-

In a tough quarter for the auto industry, the Detroit-based lender posted earnings that sped past Wall Street's expectations.

October 17 -

Scott Stengel, who has been Ally's general counsel since 2016, will succeed Ellen Fitzsimmons, who is retiring after four years as head of legal affairs at Truist.

December 13 -

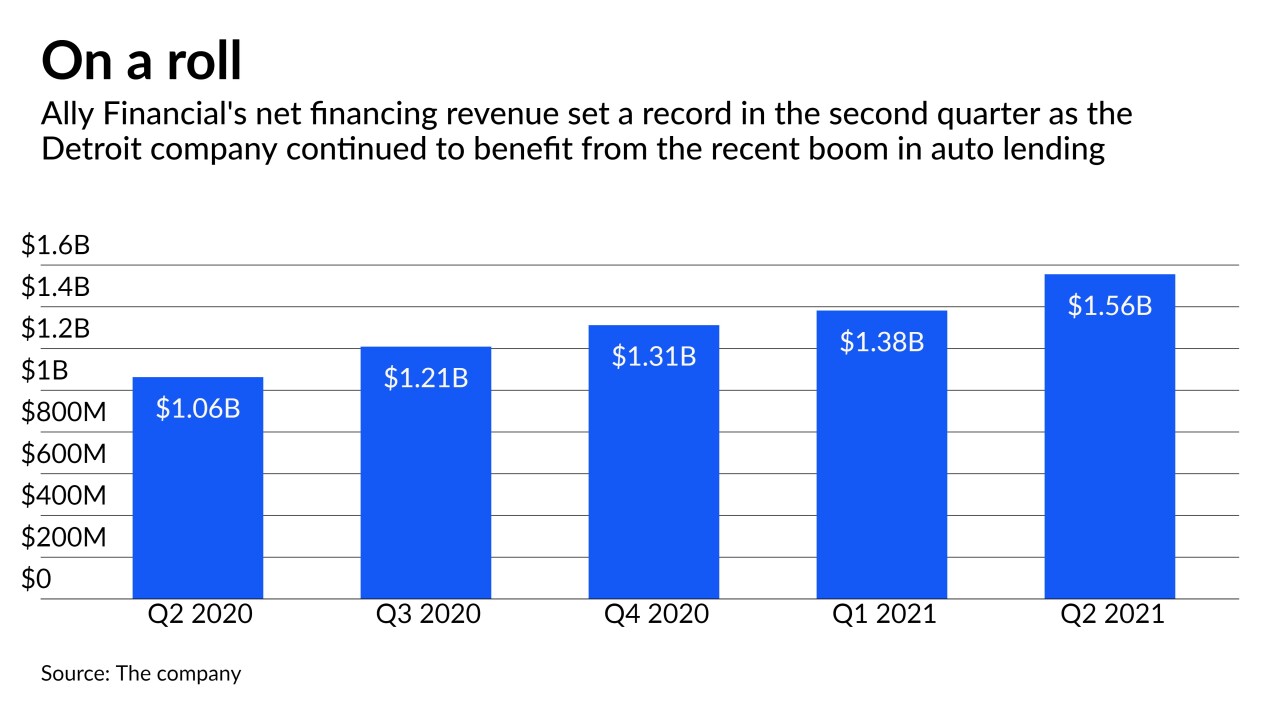

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

Surging used-car prices — brought on by a combination of strong consumer demand and limited new-vehicle supply — are boosting loan yields and profits at the Detroit company.

April 16 -

The automaker is reportedly planning to apply for a bank charter so it could collect deposits and grow its own auto-finance business. That could create more competition for Ally, which was spun off from GM in 2006 but remains a key lending partner.

December 9 -

Payment rates for auto lenders and credit card issuers have remained strong despite a spike in unemployment. Whether these trends continue into 2021 will depend largely on the actions of Congress and the pace of medical advances.

November 2 -

Some 60% of Ally’s auto originations in the second quarter were used-vehicle loans, the highest percentage in the company's history.

July 17 -

The ratings firm also took negative action with respect to Ally, Synchrony, Discover, Sallie Mae and Navient, citing the impact that the coronavirus crisis is having on their revenues and profits.

April 29 -

After more than tripling its loan-loss provision, the $182 billion-asset company became the first large U.S. bank to report a quarterly loss as a result of the coronavirus pandemic.

April 20 -

Closed showrooms, temporary bans on repossessions and a sudden spike in unemployment have dimmed the prospects of a sector that has boomed since the last recession.

April 8 -

Investors are reacting skeptically to the auto lender's deal to acquire CardWorks for $2.65 billion.

February 19 -

According to Moody's, Ally's latest auto-loan ABS will not require the issuer to repurchase loans with modified terms or maturities.

December 3 -

According to Moody's, Ally's latest auto-loan ABS will not require the issuer to repurchase loans with modified terms or maturities.

December 2 -

While demand is strong and loan performance generally remains solid, the prevalence of longer loan terms has sparked concern that losses will eventually spike.

October 16 -

The $1.11 billion Ally Auto Receivables Trust (AART) 2019-2 deal has three classes of senior term notes with early AAA ratings by S&P Global Ratings and Fitch Ratings.

May 30 -

Measures of loan performance were generally better than expected at Ally, American Express, Synchrony and Sallie Mae. Their 1Q reports suggest that consumers remain able to meet their obligations despite a long run-up in debt.

April 18 -

Executives from Ally Financial and Santander Consumer USA gave rosy outlooks about 2019 consumer trends, while other banks that rely less heavily on car lending offered more cautious appraisals.

February 1 -

The three offerings launched Thursday add to the $3.9 billion of prime auto supply already issued this year by General Motors, Ford Motor Co. and CarMax.

January 31 -

Both S&P and Moody's have cut expected losses on $732 million deal, yet credit enhancement on the senior tranches is unchanged from the prior deal.

October 22 -

DriveTime is making less-risky loans under a $750 million contract purchase agreement with Ally Financial; it appears that the sponsor is also funding some of this lending through its own securitization platform.

October 4