Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

The expanded credit access in its automated mortgage decisioning goes into effect in mid September.

August 11 -

Tight inventory and heightened competition kept prime purchasers at bay as property values continued their summer surge, according to Fannie Mae.

August 9 -

The regulation of cryptocurrencies gains momentum abroad while a number of hurdles must be cleared before lenders and banks can handle them at scale in the U.S.

August 5 -

Concerns about foreclosure and a crowded market led to an increase in listings at lower price points in the second quarter.

July 30 -

Soaring home prices and the abundance of all-cash offers that the deep-pocketed can afford makes home buying even harder for the average borrower, according to a Redfin report.

July 22 -

Meanwhile, the average new-home mortgage price climbed to a new all-time high, according to the Mortgage Bankers Association.

July 20 -

Competition amongst those shopping for homes fell for the second straight month as surging prices pushed consumers to the sidelines and inventory saw modest gains, according to Redfin.

July 13 -

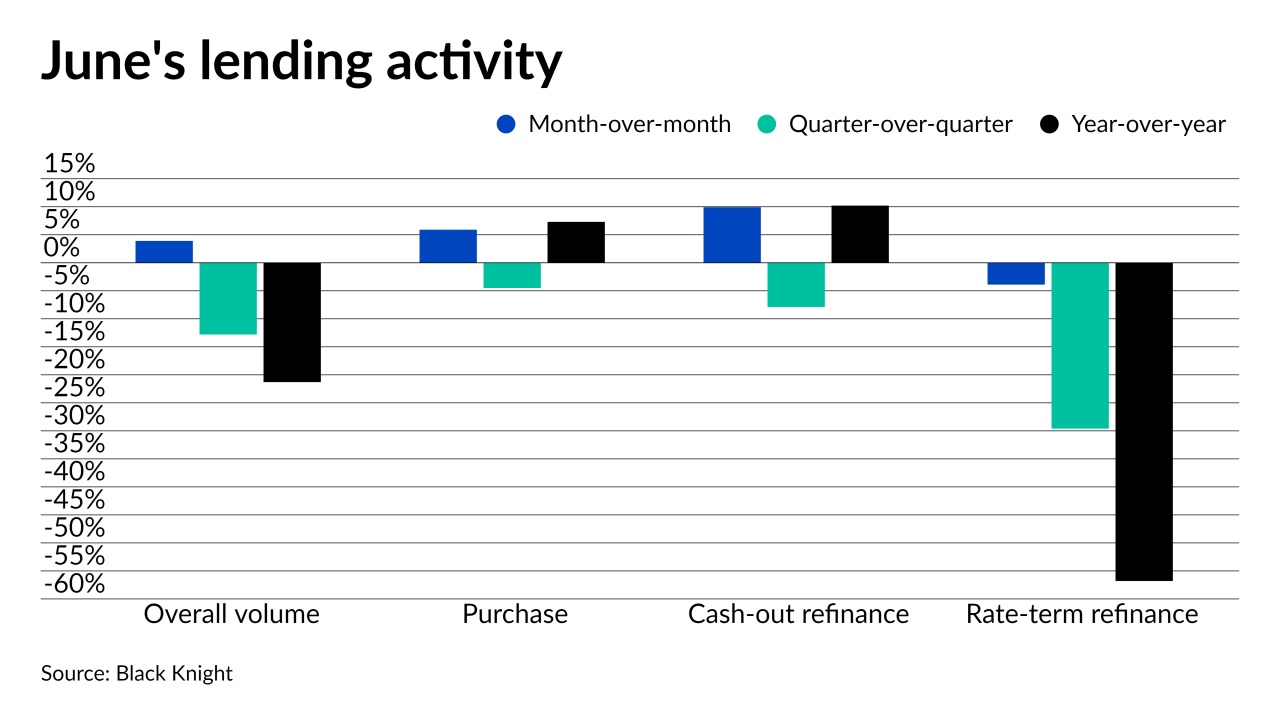

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23 -

Demand was strongest at the high end of the market, which pushed loan amounts up for the fourth straight month.

