-

Senate Majority Leader John Thune, R-S.D., moved to consider the housing package next week, but it's not clear what version of the bill senators will be voting on as the House, Senate and White House are still negotiating priorities.

February 26 -

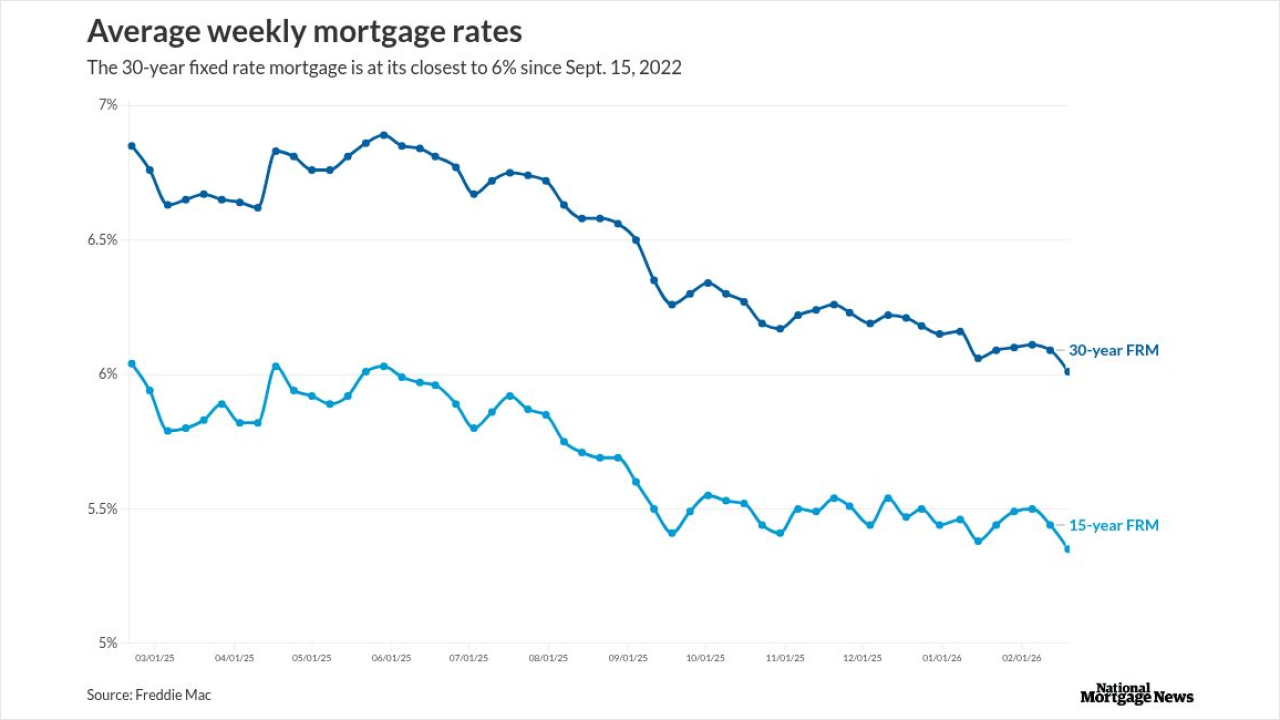

For the first time since early September 2022, the Freddie Mac Primary Mortgage Market Survey has the 30-year below 6%, but the 15-year gained this week.

February 26 -

After a long price correction in the art market, Bank of America is expanding its advisory services for collectors — and it's not alone.

February 25 -

Total consumer debt in the United States hit $18.2 trillion by the end of last year, with $12.8 trillion attributed to first mortgages, according to Equifax.

February 25 -

The Buffalo-based bank didn't specify the size of potential losses from a suit that grew out of the collapse of subprime auto lender Tricolor Holdings. M&T said its trust subsidiary will "vigorously defend itself" against claims by investors who allege that it should have protected them from alleged fraud.

February 19 -

While the Freddie Mac survey recorded a weekly decline, the benchmark 10-year Treasury yield had moved back up by 6 basis points around midday on Thursday.

February 19 -

In a speech Tuesday, Federal Reserve Gov. Michael Barr said it was possible that artificial intelligence will boost productivity in an undisruptive way. But he said policymakers should also be wary of a financial crash if those gains are not realized or a rapid adoption that could lead to labor displacement.

