Complaints to the bureau hit an all-time high in April. More than one in five said servicers wouldn't grant deferrals, forced borrowers into forbearance or violated other requirements of the coronavirus relief law.

After ending 2019 on a high note, Ocwen Financial posted an income loss in the first quarter due to the unexpected costs and volatility created by COVID-19.

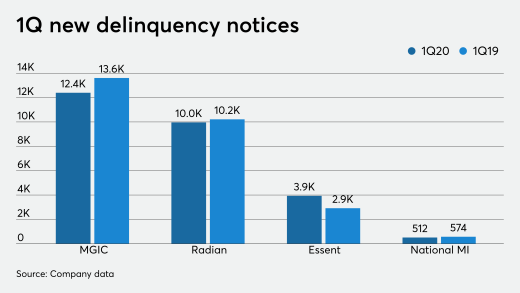

Three of the four had fewer new notices of delinquency for the quarter, but that should change going forward.

The Federal Reserve also said in a supervisory report released Friday that it would conduct stress tests this quarter as planned, taking into account sudden deterioration in the economy brought on by the coronavirus pandemic.

Up to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

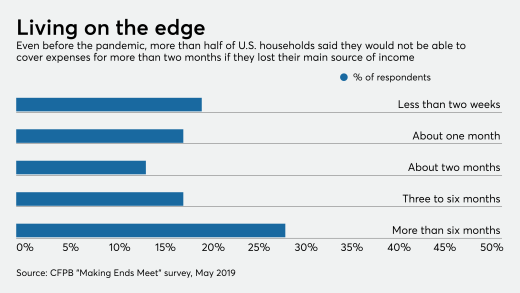

Lenders that scrambled to grant forbearance as the coronavirus pandemic took hold are unsure about the extent of potential losses.

Many originators stopped making riskier products, including jumbo loans and low credit score offerings, during April.

The government-sponsored enterprises have set new temporary limits on mortgage sales while extending processing flexibilities related to COVID-19.

-

Complaints to the bureau hit an all-time high in April. More than one in five said servicers wouldn't grant deferrals, forced borrowers into forbearance or violated other requirements of the coronavirus relief law.

May 10 -

After ending 2019 on a high note, Ocwen Financial posted an income loss in the first quarter due to the unexpected costs and volatility created by COVID-19.

May 8 -

Three of the four had fewer new notices of delinquency for the quarter, but that should change going forward.

May 8 -

The Federal Reserve also said in a supervisory report released Friday that it would conduct stress tests this quarter as planned, taking into account sudden deterioration in the economy brought on by the coronavirus pandemic.

May 8 -

Up to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

May 7 -

Lenders that scrambled to grant forbearance as the coronavirus pandemic took hold are unsure about the extent of potential losses.

May 7 -

Many originators stopped making riskier products, including jumbo loans and low credit score offerings, during April.

May 7