Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

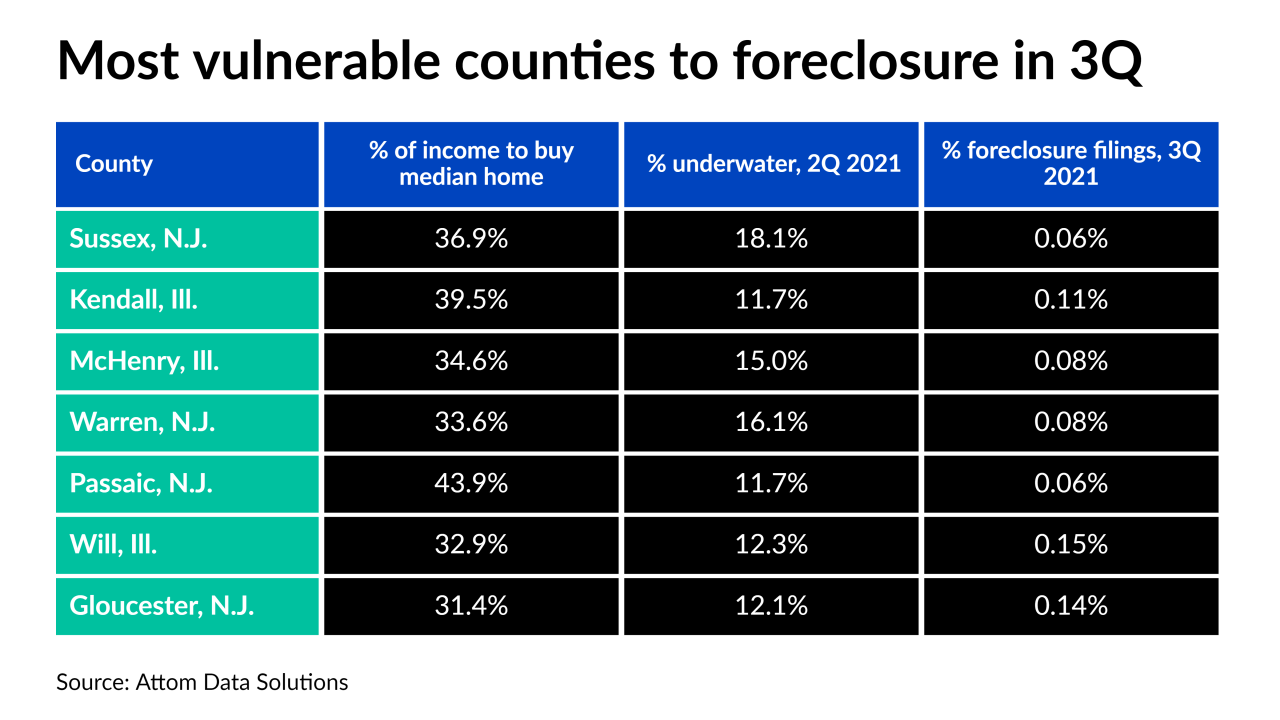

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21 -

Following the federal moratorium’s end, the number jumped, marking the highest quarterly growth on record, according to Attom Data Solutions.

