-

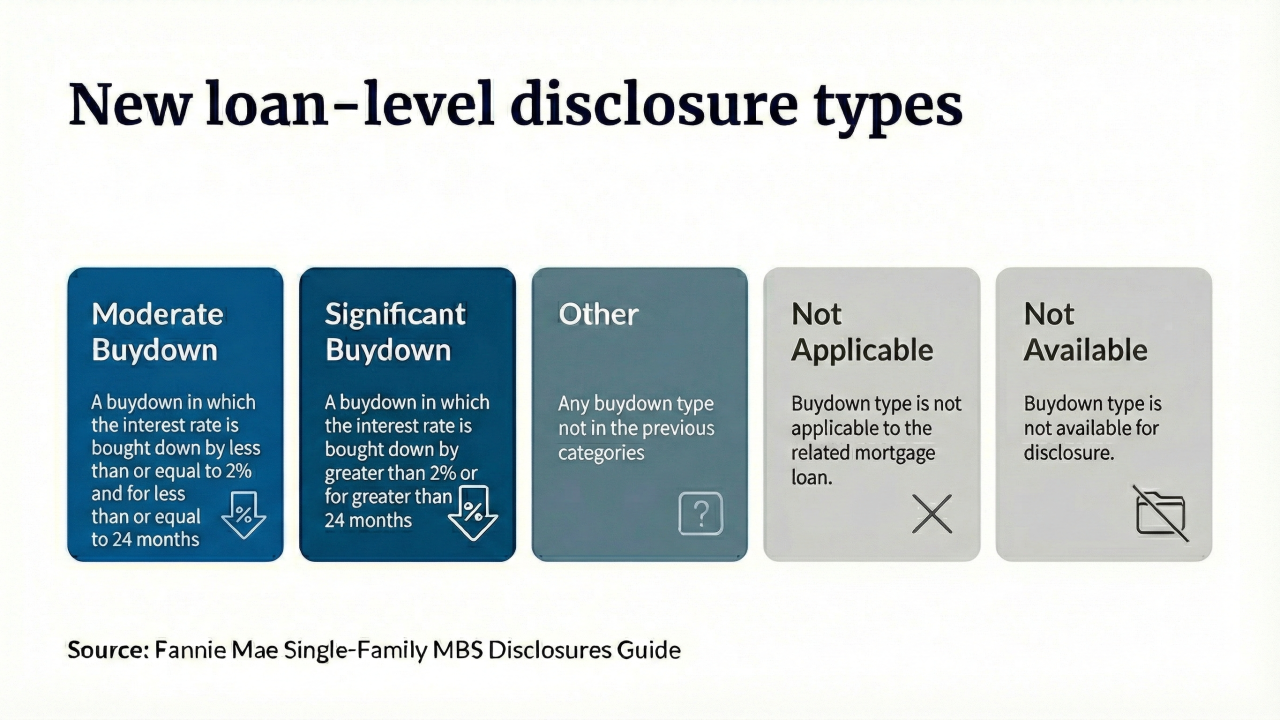

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

February 13 -

Alternative asset manager Canyon Partners is committing $250 million to buy new mortgage bonds created by A&D Mortgage LLC, a partnership that will help the mortgage finance company substantially increase the pace of its bond sales.

August 4 -

Brookfield Asset Management and a private equity partner reached a friendly deal to take over First National Financial Corp., a mortgage company backed by Canadian billionaire Stephen Smith, for about C$2.9 billion ($2.1 billion).

July 28 -

On a cumulative basis, advance rates on the notes range from 95.4% on the A1 notes to 121.8% on the class M5 notes.

June 3 -

The transaction's pool of 365 fixed-rate mortgages, all first lien, breaks down to mostly non-agency loans (61.4%). The rest, 38.6%, are agency eligible.

May 30 -

The funding round will help Button Finance, which leverages AI to underwrite home equity financing, expand its range of products to more borrowers.

May 20 -

A range of investment residential properties, including single-family homes, condominiums and multi-unit properties, will secure the debt.

May 14 -

Moderate leverage is one example of cleaner credit, as the current collateral pool's original loan-to-value (LTV) ratio is 69.1%, down from 71.7% on the 2024-NQM1 series.

April 10 -

Originators applied bank statement, full documentation and profit and loss documentation in their underwriting.

April 8 -

The deal is composed of 11,547 seasoned performing and reperforming loans that are first and second lien. Loan servicing includes a 180-day chargeoff feature.

April 1 -

Second-lien loans make up virtually the entire pool, which carries some risk of poor recovery rates. Yet 78% of the pool is also considered safe-harbor mortgages.

March 24 -

Now the structured mortgage securities are cheap enough that CLO investors are watching them more closely, according to strategists and investors.

March 12 -

Excess cash flow will pay timely interest and protect against realized losses in the rated certificates before being paid out to the class X notes.

March 4 -

Small-balance commercial mortgages, SBA 504 and investor loans, all first-lien, make up the collateral pool.

February 24 -

Lenders and developers are now working their contacts in Washington to try to protect Ginnie Mae.

February 21 -

Stability in mortgage rates may be key to unlocking pent-up demand during the upcoming spring homebuying season, but with loans still expensive and prices continuing to rise, affordability remains a hurdle.

January 30 -

The proposal is one of several that aims to address difficulties managing early buyouts from mortgage-backed securities pools.

December 12 -

Private-label securitization volume increased 75% this year versus 2023; conditions are right for that to continue, KBRA said.

November 15 -

This is the first RTL transaction for Roc360 Real Estate Income Trust, the deal's sponsor, in three years. Also, it is Roc360's first rated RTL transaction.

October 24 -

In the non-prime pool, owner-occupied properties account for most of the assets, at 55.1%; the amount of investor properties represents 41.6% of the deal.

September 23