Both Fannie Mae and Freddie Mac exceeded their affordable housing goals for both single-family and multifamily during 2019, the Federal Housing Finance Agency's annual report to Congress said.

However, both companies fell short of their targets for bulk loan purchases from financial institutions under the

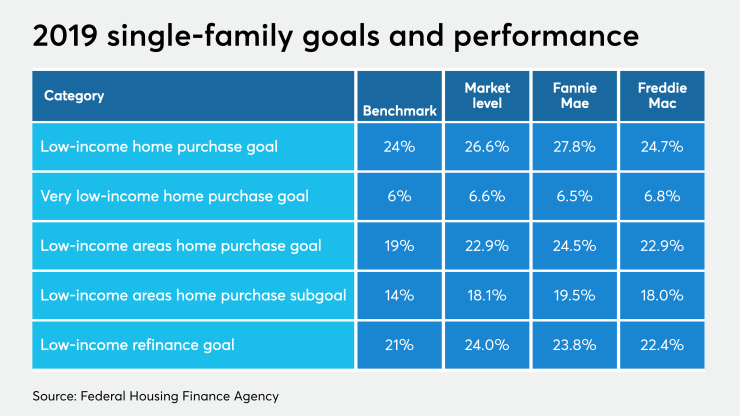

The government-sponsored enterprises can satisfy the affordable housing goals if they reach or exceed the specific benchmarks set by the FHFA in February 2018 or if they are above the "market," meaning they have share of conventional, conforming mortgage originations large enough to qualify for the goal based on the agency's analysis of Home Mortgage Disclosure Act data.

While both agencies exceeded the FHFA benchmark for single-family activity, Fannie Mae was below the market level for the very low-income home purchase goal and the low-income refinance goal. Freddie Mac was at the market level for the low-income areas home purchase goal. It was below the low-income areas home purchase subgoal and the low-income refinance goals.

Fannie Mae and Freddie Mac purchased a combined total of 21,942 Duty to Serve-eligible single-family loans in high-needs rural regions in 2019, the report said.

Despite failing to reach the rural housing goals, "FHFA has determined that each enterprise complied with its Duty to Serve requirements in all three underserved markets," the report said. "In addition, FHFA finds that each enterprise performed a satisfactory job of increasing the liquidity and distribution of available capital in each of the three underserved markets."

The GSEs purchased a combined 16,366 loans secured by

The GSEs purchased a combined total of 502 loans secured by low-income housing tax credit preservation properties. Fannie Mae's 118 loan purchases of that type marked a 40% increase over 2018 and exceeded the 2019 target by 37%. Freddie Mac’s 384 loan purchases reflected an increase of 22% over 2018 and exceeded 2019 target by nearly 133%.

Meanwhile, "each enterprise made progress in addressing the needs of the

Fannie Mae aimed to purchase at least 600 bulk loans from small financial institutions in rural areas in 2019, but fell short, with only 398 of such loans.

And fewer than expected borrowers made use of Freddie Mac's Choice Renovation product, which offers financing for the refurbishment of dilapidated homes. While the loan type is intended to address housing issues in "high-needs rural regions … adoption of the product was slow in 2019 and has room for expansion," the report said.

Because of the pandemic, the GSEs will not submit a plan for 2021 to 2023. Instead, 2021 activities and objectives will be structured as a one-year extension of their 2018-2020 plans.