-

Fannie Mae's June housing outlook was down from a month ago, reflecting expectations of a further slowing housing market.

June 25 -

The potential impacts of import tariffs cloud the outlook, though, and could lead mortgage rates to surge and fall throughout the coming year.

February 20 -

Monetary policy officials have finally gone a month without tightening but made it clear more action could lie ahead, suggesting it could be awhile before housing finance costs consistently fall.

June 14 -

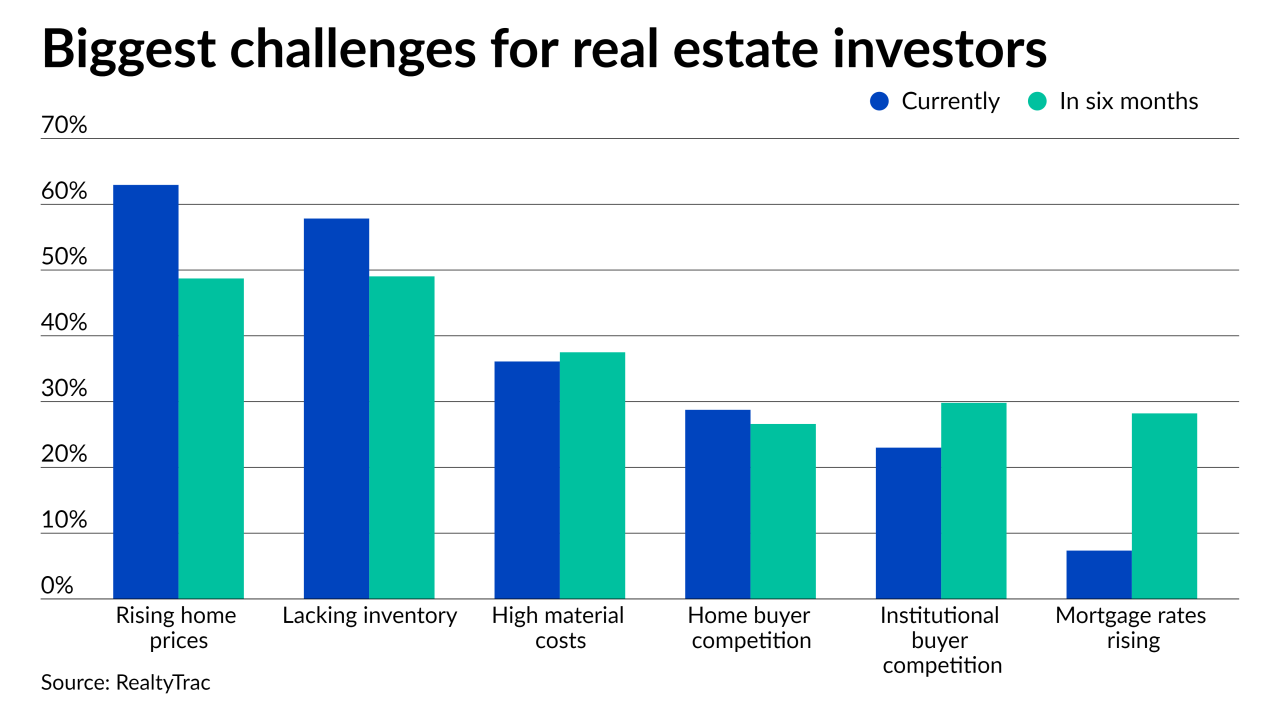

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

Tight inventory and heightened competition kept prime purchasers at bay as property values continued their summer surge, according to Fannie Mae.

August 9 -

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

After a booming 2020, more mortgage lenders than ever before expect diminishing margins in the coming months as climbing interest rates set up heightened competition.

March 11 -

Investors were also reacting to the inauguration of Joe Biden and uncertainty over additional fiscal relief, Freddie Mac’s Chief Economist Sam Khater said.

January 28 -

Despite mortgage rates expected to rise modestly in 2021, a bolstered Biden administration stimulus package and COVID-19 vaccination efforts bring promise for economic recovery.

