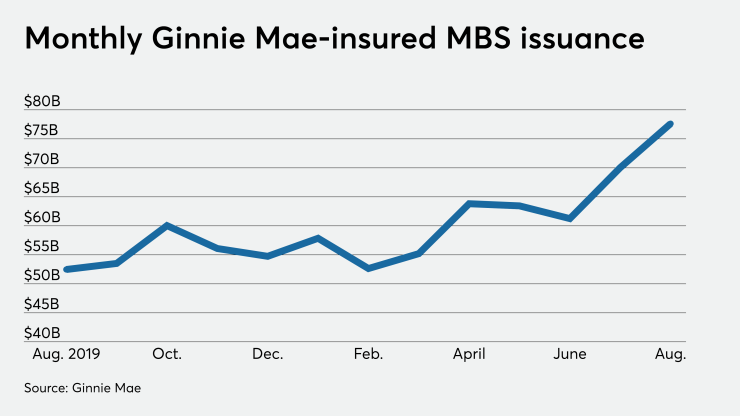

A continuing stream of originations pushed Ginnie Mae's August volume of newly insured securitized mortgages past the record high set in July.

Ginnie's total issuance rose 11% on a consecutive-month basis to nearly $78 billion from $70 billion. It was up 47% from almost $53 billion during the same month a year earlier.

In August, Ginnie insured $859 million in new-loan securitizations of Home Equity Conversion Mortgages, according to a report by capital markets consultancy New View Advisors. Roughly $850 million in new loans and $550 million in seasoned loans were issued in new securitizations

Prior to the pandemic, new mortgage-backed securities in this category had fallen as a result of the Federal Housing Administration tightening the criteria for HECMs last October. New View pegs the long-term average for monthly HECM securitization volume at $500 million to $600 million a month, which suggests production levels are elevated now, thanks to

However, the consultancy warned that recent economic concerns related to the coronavirus and

Another challenge for the broader Ginnie Mae market lies in the government-insured market's relatively higher forbearance levels, which reflect that the low-to-moderate income borrowers with these loans have been disproportionately affected by the damage the pandemic has inflicted on the economy.

While forbearance rates overall are falling, the Mortgage Bankers Association's survey shows that the share of Ginnie Mae loans in this category is not only higher than for other loan types but has

The FHA, which is a key contributor of government-insured loans to Ginnie securitizations, also recently