-

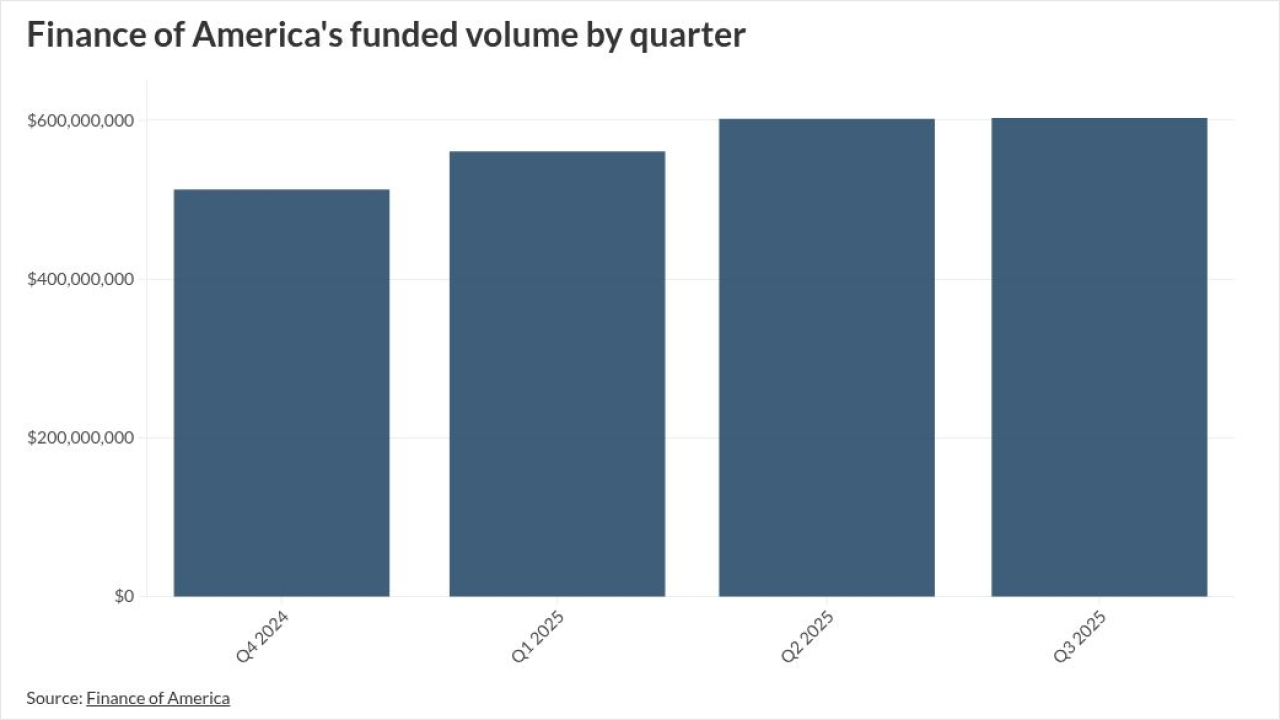

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

The class A1 notes have the lowest cumulative advance rate, which combines the interest and mortgage insurance rates to show the monthly increase in the line of credit, at 95.5%.

January 27 -

The outstanding amount that people ages 62 and up hold represented a nearly $15.4 billion gain in property value offset by a record $2.32 billion in borrowing.

December 19 -

The judge also sealed a document in the lawsuit the AARP Foundation joined but the defendants still must produce fee codes in the proposed class action.

December 11 -

The incentives are part of a broader set of Federal Housing Administration servicing changes for Home Equity Conversion Mortgages that also offers some new options for procedures.

December 1 -

If the Federal Housing Administration's rulemaking on home equity conversion mortgages were to go into effect as written, borrower contributions would be reduced by thousands of dollars.

October 25 -

While the company's long-term issuer default rating has slipped a little, affiliates of Blackstone that have a higher one back the reverse mortgage player.

October 20 -

Interest rate increases and economic concerns led the government entity to lower the required amount from $1 million to $250,000.

February 17 -

Borrowers that are couples, and where the female is younger, account for 32.55% of the pool's aggregate unpaid principal balance, the plurality.

February 15 -

While reverse mortgages allow older homeowners the opportunity to draw on home equity with minimal risk, problems arising from flaws in program structure are causing headaches for borrowers and issuers alike, according to recent reports.

February 10 -

This move comes at a time when the largest HECM producer sold its operations to a rival and another filed for bankruptcy.

January 30 -

The Lansing, Michigan-based firm was awarded the contract this spring and takes over from Novad Management Consulting, which had previously serviced government-held HECMs since 2014.

December 13 -

The deal will close for $10 million in cash, plus the right to purchase nearly 33.9 million shares of common stock.

December 7 -

In the face of a growing number in home-equity products, HECM endorsements dropped nationwide by over 43% on a monthly basis to its lowest point in more than two years.

October 4 - LIBOR

The deadline for inclusion in Ginnie mortgage-backed securities has been extended and an exception will be made for some participations.

December 16 -

HomeEquity will sell an as-yet undetermined volume of notes to finance forthcoming originations by the bank sponsored by Birch Hill Equity Partners Management.

December 8 - LIBOR

The restrictions on the pooling of loans with any interest term based on Libor will be effective for traditional mortgage-backed securities issued starting Jan. 21, 2021, and earlier for reverse-mortgage securitizations.

September 21 -

Also the Federal Housing Administration, which is a key contributor of government-insured loans to Ginnie securitizations, recently set new conditions on mortgage applicants that have been in forbearance.

September 14 -

Ginnie Mae helped to fund more than $70 billion in loans aimed at helping low- and moderate-income borrowers in July.

August 10 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26