-

The North Carolina bank is the latest lender impacted by the bankruptcy of U.S. auto parts maker First Brands. First Citizens executives said credit was in good shape overall.

October 23 -

Orlando-based Cogent Bank has hired a team to finance single-tenant net lease properties, an asset class characterized by exceptional credit quality.

September 2 -

High interest rates and tough economic conditions played a role in the credit woes that overcame BayFirst Financial's small-dollar lending effort.

August 5 -

A FICO survey shows 33% think exaggerating income on credit applications is acceptable. Ironically, many also prioritize strong fraud prevention from banks.

July 30 -

Washington Trust shares plunged after the Westerly, Rhode Island, company disclosed it booked an office deal in the third quarter, boosting the size of its portfolio while other lenders are pulling back.

October 27 -

Lenders are bracing for more companies to fall behind on their loan payments. That could create more opportunities for banks to dispose of these nonperforming credits through an Article 9 sale.

April 7 -

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19 -

Kerry Killinger, former CEO of Washington Mutual, says the asset bubbles and increased consumer debt that contributed to his company's failure are reappearing.

April 30 -

Federal relief efforts have minimized loan losses so far, but risks remain in credit card, auto and business lending. Many borrowers will need another lifeline to stay afloat until the economy rebounds, CEO Jamie Dimon says.

January 15 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12 -

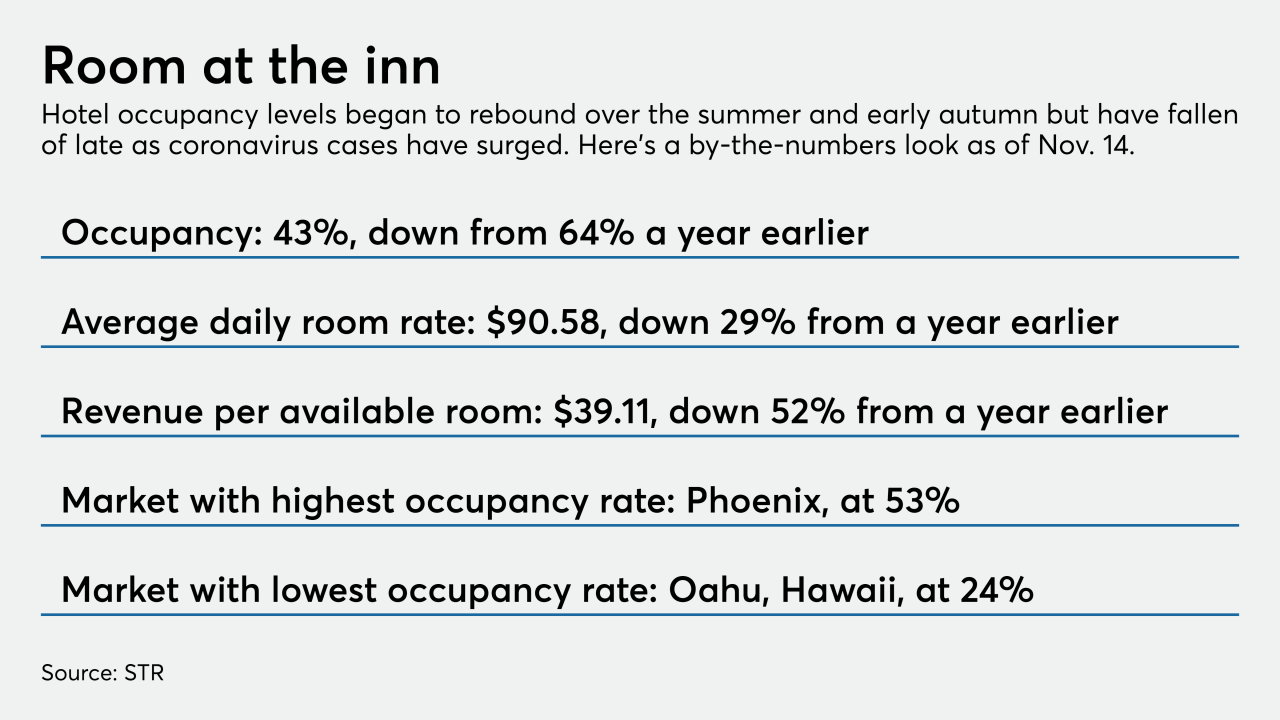

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23 -

Lenders also increased jumbo product availability as well as rolling out new SOFR-indexed ARMs.

November 16 -

Lenders pushed back against the notion that city dwellers' pandemic-driven flight to suburbia would hurt them. They say fewer landlords have sought deferrals as vacancy rates remain low and rent collections have stabilized.

October 29 -

The subprime lender cited low odds that Washington will deliver further economic relief, and the fact that $1.5 billion of loans whose deferral period expired are now more than 30 days behind.

October 28 -

Credit portfolio manager’s outlook on corporate borrower defaults and spreads on their loans, while still gloomy, has improved somewhat as the pandemic continues.

October 15 -

Commercial real estate loans are vulnerable as financial assistance for tenants winds down and might not be fully renewed. Late rent payments could rise, leading lenders to press landlords to pay up.

September 23 -

More consumer and commercial borrowers are paying their loans, increasing the likelihood that charge-offs will be manageable for banks despite the ongoing pandemic.

September 11 -

Conditions have improved for the first time since November.

August 6 -

Community bank earnings are usually easy to understand, but loan deferrals and modifications as well as the complexities of the Paycheck Protection Program are skewing financial statements.

August 4