-

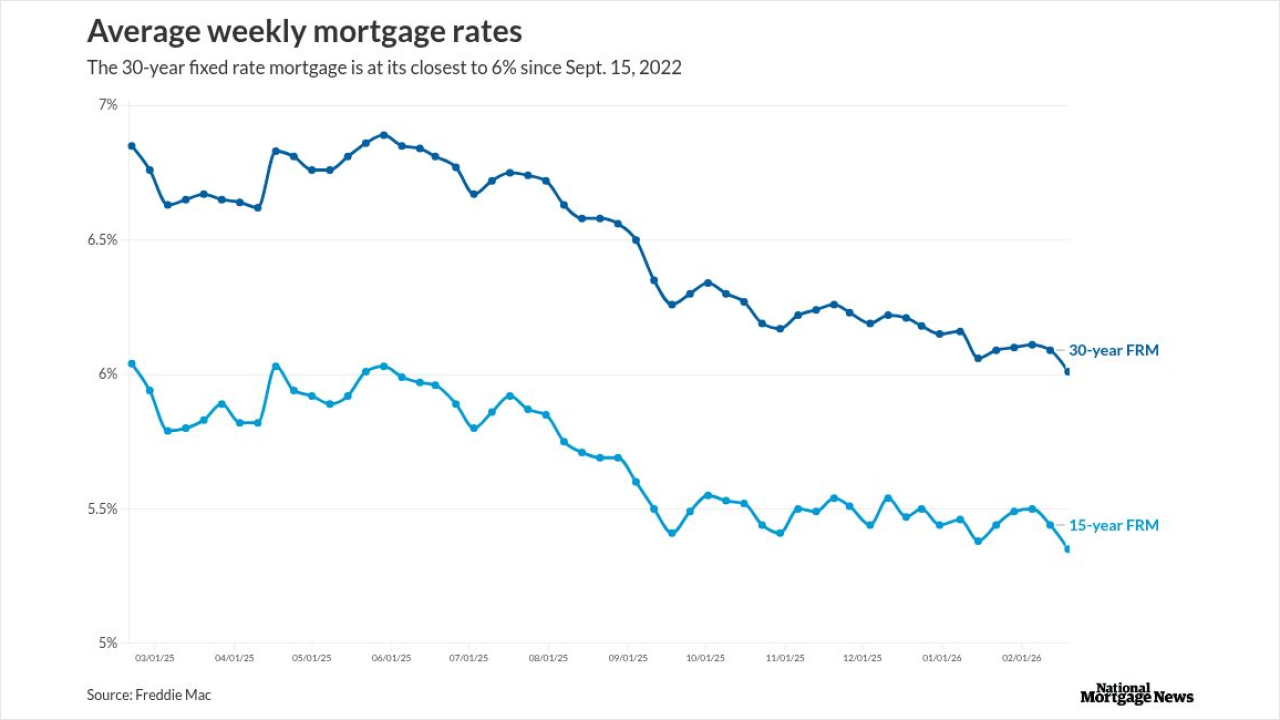

For the first time since early September 2022, the Freddie Mac Primary Mortgage Market Survey has the 30-year below 6%, but the 15-year gained this week.

