Bracing for a spike in bad auto loans, Ally Financial became the first large U.S. bank to report a quarterly loss as a result of the coronavirus crisis.

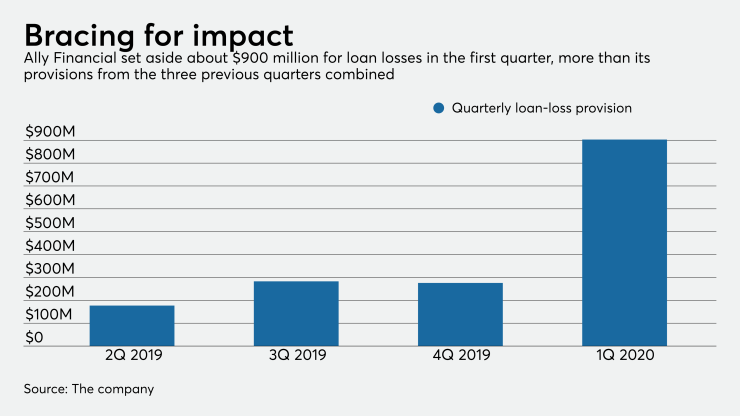

The Detroit-based lender set aside $903 million for future loan losses during the first quarter, up from $282 million a year earlier. The 220% increase in loss provisions was roughly in line with what the median of what other American banks have reported over the last week, according to an analysis by Piper Sandler.

But Ally, which derives nearly three-quarters of its net revenues from the auto finance business, has relatively few ways to offset higher expected loan losses. The result Monday was a quarterly net loss of $319 million, after Allly reported net income of $374 million in last year's first quarter.

“While some positive trends are emerging in regard to the spread of the virus, we still do not know how long it will take to return to a state of normalcy,” Ally CEO Jeffrey Brown said during the company’s quarterly earnings call.

Ally’s ability to weather the pandemic-induced economic shutdown will hinge on its ability to resume collecting payments on loans that have been put into forbearance in recent weeks.

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

The two states' combined plans amount to over $1.5 billion of the Homeowner Assistance Fund included within the American Rescue Plan Act , which was passed a year ago.

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

Some 73% of Ally’s loans to auto dealers are currently in a payment deferral status, according to Chief Financial Officer Jennifer LaClair. The same is true of roughly 25% of Ally’s loans to consumers.

The $182.5 billion-asset company is offering to payment deferrals of up to 120 days to its retail borrowers. “Our commitment to them in this environment will ultimately strengthen relationships and mitigate losses down the line,” Brown predicted.

During the first quarter, 1.44% of Ally’s retail auto loans were charged off. The company said it expects that metric to rise to 1.8% to 2.1% for all of this year.

Stock market investors on Monday weighed the question of whether that scenario is realistic, or if the losses at Ally are likely to climb higher. Ally shares were down 3.25% in afternoon trading, compared with a less than 1% decline in the S&P 500.

During a call with analysts, Ally executives acknowledged that the U.S. unemployment forecast has worsened since the end of March, when it made projections based on an assumption that the jobless rate would approach 10%. On the other hand, the company stated that its outlook did not consider the positive effects of federal stimulus spending.

If deterioration in the U.S. economy ultimately proves to be persistent and broad-based, Ally expects its loan losses to reach the 2.5% to 3% range, LaClair said.

The COVID-19 pandemic

Ally hinted Monday at one potential longer-term scenario in which the auto industry stands to benefit from the crisis. In a hypothetical future, fears about viral contagion could prompt some Americans to stop using taxis, ride-hailing apps and subways. “Obviously, you know, we’re all waiting to see what happens to public transportation,” Brown said.

In addition to the sharp increase in its loss provision, Ally’s first-quarter results were also hurt by a $185 million decline in the fair value of equity securities that it holds.