JPMorgan Chase borrowers are hanging in there — but more stimulus is needed to help them ride out the coronavirus pandemic.

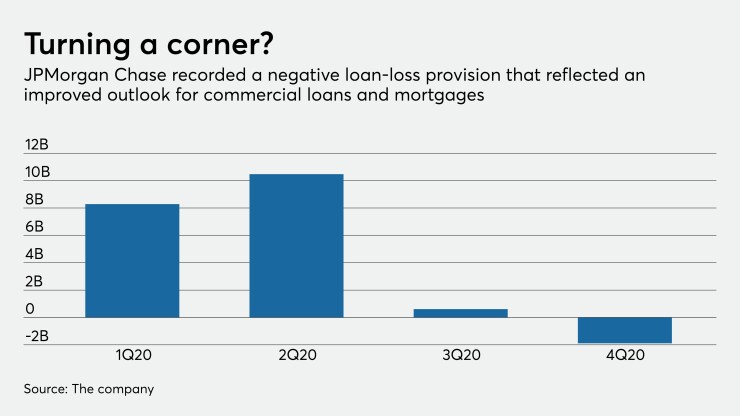

While the $3.4 trillion-asset company released $2.9 billion in loan-loss reserves in the fourth quarter, allowing it to record a negative provision, executives cautioned that plenty of uncertainty remains with credit quality. The release largely reflected an improved outlook for commercial loans and mortgages; the allowances for credit cards and auto loans were untouched.

Vaccines and new stimulus hold promise, but their overall benefit to the economy remains unclear.

Jamie Dimon, JPMorgan’s CEO, said during a Friday earnings call that he supports the $1.9 trillion stimulus plan outlined by President-elect Joe Biden.

“We’re supportive of [the plan] not because it’s good for the bank, but because it’s good for American citizens,” Dimon said.

“Hopefully, by sometime in the summer, you could have a very healthy economy,” he added. “Sometime next year there will be a lot of focus on the debt and deficit, but let’s get through this now.”

Additional stimulus could help stave off credit issues at the New York banking giant.

“The bridge has been strong enough,” Chief Financial Officer Jennifer Piepszak said of existing relief efforts. “The question remains: Is it long enough?”

Loan losses are not expected to rise “in a meaningful way” until later in 2021, and the stimulus package signed into law last month could keep problems at bay even longer, Piepszak said during a call with reporters.

Nonperforming assets fell by 5% in the fourth quarter from a quarter earlier to $10.9 billion, and the loan-loss allowance was $30.7 billion on Dec. 31. About $24 billion in consumer loans remain in deferral, representing a 17% decrease from the third quarter and roughly half the amount reported over the summer.

Net charge-offs decreased by 11% to about $1.1 billion. About 90% of cardholders who exited one of the company’s deferral programs are current on their payments.

JPMorgan’s profit, aided by the negative provision, increased by 29% increase from a quarter earlier to $12.1 billion. Earnings per share of $3.79 beat the average analyst estimate tracked by FactSet Research Systems by $1.17.

The negative provision was notable, industry observers said.

Jason Goldberg, an analyst at Barclays Capital, wrote in a note to clients that he had expected another provision in the quarter, while Brian Kleinhanzl at Keefe, Bruyette & Woods had forecast a much smaller reserve release.

“Overall, fundamentals are improving,” Kleinhanzl said.

While striking an optimistic note on credit quality, JPMorgan executives were more restrained in their comments about loan demand. Total loans increased by 2.3% from a quarter earlier, to $1 trillion, reversing two consecutive quarters of declines.

Credit card balances increased by 2.7%, to $144 billion, while commercial loans rose by 4.3%, to $550 billion. Those gains were partially offset by a 1.1% decrease in other consumer loans to $319 billion.

Loan demand is unlikely to pick up in 2021, Piepszak said.

JPMorgan is planning to open more branches in certain markets to boost business. It aims to open 150 branches this year — after opening 90 in 2020.

To be sure, the company has been closing more branches than it opens, with a net reduction of 68 locations last year.

The value of the new offices was “extraordinary and underestimated,” Piepszak said. “We’re optimistic that the strategy will pay off.”

“We still have almost 1 million people a day visiting branches,” Dimon added.

While last year’s openings focused in major cities such as Boston, Philadelphia and Washington, Dimon said the company is now looking at new markets like North Dakota.

“The second I’m allowed, I’m on my way to Bismarck or Fargo,” Dimon said.