-

Bowing to industry pressure, the Consumer Financial Protection Bureau is warning consumers with notices on its complaint portal not to file disputes about inaccurate information on credit reports, among other changes.

February 5 -

The credit score firm partnered with Plaid to bring additional cash-flow data into its previously released UltraFICO score.

November 20 -

Equifax will hold costs for scores from FICO rival Vantagescore through 2027 and offer other incentives meant to drive adoption of the alternative metric.

October 8 -

Through a new program, mortgage resellers will be able to calculate and distribute credit scores directly to customers, reducing their reliance on credit bureaus.

October 3 -

The credit scoring agency's rollout comes after years of criticism from home lenders over its prices, with delivery costs rising over 40% in the past year.

October 2 -

Bill Pulte, regulator and conservator of entities that buy and securitize many mortgages, also reaffirmed he's 'not happy with" lenders' main score provider.

June 30 -

Although credit bureaus have collected this data for three years, it's only now being factored into assessments of consumer creditworthiness.

June 23 -

Consumer Financial Protection Bureau Director Rohit Chopra said the FICO credit-scoring model has drawbacks in price, predictiveness and market competition, and stakeholders should develop a more open-sourced model that uses artificial intelligence.

November 21 -

Democrats Ritchie Torres and Gregory Meeks called on the New York Home Loan bank to follow the lead of its peers and use alternative credit scoring models for collateral to improve consumers' access to homeownership.

August 9 -

The partnership between personal finance platform Esusu and the National Rental Home Council has several of the trade group's members delivering payment data. They say that has helped result in over 85,000 originations across lending segments.

June 17 -

The changes made to the schedule of bringing advanced credit metrics to major mortgage investors Fannie Mae and Freddie Mac affect bi-merged reports and Vantagescore 4.0's implementation.

February 29 -

Industry executives coming off a tough year are wondering what the transition will cost and how many borrowers it'll bring in.

August 15 -

The findings from Standard & Poor's show little impact from the Federal Housing Finance Agency's proposal regarding what information is required to underwrite a conforming mortgage.

June 15 -

Fannie Mae and Freddie Mac asked originators to resubmit applications that contained errors and adjust sold mortgage information due to incorrect life-of-loan representations and warranties.

June 8 -

Kikoff, whose investors include Golden State Warriors' star Stephen Curry, provides applicants with a no-fee $500 revolving line of credit they can use to purchase personal finance books and courses from its online store. The company then reports this payment activity to some credit bureaus.

June 30 -

The agency said lenders should avoid reporting delinquent payments to credit bureaus for consumers who have sought payment relief due to the pandemic.

April 1 -

The six bills championed by Democrats aim to reduce consumer burdens and provide opportunities for borrowers to rehabilitate their credit, but the legislation has garnered no Republican support.

January 28 -

The percentage of recent mortgage borrowers with subprime credit scores still resides in the single digits, but nearly doubled what is was in 2013, according to TransUnion.

November 13 -

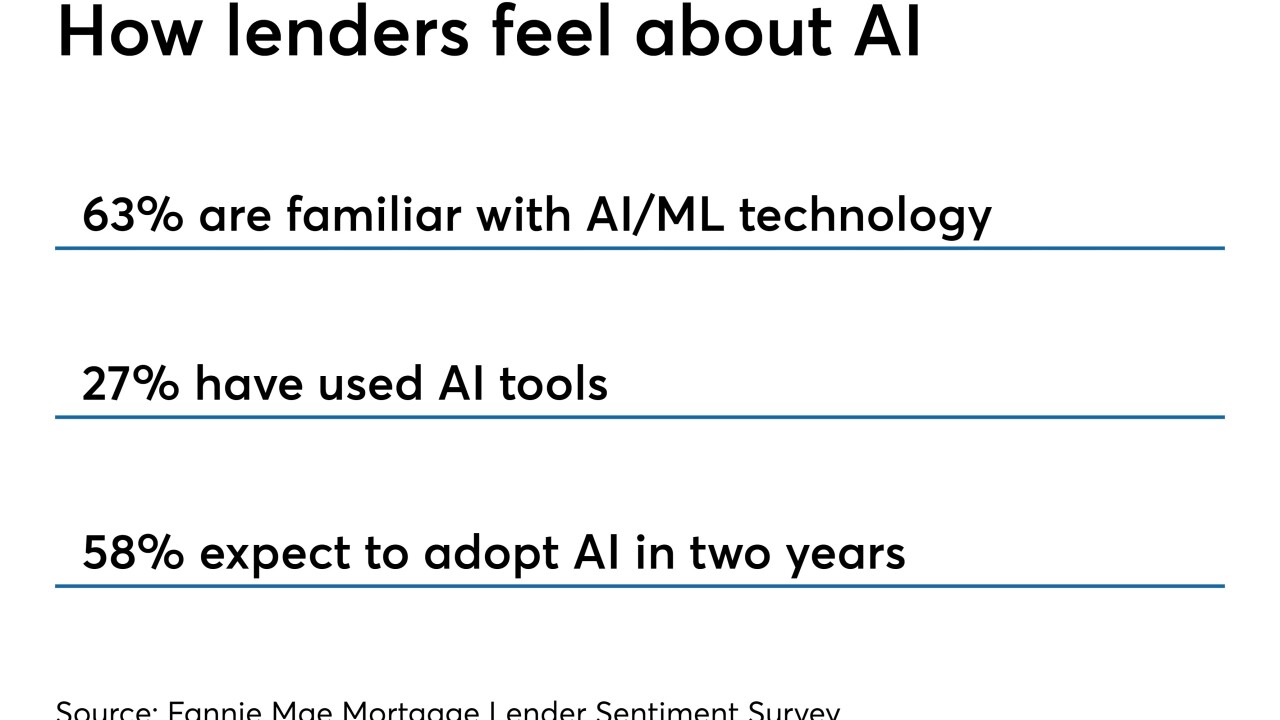

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

Refinances jumped in July in response to a considerable mortgage rate decline from the month prior as homeowners set to lock in lower costs, according to Ellie Mae.

August 22