After over

As the pandemic dragged

"Shifting home preferences and simply not enough homes on the market created these expensive and competitive conditions," Daryl Fairweather, Redfin's chief economist, said in a statement to NMN. "We saw rents fall in the most expensive cities, as people flocked to the suburbs and more rural areas where it is more common to own a home than to rent one."

Generally, areas with warmer climates and better affordability experienced migration waves from COVID-19's remote working conditions, Fairweather added.

Austin, Texas, led the country with a 34% year-over-year change in median mortgage payments. As the Lone Star State’s capital’s booming technology scene brings an influx of companies and workers, it saw

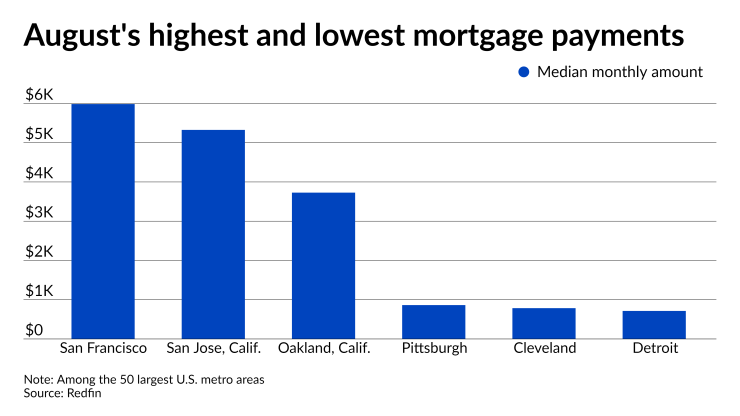

The highest median mortgage payments were all in California. San Francisco topped the country with a $5,984 median monthly mortgage payment in August, trailed by $5,326 in San Jose, $3,728 in Oakland, $3,570 in Anaheim, $3,217 in Los Angeles and $2,943 in San Diego. The bottom six all fell under $1,000. Detroit was the least expensive place for borrowers, with a median of $714 per month. Next up was Cleveland at $785, Pittsburgh at $863, St. Louis at $902, Cincinnati at $973 and Indianapolis at $981.

Florida saw the largest rental growth, as Tampa experienced an increase of 29.2%, followed by 28.9% in Miami, West Palm Beach and Fort Lauderdale, and 26.8% in Jacksonville. Three cities saw rental appreciation fall, with drops of 5.1% in Pittsburgh, 2.9% in San Jose and 0.5% in St. Louis. Boston — which had the

Nationwide, property values posted quarterly year-over-year gains for the last decade straight,

Additionally, “the end of pandemic eviction moratoriums and mortgage forbearance may also cause landlords to raise rents to cover the risk of future tenant protections or make up for lost rental income,” Marr said.