Amid persistent industry concerns, growing commercial and multifamily mortgage activity is improving the outlook for next year’s market, according to the CRE Finance Council.

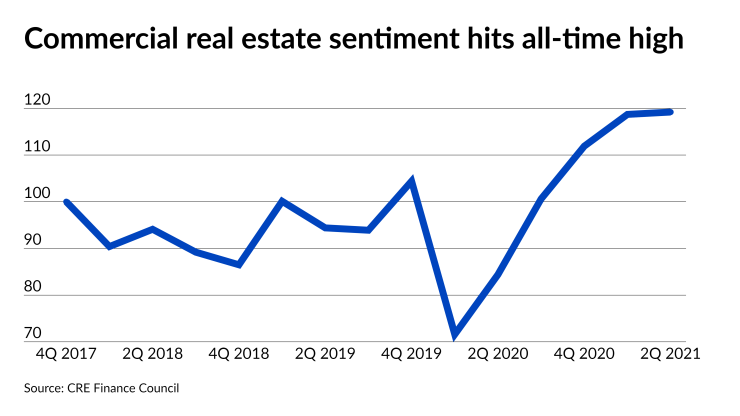

The group’s Sentiment Index climbed to its highest level, 119.2, in the second quarter from 118.7 in the first quarter and 84.4 a year ago. The survey started with a baseline of 100 in the fourth quarter of 2017.

A survey-high share of 83% of the board of governors felt positive about CRE business in the next 12 months, spiking from 72% quarterly and 21% annually. Concurrently, 58% expressed positivity around the surrounding CRE environment in the next year, about even with the 59% from 1Q while nearly quadrupling the 15% from the year before.

An 88% share of those surveyed said their commercial lending programs are running at full capacity, with 7% partially operational and 5% not taking on any new business. Those shifted from 71%, 24% and 6% in the first quarter and 34%, 54% and 11% year-over-year. Additionally, 31% claimed they saw more transaction volume in the second quarter than before the pandemic started.

Other industry analyses align with the increasingly positive picture. The

"As restrictions are lifted in states across the country and the economy reopens, we are hopeful for a strong recovery with investors eager to move off the sidelines," Lisa Pendergast, executive director of CREFC, said in a press release.

However, a rising negative outlook surrounds government policy and regulations. A 30% share anticipate policies to restrain CRE finance in the next 12 months, versus 13% quarterly and 15% annually. Any changes, including

“For example, a Section 1031 like-kind exchange for real estate allows borrowers to defer tax recognition when selling a property to buy a similar property. The deferred tax treatment is a major driver of transactions and discontinuing it could further burden the CRE industry as it tries to recover from the pandemic,” a CREFC representative told NMN.

Although not every CRE segment is held in the same regard. The trade association ranked

"Retail and hotel remain the most stressed in the economic wake of the pandemic, and the survey indicated

Worries around CRE loan distress seem to have waned since the pandemic began. The latest poll results showed 90% think commercial lending will do better than it did coming out of the global financial crash in 2008 and 5% worse, compared to 91% and 9% in the first quarter and 31% and 54% in June 2020.