February 17 -

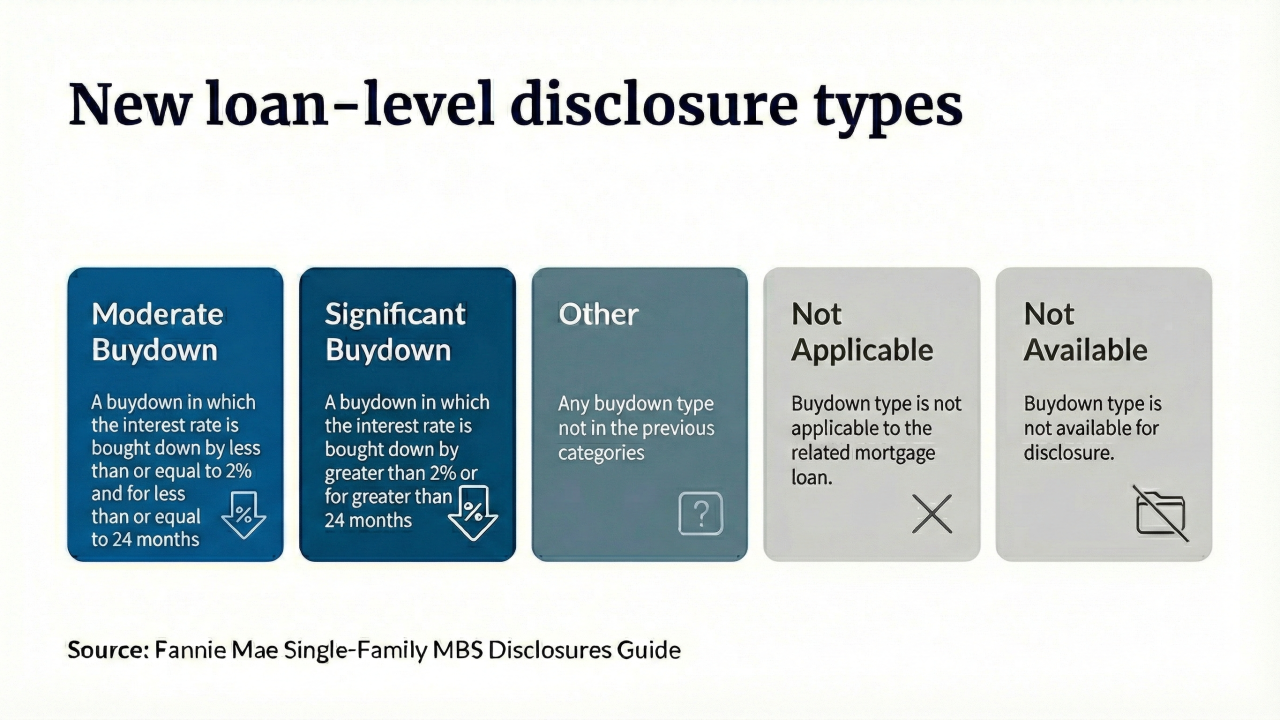

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

February 13 -

A House subcommittee hearing discussing the future of the government-sponsored enterprises, noted both are still severely undercapitalized.

February 12 -

The Bureau of Labor Statistics issued its delayed January employment report Wednesday morning, showing the economy added 130,000 jobs in January. But the agency also sharply revised its estimates for total jobs created in 2025 to 181,000 from 584,000.

February 11 -

The SASB refinances a $900 million whole loan securitized through LBTY 2016-225L, for renovations and modernizations.

February 10 -

Borrowers in the lowest-income areas have seen their 90 or more day delinquency rates soar since 2021, jumping from 0.5% to nearly 3%, the New York Fed said.

February 10 -

Delinquencies on credit-card debt mostly held steady at the end of last year, but certain groups of consumers are faring better than others.

February 10 -

Federal Reserve Gov. Lisa Cook said in a speech Wednesday night that the central bank's credibility depends on its ability to bring inflation back to its 2% target.

February 4 -

Many details have yet to be determined, including the role that federally-backed mortgages should play.

February 3 -

Across US CMBS and ABS, JPMorgan projects annual data center securitization issuance could reach $30 billion to $40 billion in both 2026 and 2027.

February 2 -

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

January 29 -

The buy now/pay later lender is seeking to create Affirm Bank, a Nevada-chartered industrial loan company.

January 23 -

Sponsors used a master trust structure, raising £200 million and £54 million through the existing class A2 and class B tranches.

January 15 -

This week the conforming 30-year fixed rate mortgage fell 10 basis points, with Optimal Blue data showing it broke through, at least briefly, the 6% level.

January 15