-

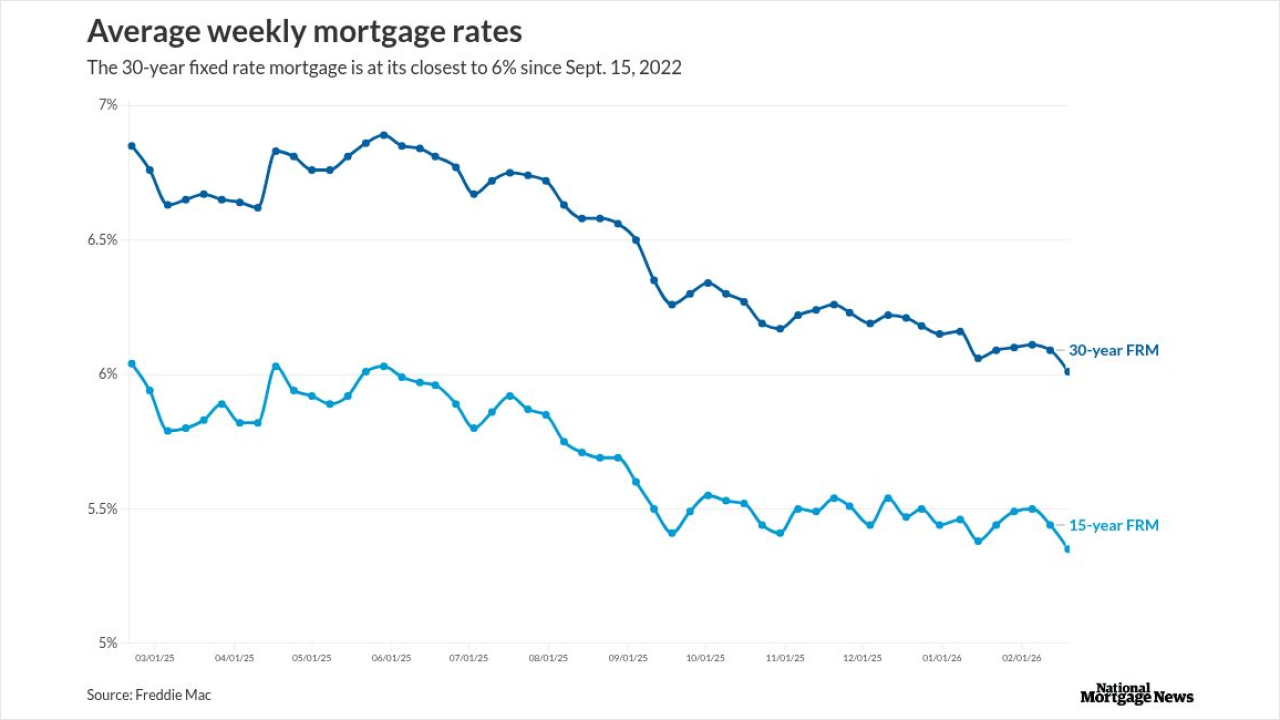

For the first time since early September 2022, the Freddie Mac Primary Mortgage Market Survey has the 30-year below 6%, but the 15-year gained this week.

February 26 -

First liens and junior liens account for 197 and 1,755 of the pool, respectively, DBRS said. They have unpaid balances of $30.5 million and $217 million, with FICO scores of 747 and 740 on a WA basis.

February 26 -

Total consumer debt in the United States hit $18.2 trillion by the end of last year, with $12.8 trillion attributed to first mortgages, according to Equifax.

February 25 -

Underwriting relied heavily on alternative documentation, led by debt-service coverage ratios (35.7%) and bank statements ranging from 12-23 months (28.2%) and longer than 24 months (4.6%).

February 25 -

In a letter to regulators, the consortium of organizations recommended regulatory changes affecting a range of rules from risk weights to warehouse financing.

