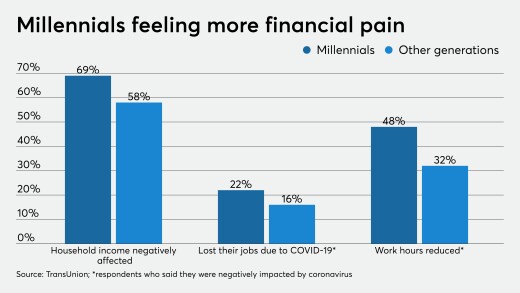

Nearly 70% of U.S. adults between the ages of 26 and 40 said their earnings had been negatively affected by the outbreak, about 10 percentage points higher than other age groups.

Mortgage rates fell to their lowest level since Freddie Mac started reporting this data in 1971, as the coronavirus shutdown continued to play havoc with the economy.

Mounting economic fallout from the pandemic is fueling apartment landlords' concerns that more tenants will struggle to make their rent payments, even after most managed to come up with the money for April.

The ratings firm also took negative action with respect to Ally, Synchrony, Discover, Sallie Mae and Navient, citing the impact that the coronavirus crisis is having on their revenues and profits.

The Federal Reserve chairman pledged to use every tool at the central bank's disposal to limit the economic fallout from the coronavirus and urged lawmakers to take further action.

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

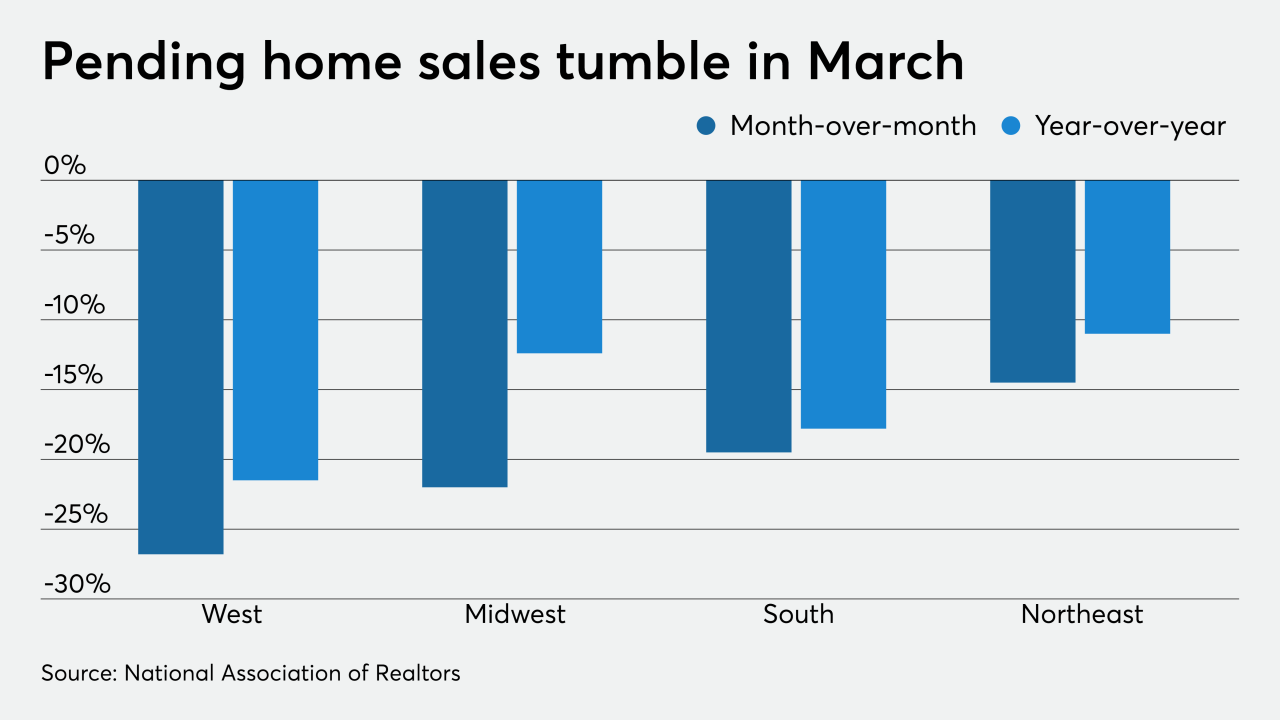

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

The government-sponsored enterprises are focusing on how loans can be repaid after the federal forbearance period ends, and projections for loan modification volumes suggest the larger industry should, too.

-

Nearly 70% of U.S. adults between the ages of 26 and 40 said their earnings had been negatively affected by the outbreak, about 10 percentage points higher than other age groups.

April 30 -

Mortgage rates fell to their lowest level since Freddie Mac started reporting this data in 1971, as the coronavirus shutdown continued to play havoc with the economy.

April 30 -

Mounting economic fallout from the pandemic is fueling apartment landlords' concerns that more tenants will struggle to make their rent payments, even after most managed to come up with the money for April.

April 29 -

The ratings firm also took negative action with respect to Ally, Synchrony, Discover, Sallie Mae and Navient, citing the impact that the coronavirus crisis is having on their revenues and profits.

April 29 -

The Federal Reserve chairman pledged to use every tool at the central bank's disposal to limit the economic fallout from the coronavirus and urged lawmakers to take further action.

April 29 -

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

April 29 -

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29