-

Mortgage borrowers filed a third amended class action complaint against the bank over modification issues from 2010 to 2015.

January 22 -

Despite RCKT Mortgage's second-lien composition, the loans display several positive credit characteristics, including a WA credit score of 745.

January 20 -

Hot securitization sectors such as non-qualified mortgages and home equity are set to expand further amid market shifts this year, recent forecasts suggest.

January 20 -

Canyon Partners sees opportunities in corners of the mortgage, with tightened due diligence, and the auto ABS markets.

January 20 -

The notes are expected to pay coupons of 4.94% on notes in the A1FCF tranche, rated AAA from KBRA and Fitch Ratings, to 6.78% on the B1 notes.

January 16 -

This week the conforming 30-year fixed rate mortgage fell 10 basis points, with Optimal Blue data showing it broke through, at least briefly, the 6% level.

January 15 -

A Florida man's racketeering class action case accuses two mortgage employees of conspiring with a homebuilder to facilitate fraudulent construction draws.

January 13 -

Cryptocurrency development in the mortgage industry has accelerated in no small part from easing regulation and a push from FHFA Director Bill Pulte.

January 13 -

A new move that would open up more use of certain dedicated savings accounts for home purchase purposes is under consideration, according to Politico.

January 12 -

The survey, taken before Pres. Trump's $200 billion MBS buy demand, finds panelists worried over inflation, but also see employment as the larger downside risk.

January 12 -

Lenders shouldn't expect the latest jobs numbers to yield major monetary policy moves after the unemployment rate came in mostly flat last month, experts say.

January 9 -

The deal comes to market as President Trump suggested barring institutional buyers from snatching up single-family homes, the type of properties secure the bulk of SEMT 2026-INV1.

January 8 -

ODF II will focus on originating senior and junior commercial rea estate debt investments across major U.S. markets, focused on multifamily properties.

January 8 -

Across-the-board decreases across all loan types drove the Mortgage Bankers Association's full credit availability index to its lowest in three months.

January 8 -

Analysts at RBC Capital Markets said the plan is bad news for Invitation Homes and American Homes 4 Rent, but the companies "are long past the time of significant growth in home count

January 8 -

Late last year, commercial bank holdings of mortgage paper reached the highest level since 2023 as these depositories are flush with deposits.

January 6 -

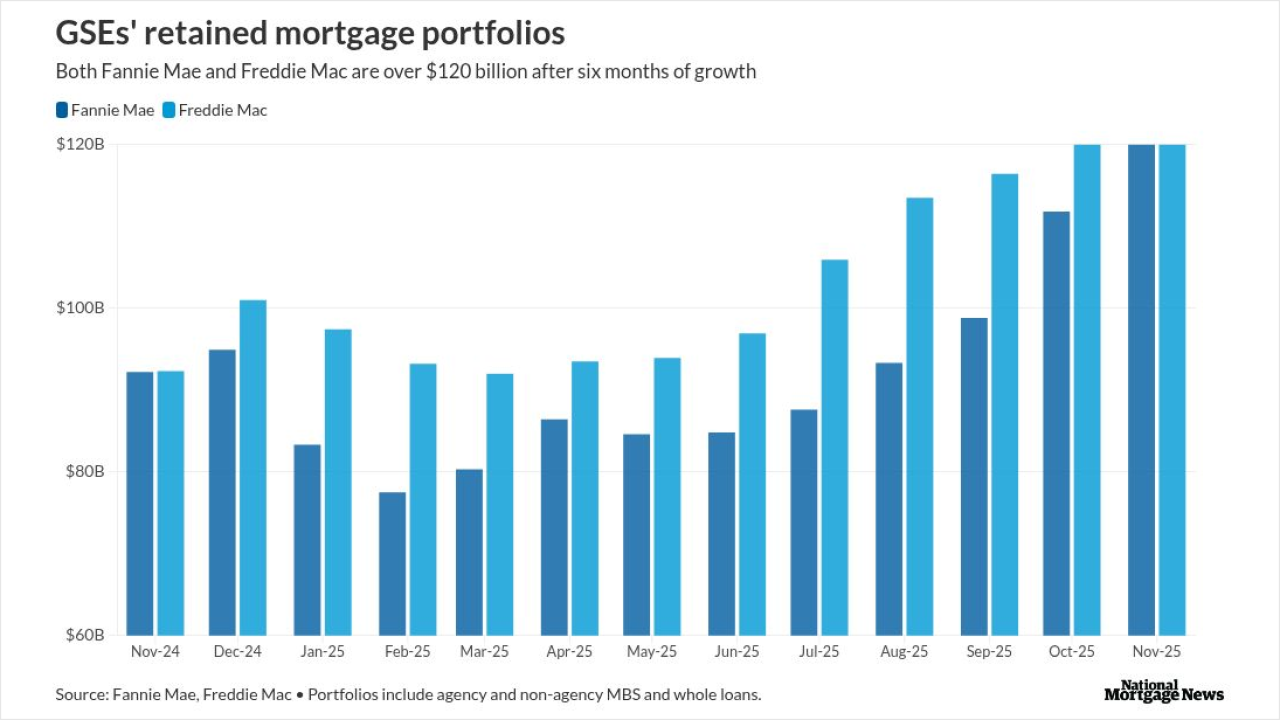

Keefe, Bruyette & Woods attributes Fannie Mae and Freddie Mac portfolio growth for the narrower spreads, but other reasons include lower volatility.

January 5 -

Despite a limited representation and warranty framework, the entire pool has experienced third-party due diligence, which reduces the risk of future violations.

December 31 -

National home prices grew monthly and annually in October, but considerably less than last year, according to S&P Dow Jones Indices.

December 30 -

The additional research Secretary Scott Turner acknowledged would be required should include a cost-benefit analysis, mortgage professionals suggested.

December 29