-

Total consumer debt in the United States hit $18.2 trillion by the end of last year, with $12.8 trillion attributed to first mortgages, according to Equifax.

February 25 -

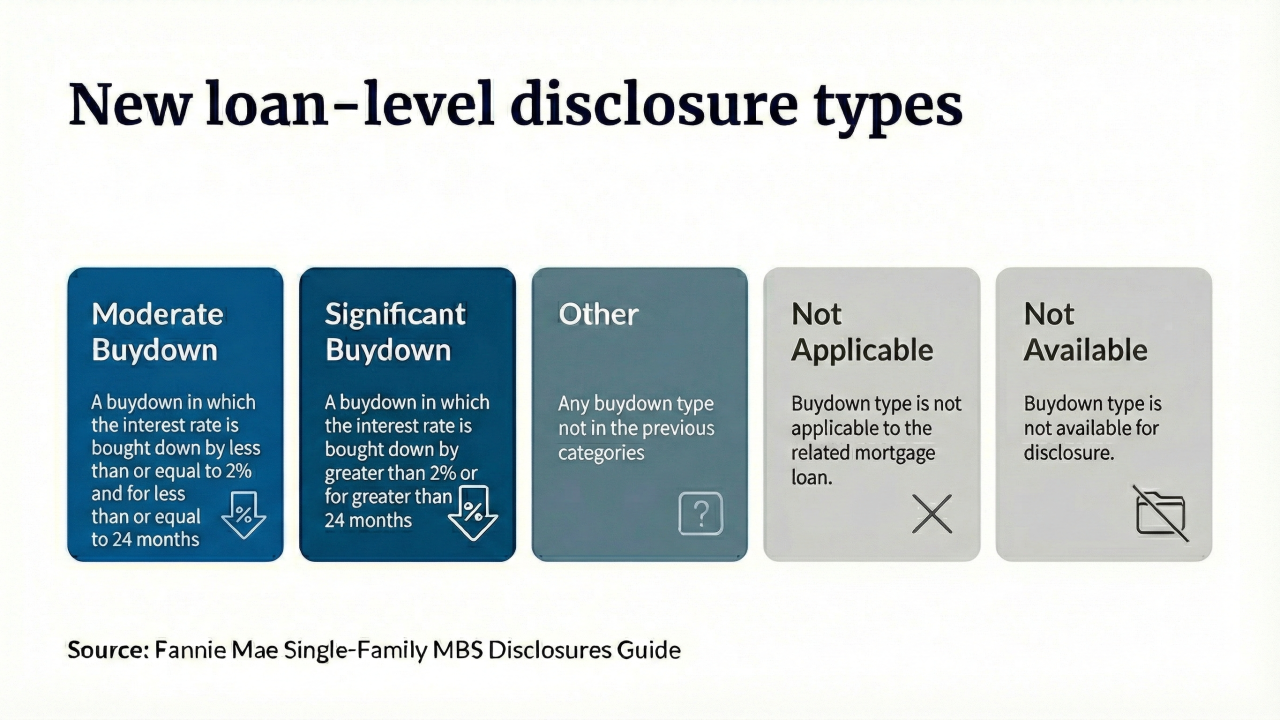

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

February 13 -

Borrowers in the lowest-income areas have seen their 90 or more day delinquency rates soar since 2021, jumping from 0.5% to nearly 3%, the New York Fed said.

February 10 -

Less than 45% of mortgage residential properties in the United States were equity-rich last quarter, a 1.5-percentage-point drop from the third quarter.

February 3 -

Preemption would hurt affordability for many, the Conference of State Banking Supervisors and the American Association of Residential Mortgage Regulators said.

January 30 -

The government mortgage securitization guarantor flagged the goal back during the first Trump administration, warning then that it would be a long-term project.

January 26 -

Mortgage borrowers filed a third amended class action complaint against the bank over modification issues from 2010 to 2015.

January 22 -

The national mortgage delinquency rate jumped to 3.85% in November, up 15% month over month and 2.79% year over year, according to ICE Mortgage Technology.

December 23 -

The acquisition forms the eighth largest mortgage servicer nationwide, with a combined $400 billion in mortgage servicing rights.

December 17 -

After home equity surged in 2023, average gains slowed last year before falling into negative territory over the past 12 months, Cotality said.

December 12 -

Delinquency trends split in Q3, with securitized and agency loans showing more strain while banks and life companies saw small improvements amid uneven vacancy and rent conditions.

December 4 -

What developments around rent reporting and new credit standards portend for mortgage companies. Part 2 of a series on government-sponsored enterprise changes.

December 2 -

The prepayment rate grew by 37% over September as mortgage rates fell leading to higher refinancing volume in October, ICE Mortgage Technology said.

November 25 -

The Structured Finance Association is adding its weight to recent support for a Securities and Exchange Commission action that could modernize Reg AB II.

November 18 -

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

November 17 -

Delinquencies are at their second highest level in three years, led by deterioration in the performance of FHA loans, the Mortgage Bankers Association said.

November 14 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

Late-stage mortgage delinquencies hit the highest level since January 2020 in September, a new report from VantageScore found.

October 28 -

FHA loans accounted for about half of the annual rise in foreclosure starts and 80% of the rise in active foreclosures in September, according to ICE.

October 24 -

Other studies have found fewer credit pulls could be viable, but this shows millions more would be adversely impacted than in a bi-merge.

October 20