October 14 -

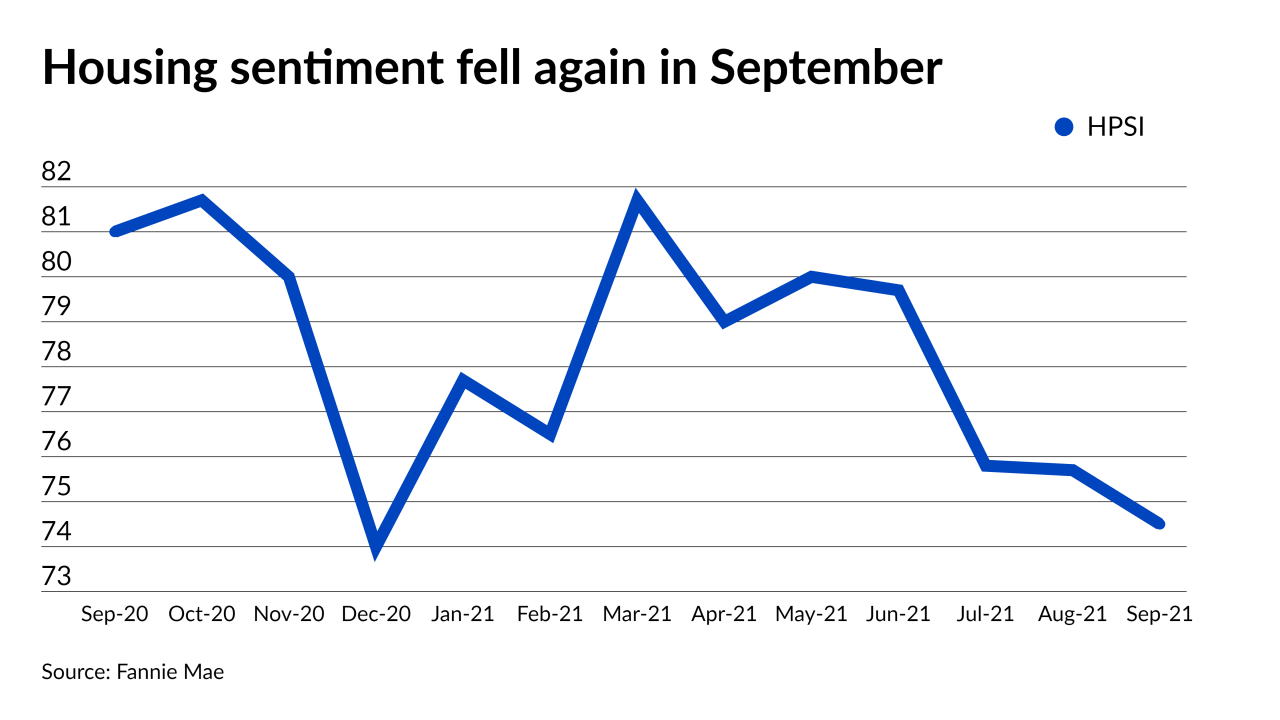

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7 -

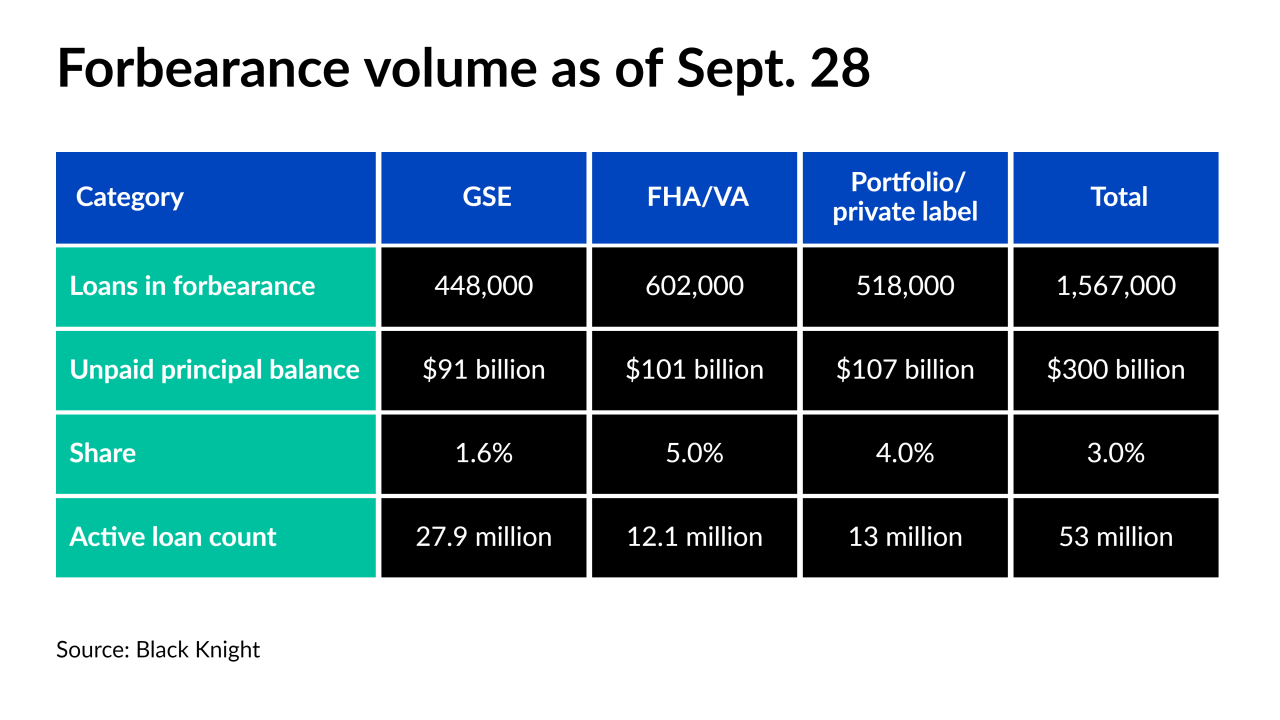

Although over 1.5 million forborne borrowers remain, a fifth could exit their plan in the next week, according to Black Knight.

October 1 -

More for-sale homes hit the market than at any point this year but a turning point may lie ahead, according to Realtor.com.