February 20 -

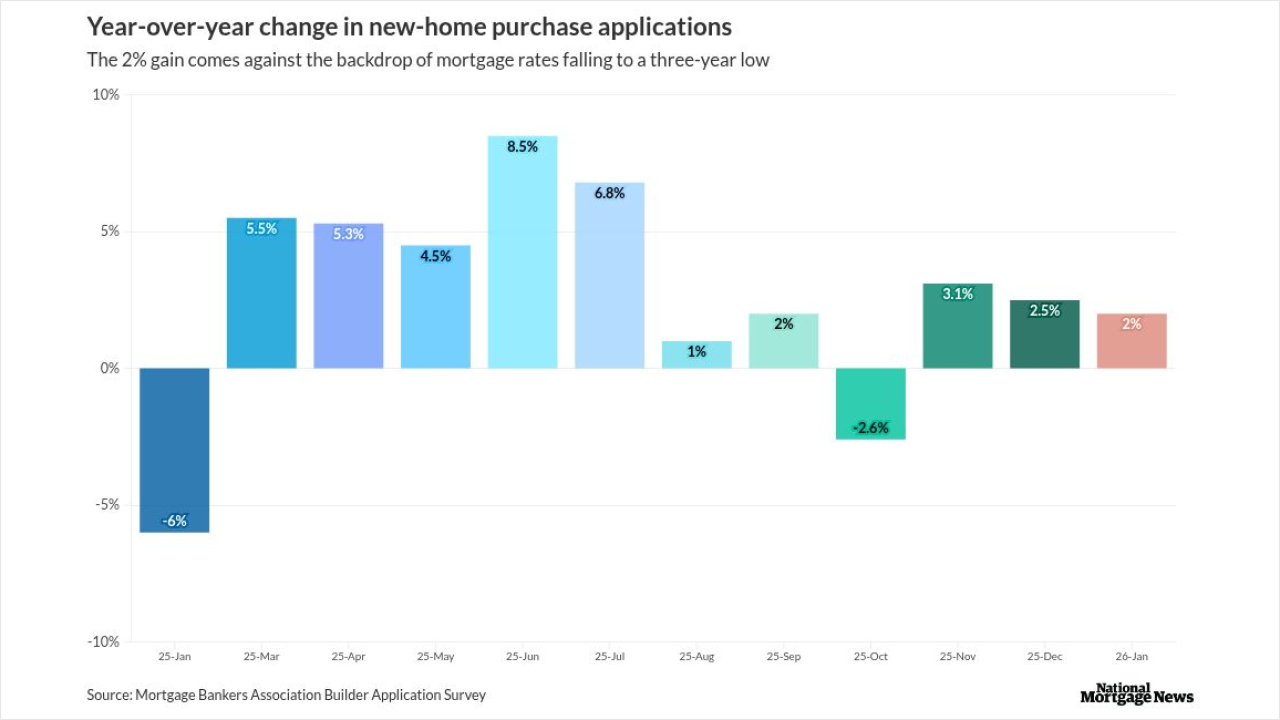

The increase in borrower activity came as housing starts ended 2025 on a high note, while mortgage rates were a percentage point lower year-over-year.

February 19 -

While the Freddie Mac survey recorded a weekly decline, the benchmark 10-year Treasury yield had moved back up by 6 basis points around midday on Thursday.

February 19 -

Large and mega investors accounted for 5.8% of all single family-home purchases in December, up from 4.8% at the same time last year, according to Cotality.