January 15 -

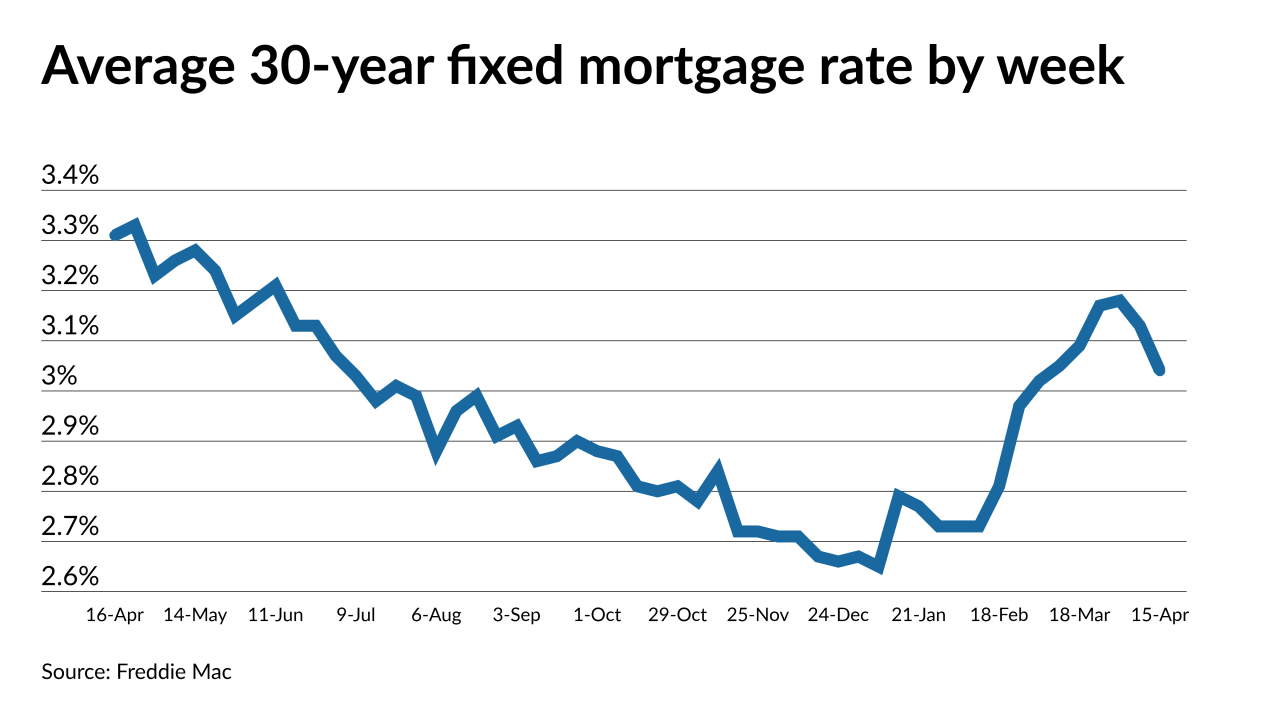

Mortgage rates, whose movements until now had not reflected gains in the benchmark 10-year Treasury yield, rose 14 basis points this week, according to Freddie Mac.

January 14 -

Mortgage rates yet again have dropped to a record low, even as the yield on the benchmark 10-year Treasury flirts with breaking back above the 1% mark, according to Freddie Mac.

December 24 -

With coronavirus inoculations underway and government stimulus likely to come, the outlook for next year’s housing market and lending environment grew more optimistic in December.

December 15 -

Rates could be 50 basis points steeper than the MBA’s current projections, which anticipate the 30-year mortgage will average 3.3% next year, up from nearly 3% this year.

November 16 -

Mortgage rates moved off of their all-time low this week as a result of reports that Pfizer's coronavirus vaccine was potentially 90% effective, according to Freddie Mac.

November 12 -

Mortgage rates are currently the lowest in the history of Freddie Mac’s survey, but sharp differences of opinion persist on whether that will make this a $4-trillion year or not.

November 5 -

Mortgage rates fell this week to another record low, and are now over a full percentage point below where they were five years ago, according to Freddie Mac.

October 22 -

But an expected drop in refinancings as mortgage rates rise should more than cancel that out, resulting in declining overall volume through 2023.

October 21