Although over 1.5 million forborne borrowers remain, a fifth could exit their plans by next week, according to Black Knight.

Loans in pandemic-related forbearance fell by 11,000 for the seven days ending Sept. 28, representing

The largest exit waves typically happen right after months end since expired plans “are deactivated in servicing systems of records,” Andy Walden, Black Knight’s vice president of market research, said in a blog post. This turn of the calendar should be no exception as over 300,000 active plans come up for review, with most facing their final expiration date.

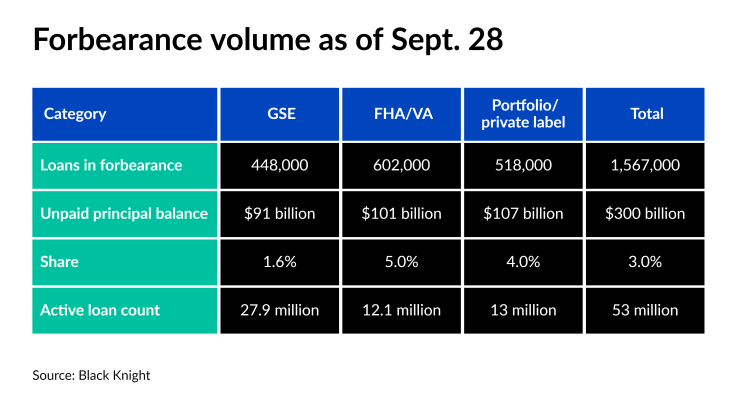

By investment type, mortgage pools backed by the Federal Housing Administration or Department of Veterans Affairs again led the weekly improvement by count, falling 22,000. That change dragged the share of forborne FHA and VA loans down to 5% from 5.2%, and represented a drop in the collective unpaid principal balance to $101 billion from $105 billion. Mortgages purchased by government-sponsored enterprises came next with a 15,000 decline in distressed plans, shrinking the total in this category to 448,000 from 463,000, the share to 1.6% from 1.7% and the UPB to $91 billion from $95 billion.

However, portfolio and private-label loans in forbearance rose for the second week in a row. After increasing by 3,000 the previous week, they jumped another 27,000, bringing the total to 518,000, distressed share to 4% from 3.8% and the UPB to $107 billion from $104 billion.

The latest analysis showed servicers

At the beginning of August, about half of the GSE-backed loans with forbearance and nearly two-thirds of government-insured or guaranteed mortgages with suspended payments were delinquent, according to a separate report from CoreLogic. Some of those borrowers may need modification or loss mitigation plans due to the upcoming wave of expirations.

“It is true that