Politics and policy

Politics and policy

-

MBS buying has become the near-term focus but a 2026 offering is still possible, Federal Housing Finance Agency official Bill Pulte told Fox Business.

February 26 -

Senate Majority Leader John Thune, R-S.D., moved to consider the housing package next week, but it's not clear what version of the bill senators will be voting on as the House, Senate and White House are still negotiating priorities.

February 26 -

For the first time since early September 2022, the Freddie Mac Primary Mortgage Market Survey has the 30-year below 6%, but the 15-year gained this week.

February 26 -

In a letter to regulators, the consortium of organizations recommended regulatory changes affecting a range of rules from risk weights to warehouse financing.

February 20 -

Federal Reserve Vice Chair for Supervision Michelle Bowman said in comments Wednesday that the central bank plans to publish its Basel III endgame capital proposal for public comment before the end of March.

February 18 -

A White House Council of Economic Advisers report published Tuesday found that the CFPB cost consumers between $237 and $369 billion since its creation, an analysis that consumer advocates and some financial academics say is flawed.

February 18 -

In a speech Tuesday, Federal Reserve Gov. Michael Barr said it was possible that artificial intelligence will boost productivity in an undisruptive way. But he said policymakers should also be wary of a financial crash if those gains are not realized or a rapid adoption that could lead to labor displacement.

February 17 -

Large and mega investors accounted for 5.8% of all single family-home purchases in December, up from 4.8% at the same time last year, according to Cotality.

February 17 -

The Consumer Financial Protection Bureau's complaint portal has been flooded in recent years, but corporate debt collectors, industry attorneys and consumer advocates question whether the bureau's efforts to reduce the volume will help consumers as much as it helps the firms they're complaining about.

February 13 -

A House subcommittee hearing discussing the future of the government-sponsored enterprises, noted both are still severely undercapitalized.

February 12 -

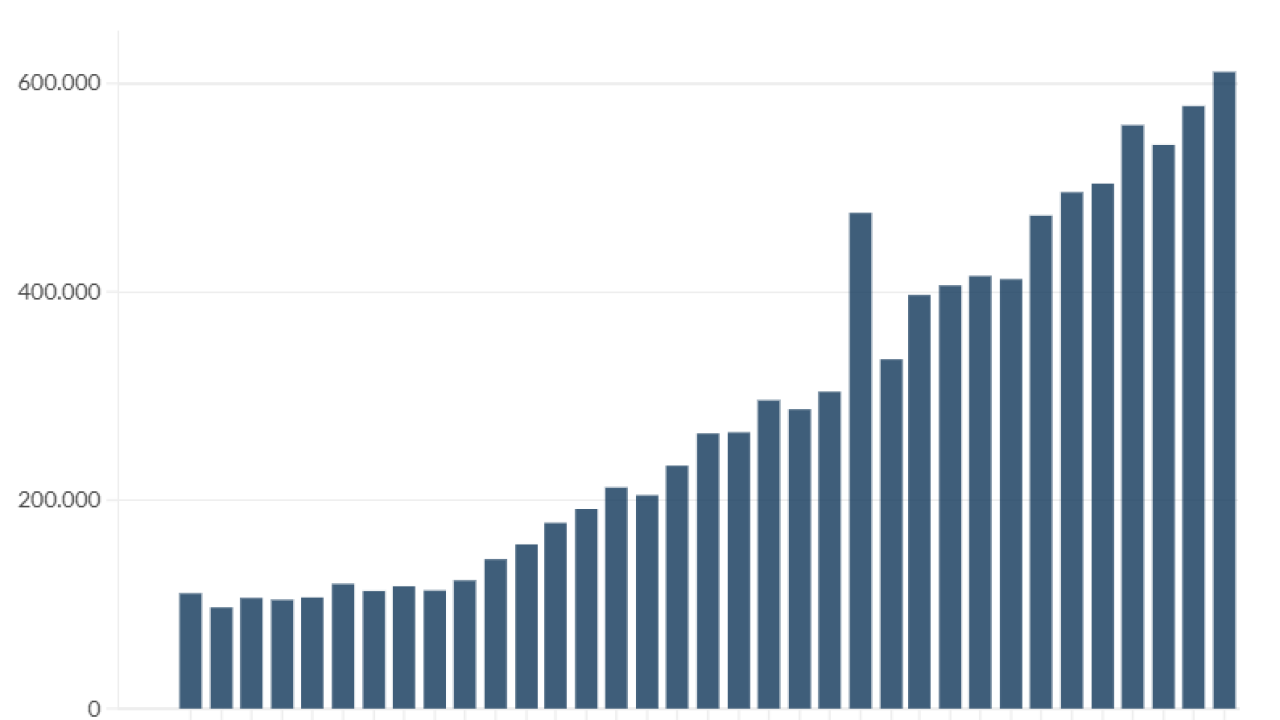

The Bureau of Labor Statistics issued its delayed January employment report Wednesday morning, showing the economy added 130,000 jobs in January. But the agency also sharply revised its estimates for total jobs created in 2025 to 181,000 from 584,000.

February 11 -

The Government Accountability Office was tasked with investigating the Consumer Financial Protection Bureau's stop-work order, but CFPB officials refused to meet with or provide information to Congress' investigative arm.

February 9 -

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

February 6 -

Bowing to industry pressure, the Consumer Financial Protection Bureau is warning consumers with notices on its complaint portal not to file disputes about inaccurate information on credit reports, among other changes.

February 5 -

Federal Reserve Gov. Lisa Cook said in a speech Wednesday night that the central bank's credibility depends on its ability to bring inflation back to its 2% target.

February 4 -

In a contentious House Financial Services Committee oversight hearing, Treasury Secretary Scott Bessent sidestepped questions on the Trump family crypto conflicts of interest and inflation with pugnacious responses to Democratic lawmakers' questions.

February 4 -

President Donald Trump's support of legislation that would cap credit card interest rates at 10% has flagged in recent weeks, but experts say that the debate has highlighted significant gaps in regulators' understanding of the credit card market and how its risks are priced.

February 3 -

The Chicago-based, $261 million-asset Metropolitan Capital Bank & Trust was placed in receivership and its assets sold to Detroit-based First Independence Bank, costing the Federal Deposit Insurance Corp.'s Deposit Insurance Fund an estimated $19.7 million.

January 30 -

Preemption would hurt affordability for many, the Conference of State Banking Supervisors and the American Association of Residential Mortgage Regulators said.

January 30 -

Former Fed Gov. Kevin Warsh is a relatively known quantity to financial markets, but his embrace of President Trump's agenda and the White House's own contentious relationship with the central bank make it hard to know with certainty where — or even whether — he will lead the Fed.

January 30