Applications for federal relief from the

Texas and Florida, which rank second and third by population, both launched federal borrower-assistance programs this week, following approval of their proposals by the U.S. Department of the Treasury earlier this year. Texas expects to distribute approximately $840 million to distressed homeowners across the Lone Star State, while Florida will provide over $676 million to qualifying households.

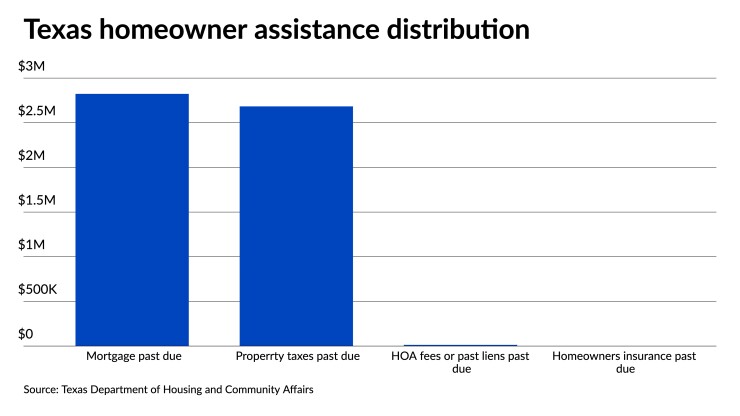

Texas mortgage borrowers are eligible for up to $65,000 in relief, with its plan divided into two parts. Households can receive a maximum of $40,000 to pay off past-due mortgage payments, while $25,000 is available for

Florida had yet to release full details of packages available to its residents, but qualified applicants will be able to apply funds toward mortgages, property taxes, insurance, utilities and other fees.

“These funds will help the state’s homeowners become current on their mortgages and other homeowner expenses and will help prepare Florida families for future financial stability,” said Dane Eagle, secretary of the Florida Department of Economic Opportunity, in a press release.

Money for these programs comes via the Homeowner Assistance Fund, or HAF, which was included under the American Rescue Plan Act of 2021. It designates nearly $10 billion in aid to households experiencing financial distress due to the COVID-19 pandemic.

Both Florida and Texas were among states to initiate their own pilot mortgage-assistance programs prior to receiving U.S. government approval of their HAF proposals. Florida has already helped 137 households in its pilot with over $1 million and will continue to operate it concurrently with the newly approved federal program. Through two pilots, Texas has also distributed over $5 million thus far, according to the Texas Department of Housing and Community Affairs.

The America Rescue Plan Act received congressional approval one year ago, and states submitted funding requests throughout the spring and summer. The fund was expected to provide short-term relief to help prevent mortgage delinquencies, defaults and foreclosures, with aid distributed through each state’s housing agency.

But assistance is coming