-

The auditing giant KPMG audited the three regional banks that failed last year. New York Community's recent disclosures that it had financial reporting weaknesses in 2023 raises new questions over the auditors' role.

March 5 -

A more active Consumer Financial Protection Bureau, competition from Big Tech and sanctions on Russia are combining to make compliance a much larger concern than in the past, according to legal experts who spoke at American Banker's Payments Forum.

May 19 -

During his March Federal Open Market Committee meeting press conference, acting Federal Reserve Chair Jerome Powell said the Fed's supervision and regulatory panel was no longer active and key decisions about stress tests and bank mergers were being handled by the full board.

March 16 -

The Federal Deposit Insurance Corp. reported a spike in troubled assets, suggesting a fairly large bank may be under heightened scrutiny. But confidentiality rules make it impossible to confirm any details.

March 10 -

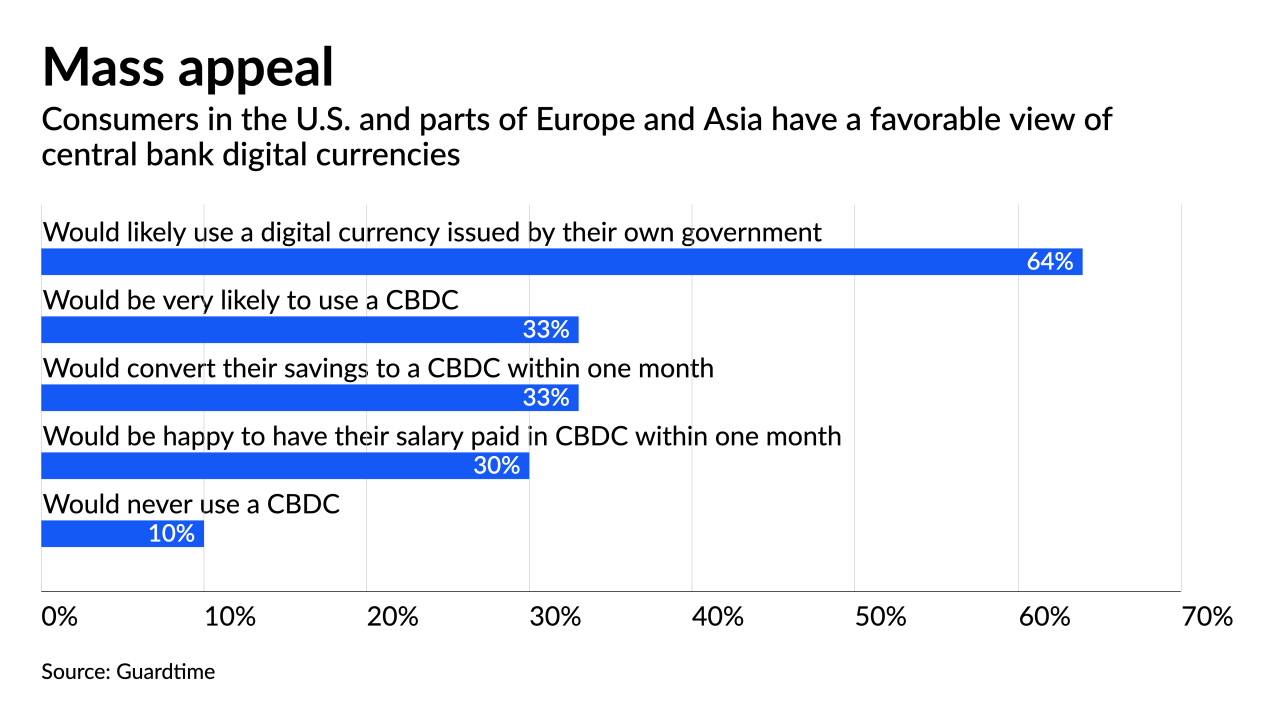

Western central banks trying to develop sovereign cryptocurrency models face pushback from lawmakers and other obstacles, while the digital yuan has a much clearer path.

July 27 -

Those handling loan modifications anticipate a growing secondary market for loans in forbearance as they budget cautiously for additional alterations of regulations down the road.

July 14 -

Income share agreements, which allow college graduates to repay tuition financing as a percentage of their future income, have come under fire lately from consumer advocates for questionable marketing and other potential legal violations. Some hope a partnership between a Virginia bank and an ISA provider will give the product more legitimacy, while others worry it just masks risks for borrowers.

July 12 -

Financial institutions spent nearly $214 billion last year — an 18% jump from 2019 — to meet regulatory requirements for fighting financial crimes, a new study says. The spending included more staffing to manage risks posed by customer growth.

June 9 -

The agency finalized a policy allowing companies to submit formal requests for clarification on a regulatory issue. The bureau said it will publish the advisory rulings in the Federal Register.

November 30 -

But both fell short under the Duty to Serve goals in rural housing.

November 2 -

Electronic notes did come in handy this year given the mortgage industry's need to operate remotely, but they also increase the government-sponsored enterprises' responsibility for monitoring the risk of multiple counterparties.

September 15 -

The agency has proposed letting firms seek specific guidance, which can be applied to other institutions. But consumer groups worry the plan circumvents formal rulemaking.

July 1 -

A new CFPB rule will expedite the forbearance and loss-mitigation process for consumers suffering financial hardship from the pandemic.

June 23 -

The new FHFA rule sets a percentage-based threshold to measure compliance, rather than Home Mortgage Disclosure Act data.

June 3 -

Periods of significant loan defaults are tough on banks and force unpleasant choices. Here are steps to evaluate collateral in such uncertain times.

June 1 Ludwig Advisors

Ludwig Advisors -

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

April 29 -

The reprieve from mortgage data collection was among several changes to the agency’s supervisory and enforcement procedures to help firms responding to the COVID-19 pandemic.

March 26 -

The agency's effort to engage with lawmakers on a whistleblower award program is one of three initiatives the bureau announced to advance its strategy of preventing consumer harm.

March 6 - asr daily lead

A proposed change could resurrect bond buckets, but loan industry observers also point to "covered fund" changes shielding loans from a potentially disruptive court decision.

February 18 -

The board- and management-level handing of CRE concentration was the chief concern of FDIC examiners, making up more than 56% of all the supervisory recommendations regulators made in the two-year period.

December 23