Rates of serious mortgage distress, while projected to climb as pandemic-era forbearance plans expire, are unlikely to reach the sky-high levels hit after the Great Recession, researchers at the Federal Reserve Bank of New York said Wednesday.

Their

“We anticipate that they are still going to be struggling,” Wilbert van der Klaauw, senior vice president at the New York Fed, told reporters.

How much late-payment rates will rise depends on a number of factors, including the state of the U.S. economic recovery and whether housing prices fall in the coming months. It also depends on whether mortgage servicers give struggling borrowers more flexibility as they exit forbearance, van der Klaauw said.

But it now “seems improbable” that delinquency rates will jump to the levels hit after the 2008-2009 crisis, when more than 6% of all mortgage borrowers were at least 90 days late, the analysis found. Late-stage delinquencies are often a precursor to foreclosures.

Serious delinquencies could rise as high as around 3.8% as forbearance programs come to an end, a rough estimate from the New York Fed suggested. Congress last year authorized homeowners with government-backed mortgages to receive up to a year of forbearance, renewable in six-months increments, and the Biden administration in February offered up to six additional months. Right now, only 0.9% of mortgage borrowers are at least 90 days delinquent.

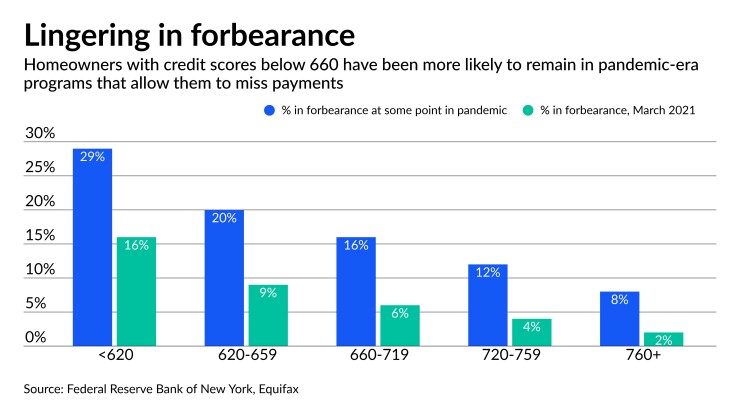

Homeowners with a broad range of credit scores took advantage of the congressionally authorized forbearance offers, but many of those who have higher scores have already left the programs. Only 2% of borrowers with scores of 760 or higher were still in forbearance as of March 2021.

Some borrowers who entered into forbearance programs continued to make their monthly mortgage payments, and many of them have since exited. As a result, the percentage of homeowners in forbearance who are not making their payments rose to more than 70% in March, according to the researchers.

The forbearance programs have helped boost participants’ credit scores — a federal relief law in March 2020 aimed to ensure that borrowers were not penalized for entering forbearance — with their average credit score rising by 14 points. The increases were largest for those with credit scores below 620, who saw a 57-point jump on average.

While forbearance has helped ensure that hard-hit borrowers’ credit scores did not suffer, the credit score may also “lose some of its power in signaling creditworthiness to lenders, at least for some time,” the New York Fed said.

Participants in mortgage forbearance programs have grown more likely during the pandemic to become delinquent on their non-housing debt, according to the research. For those homeowners, non-mortgage delinquencies rose by one percentage point to 5.8% in March compared to a year earlier. Those homeowners who did not enter into forbearance programs have seen their non-housing delinquency rates stay flat at roughly 2%.

Still, mortgage forbearance is widely credited with helping to keep pandemic-era delinquency rates on auto loans, credit cards and other consumer debt lower than they would have otherwise been. As millions of homeowners have refrained from making their monthly mortgage payments, some have likely used freed-up cash to pay other bills.

The New York Fed’s findings are consistent with those from a recent

“For many consumers, their home has become their home office or become a safe haven through the pandemic,” Komos said. “So we’ve seen that that mortgage loan has become a priority.”