September 30 -

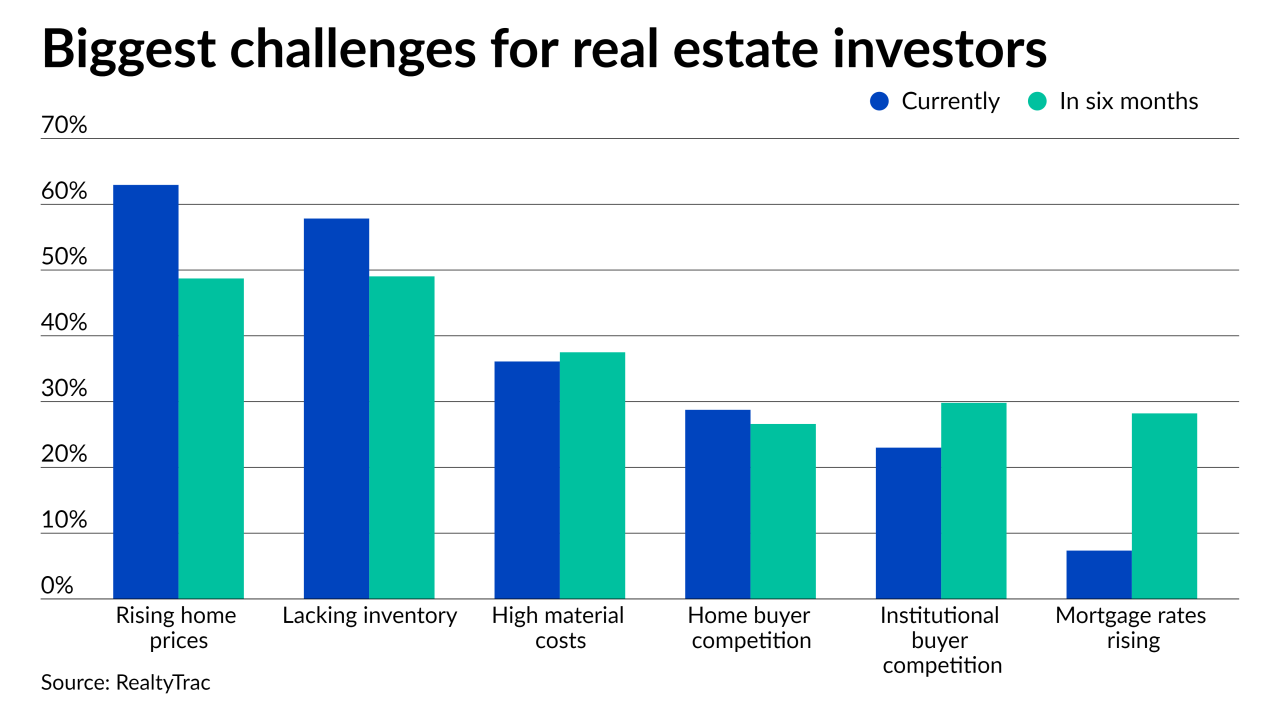

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

Southwestern housing markets had the largest annual changes in median monthly home loan payments, with one increasing more than 30%, according to Redfin.

September 10 -

Meanwhile, property values across the U.S. have increased for 40 quarters in a row, according to the Federal Housing Finance Agency.

