-

For the first time since early September 2022, the Freddie Mac Primary Mortgage Market Survey has the 30-year below 6%, but the 15-year gained this week.

February 26 -

The increase in borrower activity came as housing starts ended 2025 on a high note, while mortgage rates were a percentage point lower year-over-year.

February 19 -

While the Freddie Mac survey recorded a weekly decline, the benchmark 10-year Treasury yield had moved back up by 6 basis points around midday on Thursday.

February 19 -

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

January 29 -

Respondents to an exclusive NMN survey lay odds on lower rates boosting housing despite stagflation and recession risks. Here's how the Fed's view compares.

January 28 -

This week the conforming 30-year fixed rate mortgage fell 10 basis points, with Optimal Blue data showing it broke through, at least briefly, the 6% level.

January 15 -

The survey, taken before Pres. Trump's $200 billion MBS buy demand, finds panelists worried over inflation, but also see employment as the larger downside risk.

January 12 -

Late last year, commercial bank holdings of mortgage paper reached the highest level since 2023 as these depositories are flush with deposits.

January 6 -

Keefe, Bruyette & Woods attributes Fannie Mae and Freddie Mac portfolio growth for the narrower spreads, but other reasons include lower volatility.

January 5 -

The Federal Reserve is slated to undertake a number of important rules and regulations in 2026, but decisions around agency leadership and the Trump administration's avowed effort to exert greater control over the central bank are likely to leave a lasting legacy at the agency.

December 29 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

While the 30-year average has hovered near the same level for weeks, the past year brought with it promising trends that may ease affordability in 2026.

December 18 -

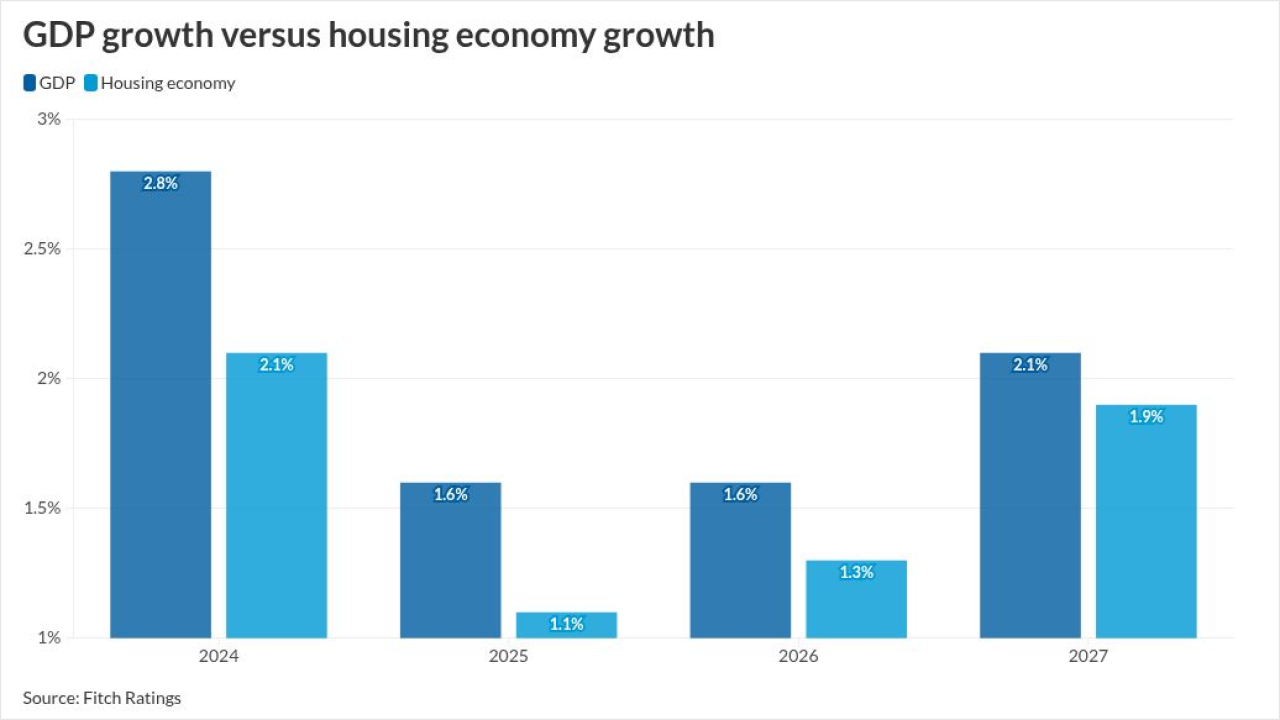

The home purchase market, which competes for consumers with rentals, should remain subdued in 2026 because of high mortgage rates and low affordability.

December 15 -

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

Decision makers have voiced support for lower financing costs but researchers have said achieving it could be complicated. Part 3 in a series.

December 3 -

After three consecutive weeks of increases, the 30-year fixed mortgage rate dropped 0.3 basis points to 6.23% this week, according to Freddie Mac.

November 26 -

The prepayment rate grew by 37% over September as mortgage rates fell leading to higher refinancing volume in October, ICE Mortgage Technology said.

November 25 -

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

The 30-year rate dropped just 0.2 percentage points, as Federal Reserve Chair Jerome Powell's recent comments caused Treasury yields to rise.

October 30 -

An index of contract signings held at 74.8 after climbing a revised 4.2% a month earlier to the highest level since March, according to National Association of Realtors data released Wednesday.

October 29