The fear of imminent

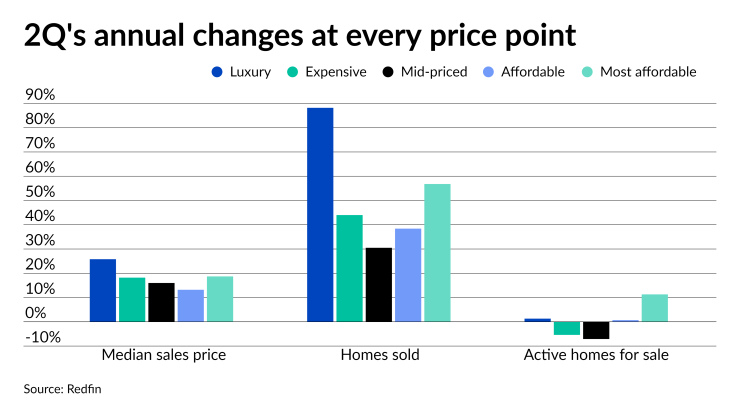

The number of active for-sale properties in the most affordable band — those with a median price of $108,000 — rose 11.3% year-over-year. Comparatively, the luxury tier — median price of $1.03 million — came next at a 1.3% annual gain in supply. Affordable homes — those with a $198,200 median — rose 0.7%, while expensive homes at a $455,000 median fell 5.4% and mid-priced homes — $290,000 — dropped 7.1%.

"The government's pandemic mortgage forbearance program is coming to an end, which is likely boosting the supply of America's most affordable homes," Fairweather said. "Some homeowners are putting their properties on the market because they're concerned about being foreclosed upon when forbearance dries up, while other owners of affordable homes are selling because they want to avoid the

The most affordable and luxury tiers also saw the

Meanwhile,

"Surging prices can be especially problematic for first-time and lower-income homebuyers,” Fairweather said. "With the pandemic eviction moratorium coming to an end and many Americans priced out of homeownership, investors are keen on buying up inexpensive properties and turning them into rentals."