, Federal Reserve Gov. Michael Barr said it was possible that artificial intelligence will boost productivity in an undisruptive way. But he said policymakers should also be wary of a financial crash if those gains are not realized or a rapid adoption that could lead to labor displacement.

February 17 -

If the senior leverage ratio is between 4.00x and 4.50x, then the transaction will pay down all outstanding class A2 note principal with 40% of all excess cash flows.

February 17 -

Justine Leigh-Bell will lead AFII's strategic direction and collaborate with asset owners and managers to integrate climate and nature factors into fixed-income portfolio construction.

February 17 -

Large and mega investors accounted for 5.8% of all single family-home purchases in December, up from 4.8% at the same time last year, according to Cotality.

February 17 -

The deal is the cell tower sector's largest-ever securitization and features its first single-B rated tranche.

February 13 -

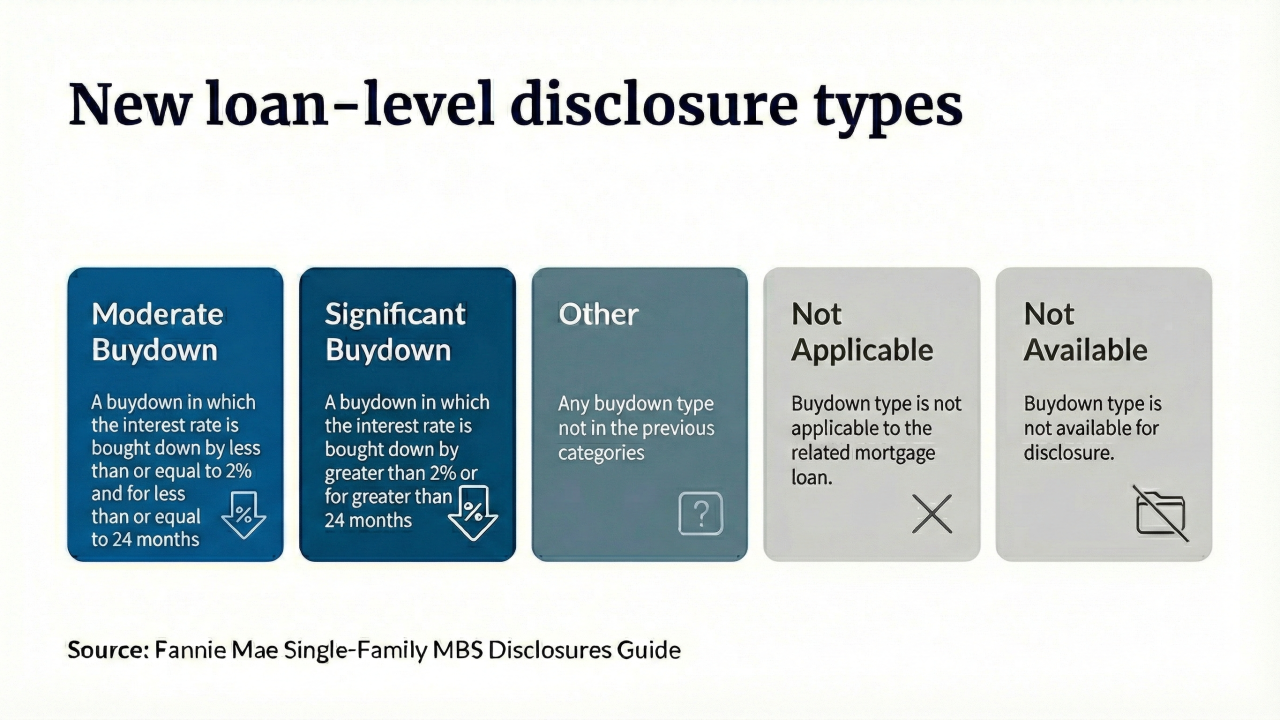

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

February 13 -

The Consumer Financial Protection Bureau's complaint portal has been flooded in recent years, but corporate debt collectors, industry attorneys and consumer advocates question whether the bureau's efforts to reduce the volume will help consumers as much as it helps the firms they're complaining about.

February 13 -

Point Digital Finance originated the underlying home equity contracts, composed of first lien (11.1%), primarily second-lien (82.9%) and third liens (5.81%) on residential properties.

February 12 -

A much shorter liquidity horizon could draw back the biggest banks, increasing liquidity and tightening spreads.

February 12 -

He will advise clients on securitization, structured finance, secured lending and receivables transactions, on his second time with the company.

February 12 -

A House subcommittee hearing discussing the future of the government-sponsored enterprises, noted both are still severely undercapitalized.

