With

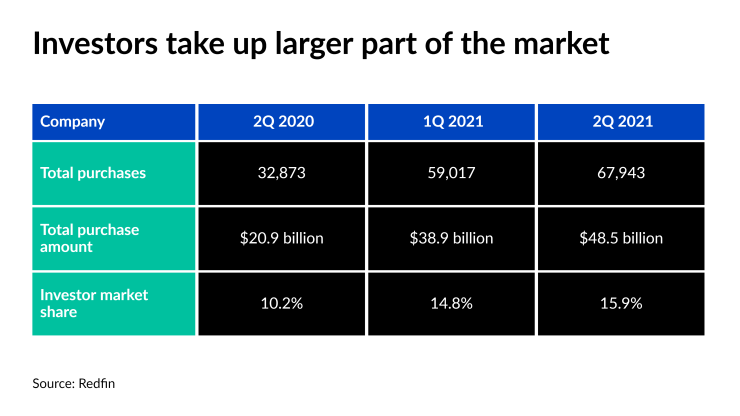

Investors — any institute or business that deals in real estate — bought 67,943 homes in the second quarter, a surge from 59,017 in the first quarter and 32,873 the year before, according to Redfin. Those purchases amounted to $48.5 billion, up from $38.9 billion quarterly and $20.9 billion annually, though many investors pulled back during the pandemic’s early stages.

Investor-owned units make up 15.9% of all U.S. properties, an increase from 14.8% in 1Q, 10.2% a year ago and just below the record of 16.1% in 2020’s first quarter. The

"With investors throwing money at the housing market, some home buyers are finding it tough to compete," Bokhari said. "Investors frequently pay with all cash, which means they often have a much higher chance of

Investors bought 26.5% of multifamily homes, 16.1% of single-family properties and 15.1%

"Investors are also taking advantage of surging demand in the rental market,” Bokhari said. “With so many Americans priced out of homeownership, investors can turn an easy profit by buying up properties and renting them out."