February 17 -

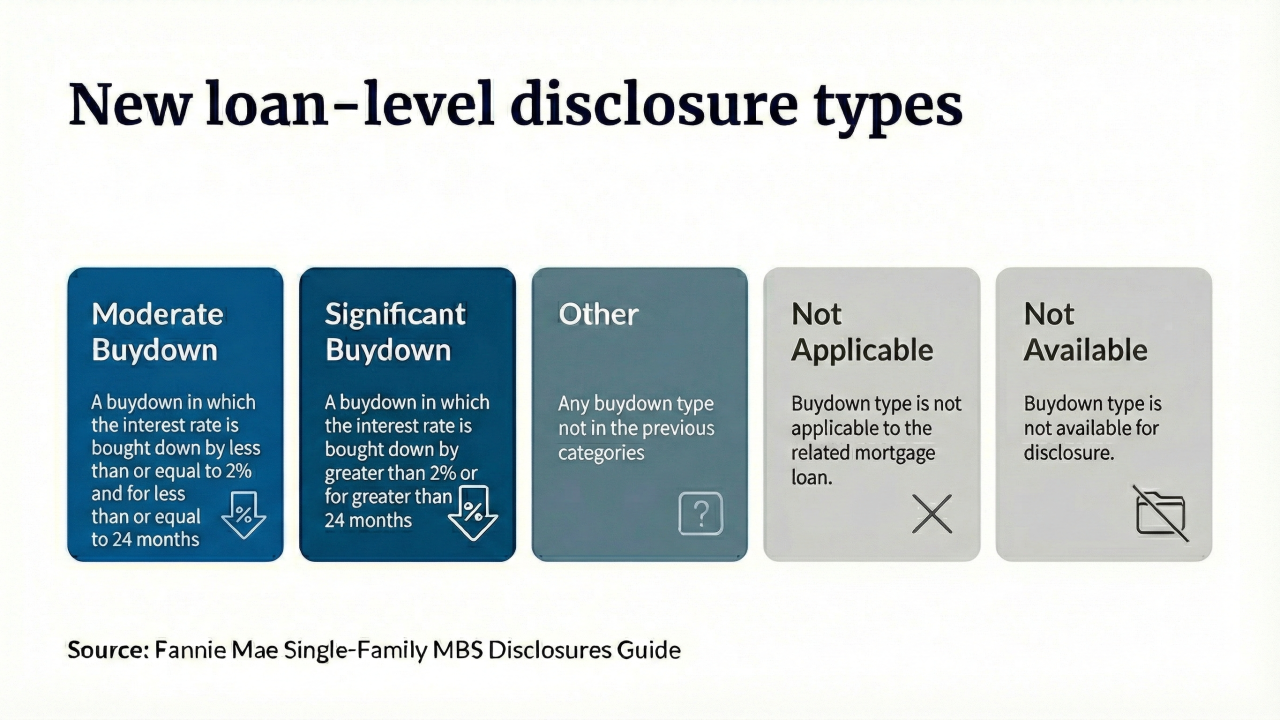

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

February 13 -

Point Digital Finance originated the underlying home equity contracts, composed of first lien (11.1%), primarily second-lien (82.9%) and third liens (5.81%) on residential properties.

February 12 -

A House subcommittee hearing discussing the future of the government-sponsored enterprises, noted both are still severely undercapitalized.

February 12 -

Traders are now pricing in the Fed's next rate reduction in July, after the term of current Chair Jerome Powell ends in May.

February 11 -

The Bureau of Labor Statistics issued its delayed January employment report Wednesday morning, showing the economy added 130,000 jobs in January. But the agency also sharply revised its estimates for total jobs created in 2025 to 181,000 from 584,000.

February 11 -

Borrowers in the lowest-income areas have seen their 90 or more day delinquency rates soar since 2021, jumping from 0.5% to nearly 3%, the New York Fed said.

February 10 -

The secondary market regulator will formally publish its own rule on Feb. 6, after a comment period and without making changes to what it proposed in July.

February 6 -

Leverage is moderate in Saluda Grade's pool, yet the junior liens carry slightly more LTV and DTI risk, on a weighted average (WA) basis.

February 4 -

Many details have yet to be determined, including the role that federally-backed mortgages should play.

February 3 -

Less than 45% of mortgage residential properties in the United States were equity-rich last quarter, a 1.5-percentage-point drop from the third quarter.

February 3 -

Preemption would hurt affordability for many, the Conference of State Banking Supervisors and the American Association of Residential Mortgage Regulators said.

January 30 -

DRMT 2026-INV1, is backed by a pool of 1,153 non-prime investment property mortgages, which have a moderate leverage levels of an original, combined loan-to-value (CLTV) ratio of 69.9%.

January 29