February 12 -

SEMT 2026-2, will repay investors through a senior-subordinate structure, with a shifting-interest structure.

February 11 -

Adjustments related to higher credit risk weights for new acquisitions and rate shifts offset increases in the government-sponsored enterprise's core earnings.

February 11 -

The Bureau of Labor Statistics issued its delayed January employment report Wednesday morning, showing the economy added 130,000 jobs in January. But the agency also sharply revised its estimates for total jobs created in 2025 to 181,000 from 584,000.

February 11 -

The SASB refinances a $900 million whole loan securitized through LBTY 2016-225L, for renovations and modernizations.

February 10 -

Borrowers in the lowest-income areas have seen their 90 or more day delinquency rates soar since 2021, jumping from 0.5% to nearly 3%, the New York Fed said.

February 10 -

Delinquencies on credit-card debt mostly held steady at the end of last year, but certain groups of consumers are faring better than others.

February 10 -

Investors expect economic growth to start accelerating this month and continue through April, as consumers benefit from tax cuts.

February 10 -

The Government Accountability Office was tasked with investigating the Consumer Financial Protection Bureau's stop-work order, but CFPB officials refused to meet with or provide information to Congress' investigative arm.

February 9 -

Total initial credit enhancement increased to 11.40% for the class D notes, from 11.25%. It also decreased for classes B, C and E, and levels on the class A notes stayed the same.

February 9 -

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

February 6 -

The highly diversified pool mix consists of 29 different aviation asset types, with a third being new and emerging technology aircraft, and 45.7% are current technology aircraft.

February 6 -

The secondary market regulator will formally publish its own rule on Feb. 6, after a comment period and without making changes to what it proposed in July.

February 6 -

The deal will not make any principal payments during the revolving period unless it needs the cashflow to maintain the required overcollateralization amount.

February 5 -

Bowing to industry pressure, the Consumer Financial Protection Bureau is warning consumers with notices on its complaint portal not to file disputes about inaccurate information on credit reports, among other changes.

February 5 -

American Banker's 2026 Predictions report finds that nonbank entities and check fraud are major threats to local banks in the coming months.

February 5 -

The financial technology firm says the hires reflect its continued investment in a solid growth, as it develops its finance offerings, and engages with industry leaders and regulators.

February 5 -

Leverage is moderate in Saluda Grade's pool, yet the junior liens carry slightly more LTV and DTI risk, on a weighted average (WA) basis.

February 4 -

Federal Reserve Gov. Lisa Cook said in a speech Wednesday night that the central bank's credibility depends on its ability to bring inflation back to its 2% target.

February 4 -

In a contentious House Financial Services Committee oversight hearing, Treasury Secretary Scott Bessent sidestepped questions on the Trump family crypto conflicts of interest and inflation with pugnacious responses to Democratic lawmakers' questions.

February 4 -

After four years, the senior note classes will either pay a 100 basis-point increase to the fixed coupon or the net weighted average coupon (WAC) rate, whichever is lower.

February 4 -

Property inspection waivers were granted on 40.2% of the underlying mortgages, reflecting an increasing trend of agency mortgages being originated without them.

February 3 -

Less than 45% of mortgage residential properties in the United States were equity-rich last quarter, a 1.5-percentage-point drop from the third quarter.

February 3 -

Machinery, medical, IT hardware, vehicles and the industrial sectors make up the top five categories in the pool.

February 3 -

President Donald Trump's support of legislation that would cap credit card interest rates at 10% has flagged in recent weeks, but experts say that the debate has highlighted significant gaps in regulators' understanding of the credit card market and how its risks are priced.

February 3 -

Although investor properties, which are prone to higher chances of default, account for 58% of the pool, the strong borrower and collateral quality mitigate the credit stress.

February 2 -

The Chicago-based, $261 million-asset Metropolitan Capital Bank & Trust was placed in receivership and its assets sold to Detroit-based First Independence Bank, costing the Federal Deposit Insurance Corp.'s Deposit Insurance Fund an estimated $19.7 million.

January 30 -

There is little wonder why the Fed is expected to maintain its dovish stance, given a leveled-off unemployment rate and cooled inflation.

January 30 -

Preemption would hurt affordability for many, the Conference of State Banking Supervisors and the American Association of Residential Mortgage Regulators said.

January 30 -

Former Fed Gov. Kevin Warsh is a relatively known quantity to financial markets, but his embrace of President Trump's agenda and the White House's own contentious relationship with the central bank make it hard to know with certainty where — or even whether — he will lead the Fed.

January 30 -

In terms of the deal's capital structure, will repay noteholders following a sequential, shifting-interest structure, and six subordinate classes support the senior notes.

