-

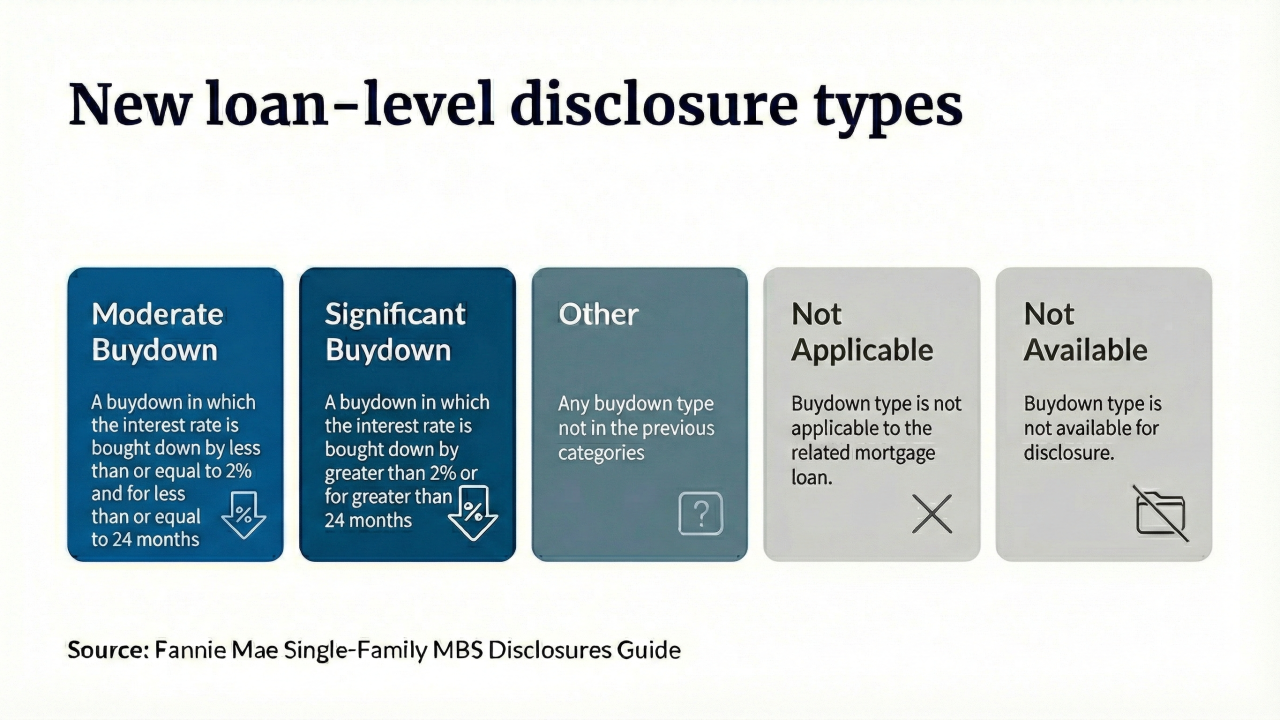

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

February 13 -

Adjustments related to higher credit risk weights for new acquisitions and rate shifts offset increases in the government-sponsored enterprise's core earnings.

February 11 -

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

December 24 -

The government-backed housing-finance giants increased their retained portfolios by more than 25% in the five months through October, according to the latest figures.

December 15 -

What developments around rent reporting and new credit standards portend for mortgage companies. Part 2 of a series on government-sponsored enterprise changes.

December 2 -

President Trump and housing regulator Bill Pulte are considering introducing a 50-year fixed rate mortgage that Fannie Mae and Freddie Mac would purchase.

November 9 -

President Trump said big homebuilders are sitting on a record 2 million empty lots, and asked Fannie Mae and Freddie Mac to help restore the American Dream.

October 6 -

In a letter to federal leaders, the Community Home Lenders of America expressed views about a possible GSE merger and the need for "critical" mortgage products.

August 22 -

Trump has yet to decide when Fannie Mae and Freddie Mac will return to the market in an IPO that regulator Bill Pulte says could top $1 trillion.

August 21 -

The tests modeled how Fannie Mae and Freddie Mac would fare after absorbing losses like a total $36.1 billion provision in credit losses in a severe downturn.

August 18 -

President Donald Trump is bringing in bank leaders to meet with him one by one at the White House. Beyond the economic discussion, there's a chance at a big payday for their firms.

July 31 -

Given FHFA Director Bill Pulte's history of making regulatory pronouncements via X, some theorize the release of Fannie Mae and Freddie Mac could occur in the same way.

July 25 -

Recently revived plans for broader use of the repositioned common-securitization platform for monetization purposes may hearken back to past concepts.

July 17 -

Federal officials directed Fannie Mae and Freddie Mac to study whether digital assets held on US regulated exchanges might someday be factored into mortgage risk assessments.

July 16 -

The notes are enhanced by a credit risk transfer agreement with Fannie Mae.

July 9 -

This might deeply disappoint Wall Street investors who've been counting on a windfall if Fannie and Freddie are set free.

June 3 -

Bill Pulte and the government-sponsored enterprise's chief executive will be working with a firm that analyzes big data and utilizes artificial intelligence.

May 28 -

President Donald Trump said that the US government would retain guarantees and an oversight role over Fannie Mae and Freddie Mac even as he pursues a public offering for the mortgage giants.

May 28 -

Hedge funds and other investors have called for the government to release the two entities from conservatorship, which could provide a windfall for shareholders.

May 22 -

Don Layton, former Freddie Mac CEO, and self-proclaimed "GSEologist" predicts that a release of the two entities will occur within four to six years.

April 22