August 31 -

Despite “color blind” underwriting algorithms, loan denial rates on mortgages that were not backed by the Federal Housing Administration and the VA skewed heavily toward minority groups, according to a study by The Markup.

August 27 -

The expanded credit access in its automated mortgage decisioning goes into effect in mid September.

August 11 -

Tight inventory and heightened competition kept prime purchasers at bay as property values continued their summer surge, according to Fannie Mae.

August 9 -

The regulation of cryptocurrencies gains momentum abroad while a number of hurdles must be cleared before lenders and banks can handle them at scale in the U.S.

August 5 -

Concerns about foreclosure and a crowded market led to an increase in listings at lower price points in the second quarter.

July 30 -

Soaring home prices and the abundance of all-cash offers that the deep-pocketed can afford makes home buying even harder for the average borrower, according to a Redfin report.

July 22 -

Meanwhile, the average new-home mortgage price climbed to a new all-time high, according to the Mortgage Bankers Association.

July 20 -

Competition amongst those shopping for homes fell for the second straight month as surging prices pushed consumers to the sidelines and inventory saw modest gains, according to Redfin.

July 13 -

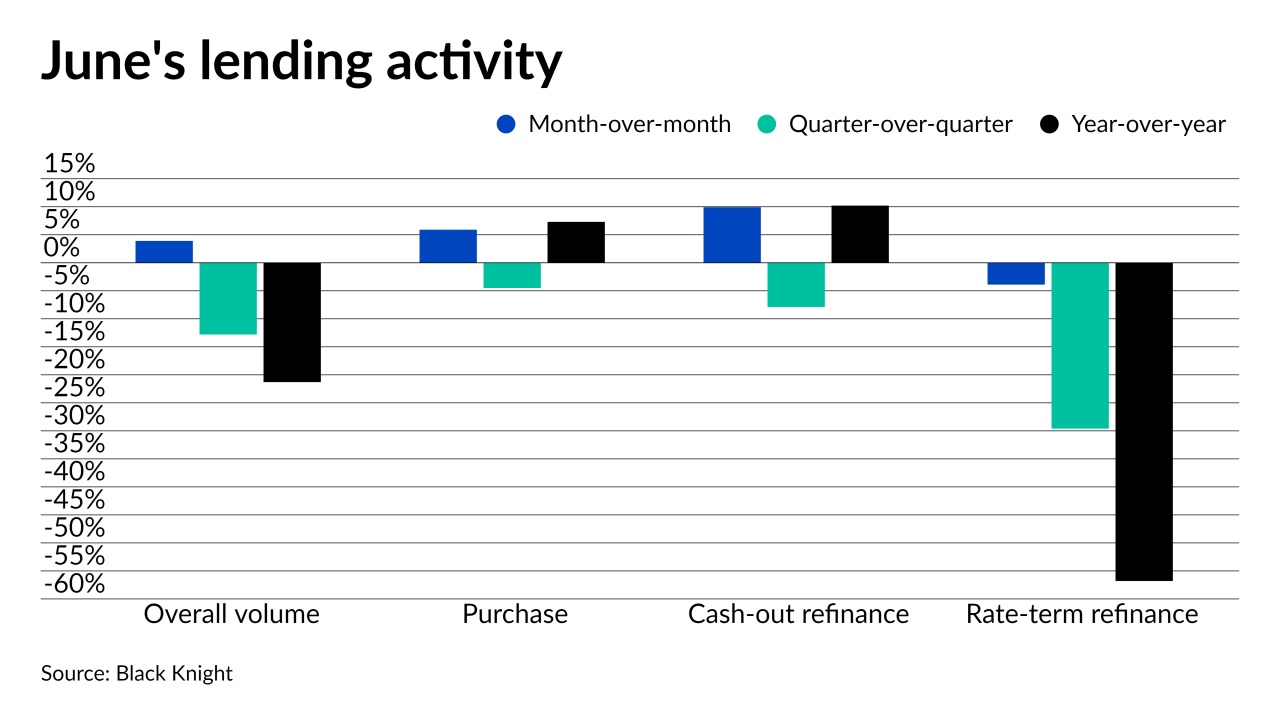

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23 -

Demand was strongest at the high end of the market, which pushed loan amounts up for the fourth straight month.

June 17