-

Rate-and-term refinances dropped 14% month over month in October, but were still up 143% from last year.

November 11 -

A pickup in refinances was offset by the first pullback in purchases in four weeks in the run-up to Labor Day, according to the Mortgage Bankers Association.

September 3 -

As high interest rates make refinancing impossible for many homeowners, increasing numbers of them are turning to HELOCs and home equity loans for cash.

July 28 -

Refinance apps made up more than 40% of all mortgage applications last week, driving an uptick as consumers seek out cheaper mortgage payments.

July 2 -

Government-backed lending drove an increase in purchase mortgages for a second straight week, even as interest rates failed to drive refinance activity.

March 26 -

The latest refinance surge helped lift total application activity up for a second straight week, even as purchases fell, the Mortgage Bankers Association said.

February 12 -

The lender claims the offering is the only one of its kind in today's mortgage market.

October 17 -

Purchases managed a small rise, but refinance activity held steady, according to the Mortgage Bankers Association.

August 28 -

Activity fell despite an ongoing slide in rates, but elevated interest in VA loans, particularly refinances, managed to lift the government-sponsored index higher by a fraction, the Mortgage Bankers Association said.

December 20 -

Purchase and refinance mortgages continued their slide as total origination volume was $475.5 billion during the final months of 2022, down 56% from the end of 2021.

March 2 -

Lenders that offer streamlined refinances in the future shouldn't be required to consider the borrower's income or employment status, according to the Mortgage Bankers Association. The trade group's comments were part of its response to a request for information on mortgage products that would support the financial stability of households.

November 29 -

In the face of a growing number in home-equity products, HECM endorsements dropped nationwide by over 43% on a monthly basis to its lowest point in more than two years.

October 4 -

Average purchase-loan amounts shrank for the second week in a row and are currently 12% below their record size in March.

July 6 -

Purchase lending grew despite headwinds in mortgage rates and rising home values.

March 14 -

But rising rates and tightening affordability are slowing appreciation rates, Black Knight found in its latest Mortgage Monitor report.

December 6 -

Rising debt-to-income ratios were behind almost a third of refinance rejections among those 65 and older, according to an analysis from the Urban Institute.

October 27 -

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

The agency’s new chief said eliminating the “adverse market fee” — in place since December — will make it easier for families to refinance while mortgage rates are still low.

July 16 -

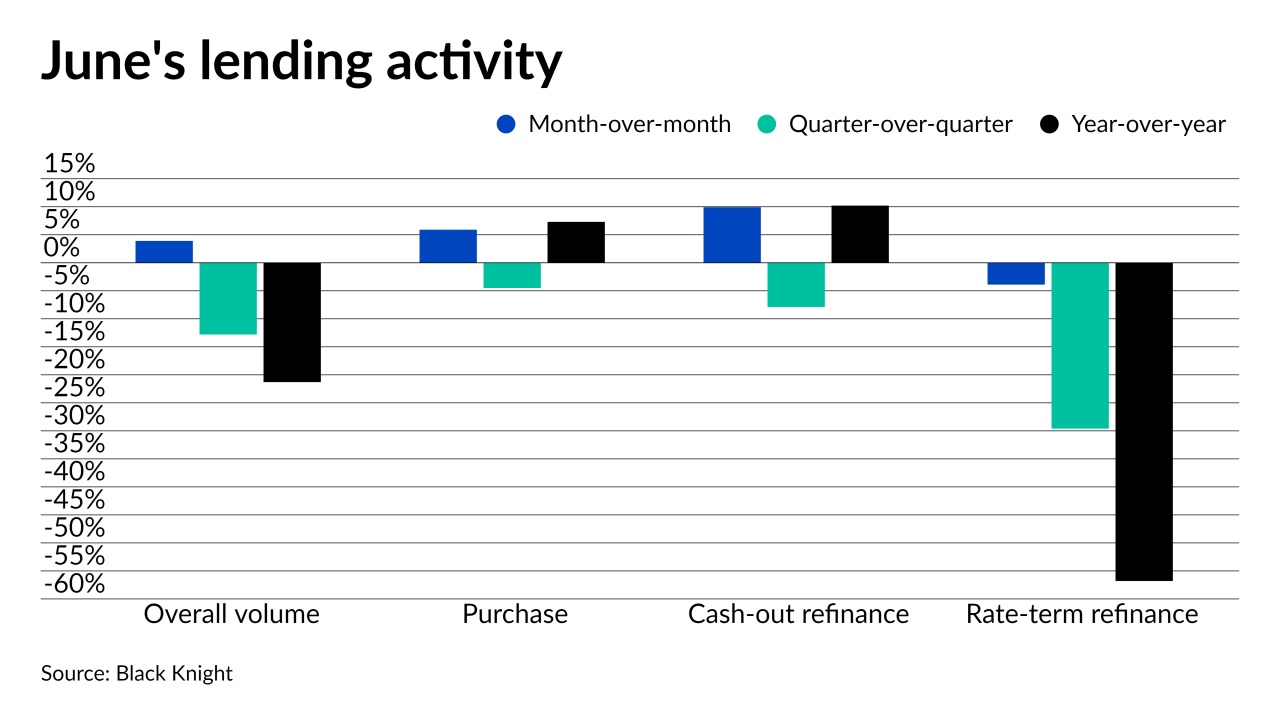

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Even though the channel helped the bank do over $2 billion in business last year, going forward it will produce loans through the traditional retail business.

July 2