June 17 -

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

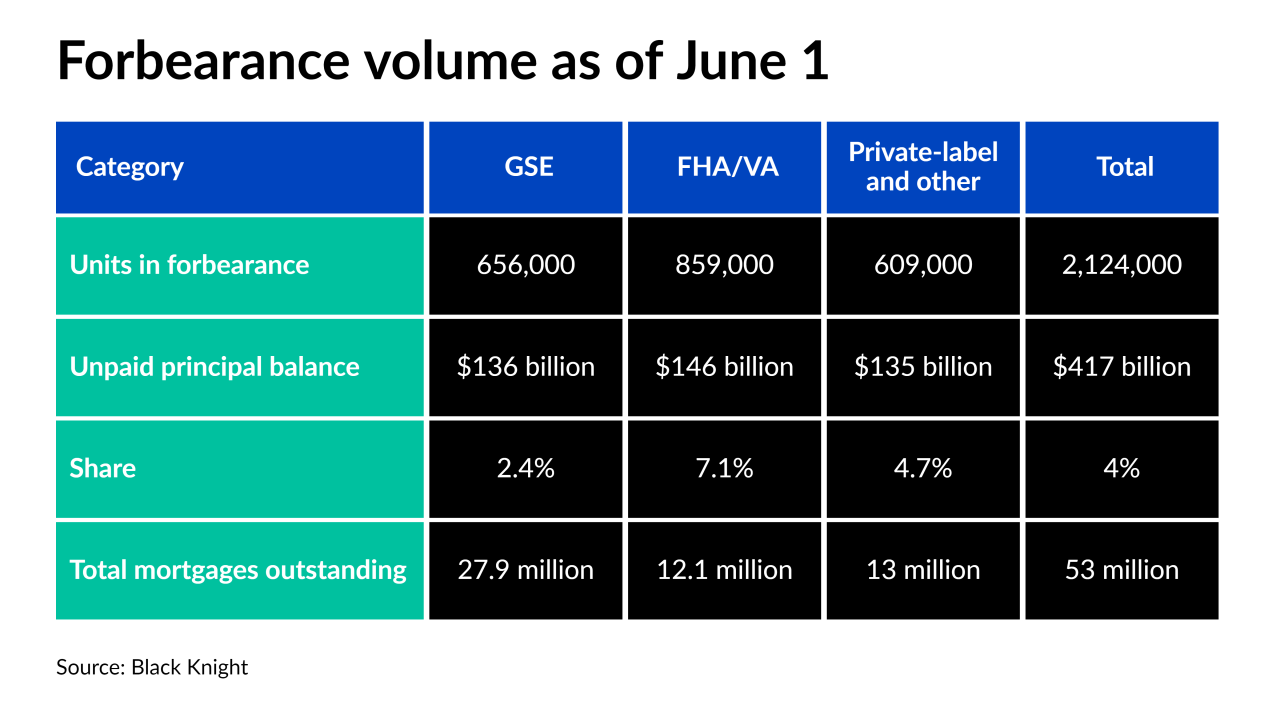

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

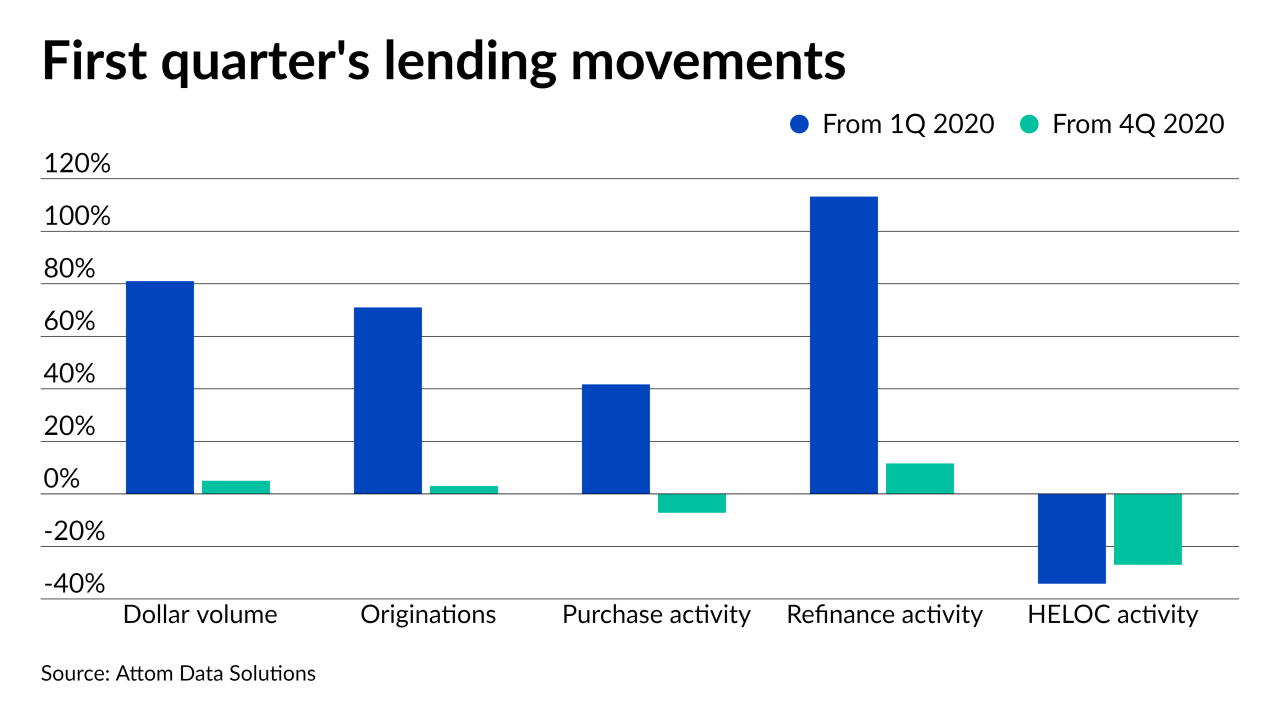

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

While government protections currently shield most borrowers and delay process timelines, a growing backlog is likely to hit some areas of the country worse than others.

April 23 -

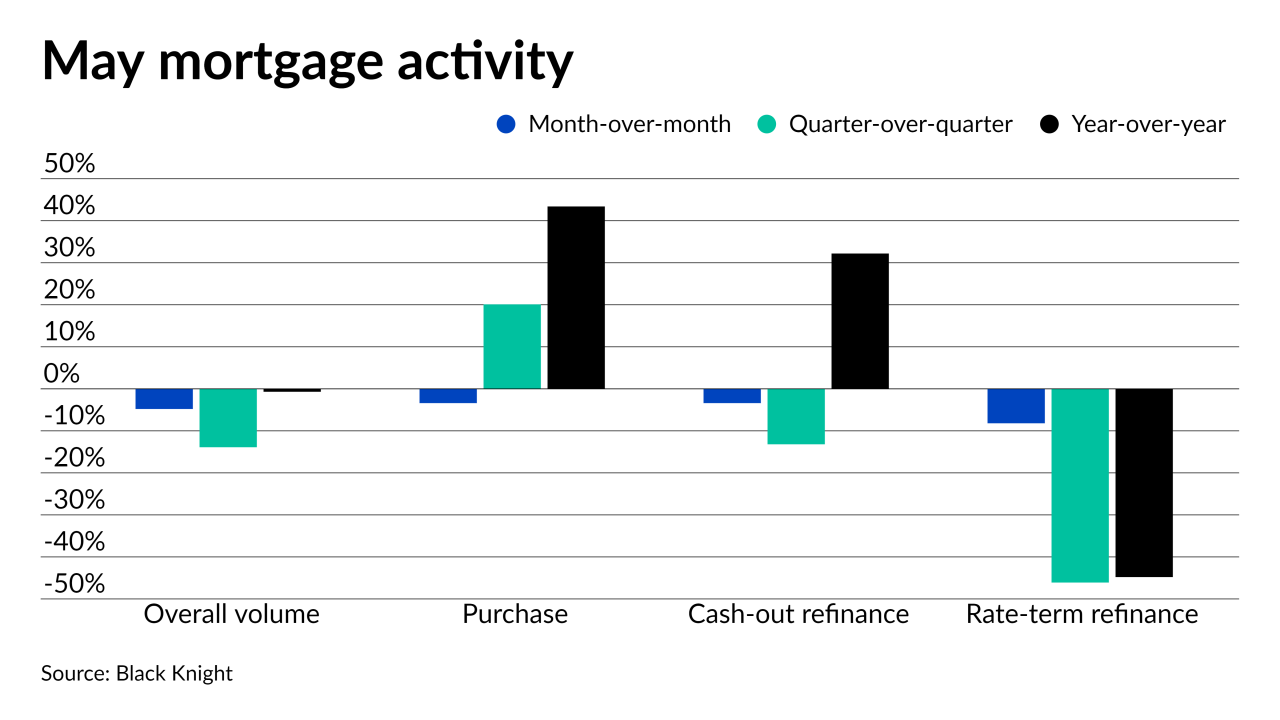

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

While the economic recovery and stimulus checks drove upward movement in purchases, it wasn’t enough to offset tumbling refinance activity.

March 17 -

After a booming 2020, more mortgage lenders than ever before expect diminishing margins in the coming months as climbing interest rates set up heightened competition.

March 11 -

As an improving job market aided financial stability for borrowers, 2020 ended with drops in delinquent home loans, a CoreLogic report found.

March 9