January 30 -

DRMT 2026-INV1, is backed by a pool of 1,153 non-prime investment property mortgages, which have a moderate leverage levels of an original, combined loan-to-value (CLTV) ratio of 69.9%.

January 29 -

A Government Accountability Office report warns the Office of the Comptroller of the Currency to clarify which records from the Basel Committee on Banking Supervision should be treated as federal records and thus retained according to the Federal Records Act.

January 29 -

Net franchise royalties support Jersey Mike's Funding 2026-1's cash flows, which accounts for 52.9% of securitized revenues.

January 29 -

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

January 29 -

Respondents to an exclusive NMN survey lay odds on lower rates boosting housing despite stagflation and recession risks. Here's how the Fed's view compares.

January 28 -

The largest single obligor exposure is to the U.S. government, accounting for $146.8 million or 14.19% of the aggregate securitization value (ASV).

January 28 -

Rocket denied the allegations, saying the lawsuit is a retread of a case the Consumer Financial Protection Bureau filed that was quickly dismissed.

January 28 -

OBX 2026-J1 will repay noteholders through a senior subordinate, shifting interest structure.

January 27 -

During a three-month period after closing, PAID 2026-1's prefunding account will use deposits to purchase unsecured consumer loans, if they meet eligibility criteria.

January 27 -

State regulators say proposed changes by the Federal Reserve that would make state bank examiners the primary boots on the ground will make bank examinations faster, but could cause some issues to go overlooked.

January 27 -

TVC Mortgage's notes, which will be generally interest-only, will repay investors sequentially.

January 26 -

Pre- and post-purchase, buy now/pay later loans from Affirm will be available on Fiserv-issued debit cards. Last year, Affirm and FIS inked a deal to bring Affirm's BNPL loans to FIS-issued debit cards.

January 26 -

The government mortgage securitization guarantor flagged the goal back during the first Trump administration, warning then that it would be a long-term project.

January 26 -

The moderate leverage reflects the quality of RMBS pools from recent issuance years. Borrowers have a non-zero WA annual income of $1 million, with liquid reserves of $594,348.

January 23 -

The buy now/pay later lender is seeking to create Affirm Bank, a Nevada-chartered industrial loan company.

January 23 -

The deal amplifies Janus' existing model portfolios and separately managed account offerings and positions the firm to be a leader in that area.

January 23 -

The deal includes some structural changes, such as subordination levels of 41.05%, 32.25%, 19.45% and 6.10% on classes A, B, C and D, respectively, and all those levels increased from the previous deal.

January 22 -

Observers said the Supreme Court likely will allow Federal Reserve Gov. Lisa Cook to remain at her post while she challenges her purported removal by President Donald Trump. But her continued presence would slow, rather than stop, the president's quest for a voting majority on the central bank board.

January 22 -

Mortgage borrowers filed a third amended class action complaint against the bank over modification issues from 2010 to 2015.

January 22 -

The notes will benefit from a reserve account, to be funded unless a default event occurs, and the transaction will deposit an amount equal to interest due on the class RR notes.

January 22 -

NewtekOne offers 10- to 25-year amortizing loans with no balloons, and either limited or no covenants, and other provisions similar to SBA 7(a) loans.

January 21 -

The Supreme Court Wednesday appeared skeptical of the Justice Department's argument that removal of a Federal Reserve governor is unreviewable or that the president's preference for Fed governors outweighs the harm to the Fed from curbing the central bank's political independence.

January 21 -

A reserve account is in place, although its percentage of the pool balance decreased compared with the previous deal. Also, pre-pricing excess spread was 13.89%.

January 21 -

The Consumer Financial Protection Bureau has backed off enforcement and supervision of consumer protection laws, leaving states to fill the void — and potentially creating a "patchwork" of state laws that banks will have to comply with.

January 21 -

Despite RCKT Mortgage's second-lien composition, the loans display several positive credit characteristics, including a WA credit score of 745.

January 20 -

Hot securitization sectors such as non-qualified mortgages and home equity are set to expand further amid market shifts this year, recent forecasts suggest.

January 20 -

The centers are also located in 15 markets, with the largest market accounting for 20.3% of the pool's annualized revenue.

January 20 -

Treasury Secretary Scott Bessent said Tuesday morning that banks should focus on the sweeping deregulation the administration has enacted as the industry pushes back on President Trump's proposed 10% credit card interest rate cap.

January 20 -

Canyon Partners sees opportunities in corners of the mortgage, with tightened due diligence, and the auto ABS markets.

January 20 -

By aircraft value, Fitch says 6% are leased to credits considered investment grade, while the weighted average rating by Fitch Value ranges between 'B' and 'B-'.

January 19