Freddie Mac increased its origination expectations for the overall market this year by $450 million — even with rising prices moving consumers to reconsider buying a home.

"Despite the housing market's recent highs, there are indications of softening demand in recent

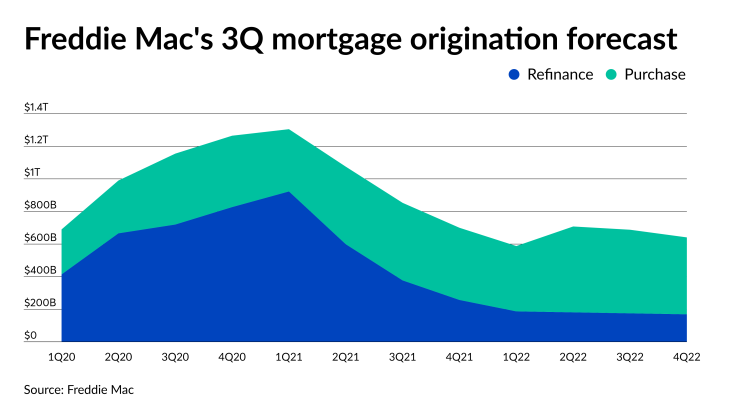

The government-sponsored enterprise’s third quarter forecast calls for $3.93 trillion in total volume this year, up from $3.48 trillion

Its refinance prediction is now $2.16 trillion for 2021, up from $1.86 trillion three months ago, with the bulk taking place in the first half of the year.

Meanwhile the purchase outlook was increased by $12 billion from the second quarter release to $1.78 trillion.

In recent weeks, the bond market has become less concerned about recent inflation headlines, resulting in declines in long-term interest rates, a blog accompanying the report said.

Expectations are for an increase in rates for the 30-year fixed loan, but it will be a gradual rise, going to 3.3% at the end of the third quarter and 3.4% at year-end from 3.0% on June 30. It will reach 3.8% by the end of 2022. The GSE's rate survey for July 15 put the 30-year FRM

For 2022, Freddie Mac is now projecting $2.63 trillion of volume, up from the second quarter's prediction of $2.39 trillion.

Home prices growth trajectory will outlast any rise in consumer prices, as the inventory shortage continues, Freddie Mac said. Most of the full year 2020's expected 12.1% rise in prices took place in the first half; for the current quarter, Freddie Mac predicts a 1.9% rise, followed by 1.8% growth. Next year, home prices will rise by a relatively-modest 5.3%.