-

Total consumer debt in the United States hit $18.2 trillion by the end of last year, with $12.8 trillion attributed to first mortgages, according to Equifax.

February 25 -

Borrowers in the lowest-income areas have seen their 90 or more day delinquency rates soar since 2021, jumping from 0.5% to nearly 3%, the New York Fed said.

February 10 -

Less than 45% of mortgage residential properties in the United States were equity-rich last quarter, a 1.5-percentage-point drop from the third quarter.

February 3 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

The prepayment rate grew by 37% over September as mortgage rates fell leading to higher refinancing volume in October, ICE Mortgage Technology said.

November 25 -

Delinquencies are at their second highest level in three years, led by deterioration in the performance of FHA loans, the Mortgage Bankers Association said.

November 14 -

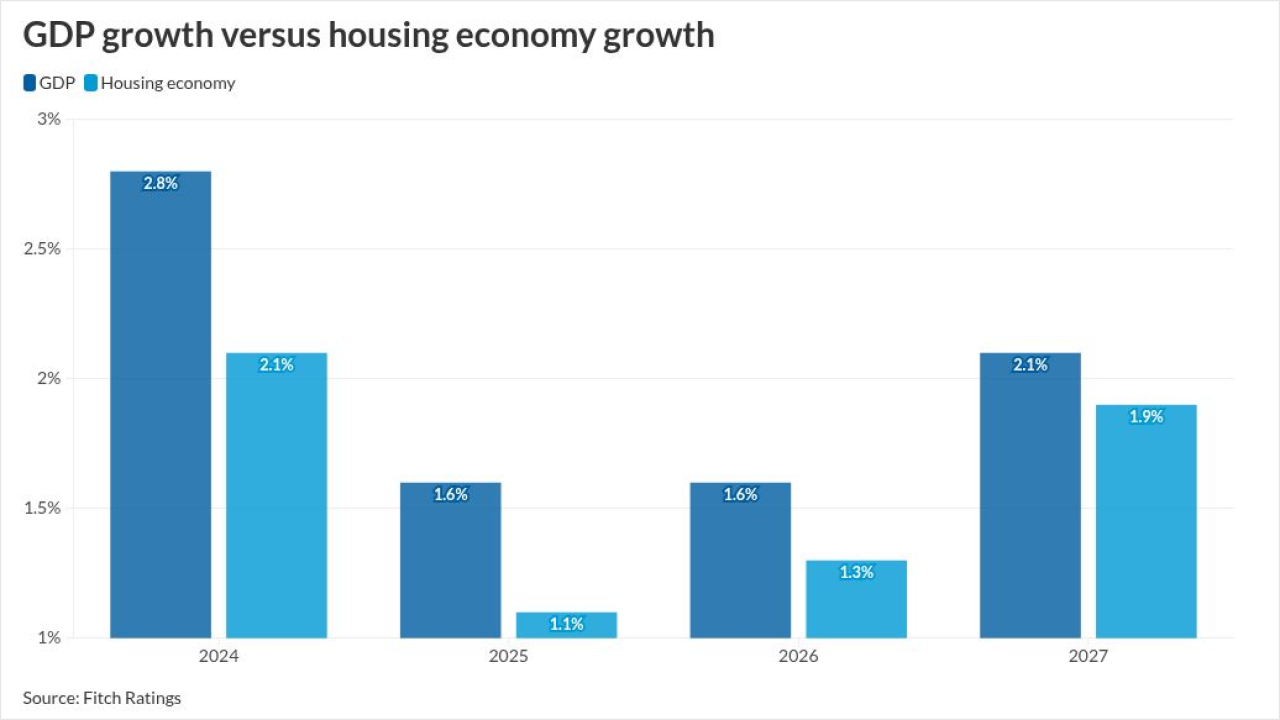

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

Retroactive interpretations have bedeviled mortgage servicers and the market for older loans. The industry will be watching other cases in New York closely now.

October 15 -

The latest reports from ICE Mortgage Technology and VantageScore appear to be in line with hints at growing borrower pressure officials are eyeing in policy.

September 24 -

While the overall delinquency rate improved this summer, FHA-backed mortgage borrowers continued to exhibit concerning levels of payment stress in July.

August 25 -

While foreclosure numbers in the first six months of this year were up compared to 2024, starts eased as the spring progressed, according to Attom.

July 18 -

Calls for foreclosure prevention advice jumped upward by almost 30% from a year ago and helped fuel overall consumer distress levels to a five-year high.

July 15 -

While consumer distress in auto and personal loans also picked up, the pace of growth among mortgages was atypical, Vantagescore's monthly credit gauge said.

June 27 -

Loans with alternative documentation and high combined loan-to-value ratios had more performance concerns, according to a new KBRA study.

June 6 -

The latest foreclosure report adds to evidence from housing research groups that economic difficulties are beginning to impact a rising number of homeowners.

April 10 -

The Department of Veterans Affairs ended a break for borrowers put at a disadvantage by a discontinuation of pandemic aid as they transitioned to a new program.

February 21 -

Completed foreclosure auctions should be 8% lower this year, but if home value and unemployment expectations change, all bets are off, Auction.com said.

February 5 -

Only 5% of homeowners in designated disaster-assistance areas were required to hold flood insurance, according to the Federal Housing Finance Agency's dashboard.

December 27 -

The Treasury, CFPB and Federal Trade Commission are joining forces to warn consumers about predatory practices in financing solar energy panels.

August 7 -

Forbearance rose for the first time since October 2022 in one report. Delinquencies jumped from a near-record low in another. Experts debate the ramifications.

July 24