February 26 -

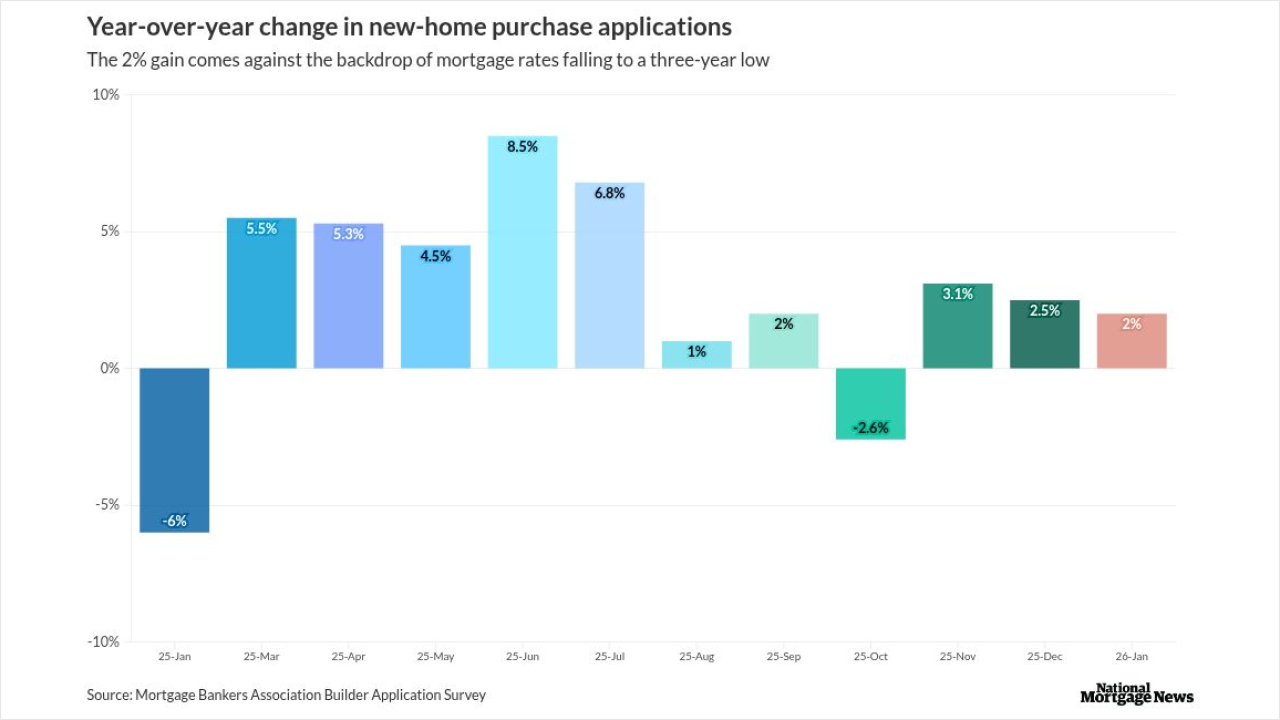

The increase in borrower activity came as housing starts ended 2025 on a high note, while mortgage rates were a percentage point lower year-over-year.

February 19 -

While the Freddie Mac survey recorded a weekly decline, the benchmark 10-year Treasury yield had moved back up by 6 basis points around midday on Thursday.

February 19 -

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

January 29 -

This week the conforming 30-year fixed rate mortgage fell 10 basis points, with Optimal Blue data showing it broke through, at least briefly, the 6% level.

January 15 -

Forty percent of Americans planning to buy or sell a home in 2026 worry about a potential market crash, according to a new report from Clever Offers.

December 9 -

While August's views on buying conditions and rates increased over July, the other components in Fannie Mae's sentiment index all declined, driving it lower.

September 9 -

Black homeownership fell to 43.9% this summer, its lowest since 2021, as rising unemployment and federal layoffs widened housing gaps across demographics.

September 8 -

The 30-year conforming fixed rate mortgage ended this week at its lowest since last Oct. 17, helped by bond traders pricing in a reduction in short-term rates.

September 4 -

The 30-year fixed rate mortgage fell 2 basis points this week, Freddie Mac said, but other sources like Zillow and Lender Price reported larger drops.

August 28 -

The bank "temporarily" paused home equity line of credit lending in April 2020, over concerns regarding the economic impact of the Covid-19 pandemic.

August 26 -

While still higher than the norm, the reduction in this spread is good news when it comes to mortgage rates for potential homebuyers as well as current owners.

August 26 -

Fannie Mae economists toned down their housing and economic outlook in August, predicting fewer home sales and less mortgage origination volume versus July.

August 19 -

The 30-year fixed rate mortgage fell by 5 basis points, with the Consumer Price Index showing muted inflation and jobs data still influencing the market.

August 14 -

As high interest rates make refinancing impossible for many homeowners, increasing numbers of them are turning to HELOCs and home equity loans for cash.

July 28 -

Fannie Mae also foresees more home sales than it did in June, but the Mortgage Bankers Association reduced its origination projections for 2025.

July 24 -

Housing supply is returning to pre-pandemic levels, but the rise comes as new listings fall, pointing to subdued demand, leading real estate brokerages said.

July 21 -

The 30-year fixed mortgage rate rose for the first time in six weeks, driven by Friday's strong jobs report and renewed uncertainty around tariffs.

July 10 -

The gap between costs and wages hit an inflection point and policy may determine what happens next, according to the Harvard Joint Center for Housing Studies.

June 24 -

While lenders have come out with more products for the spring season, rate lock data finds buyers still hesitant to act because of high mortgage rates.

June 10