-

Radnor Re will pay interest on the notes out of proceeds on coverage premiums on private mortgage insurance contracts for residential mortgage loans.

June 16 -

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

Meanwhile at Essent, more loans exited the inventory in January than in December.

February 8 -

The company expects a good year ahead for mortgage insurers, assuming that rising employment, higher home prices and payment timing deferrals will help them to mitigate risk.

December 18 -

Lower cure rates and possible rises in foreclosures and claims could force these companies to raise capital next year, Fitch Ratings said.

December 4 -

Arch's second CRT transaction this year to obtain indemnity reinsurance for mortgage-insurance premiums comes at a time it is also experiencing rising 60-plus-day delinquencies on its outstanding securitized pools.

August 31 -

The mortgage insurer is receiving $528 million of coverage in the event of defaults in a $44 billion loan pool.

July 2 -

If delinquency rates rise, all four stand-alone firms would have a capital shortfall.

June 9 -

Rick Thornberry is looking to the lessons from the Great Recession and applying them to current conditions.

May 12 -

Three of the four had fewer new notices of delinquency for the quarter, but that should change going forward.

May 8 -

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

March 27 -

Now is not the time for the government to cut Federal Housing Administration premiums and enter new segments of the housing market.

December 27

-

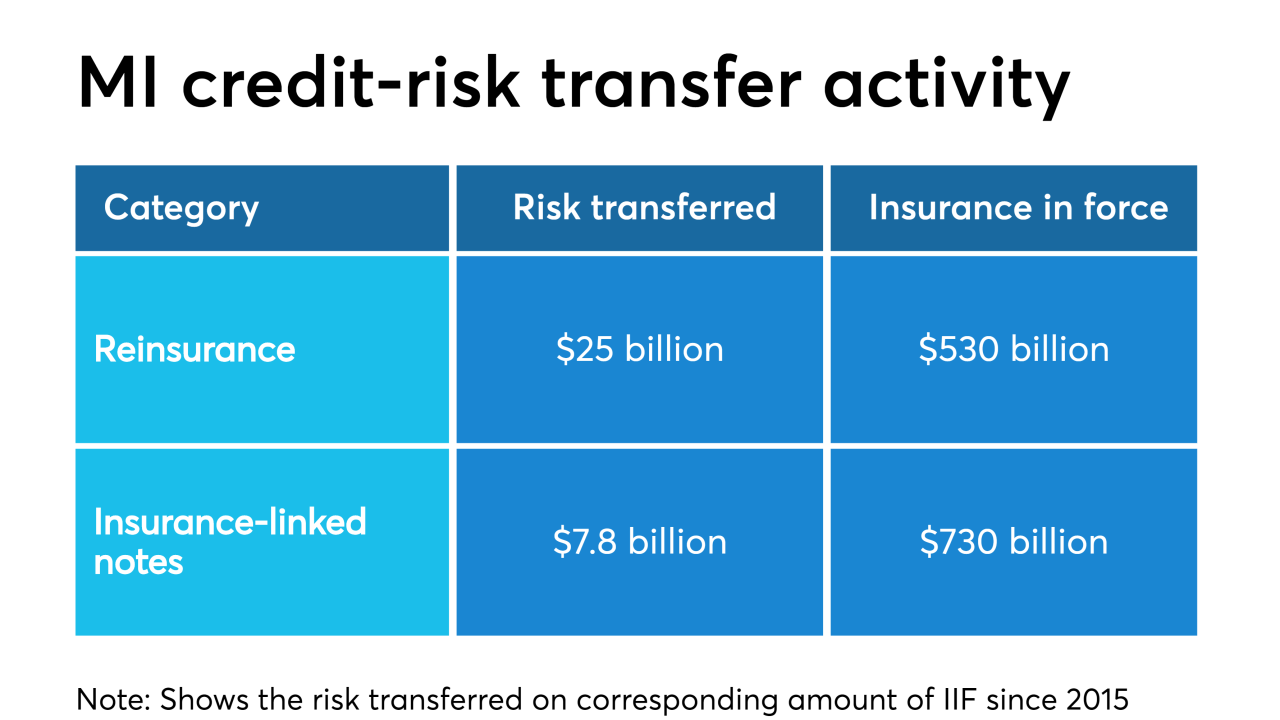

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

Mr. Cooper Group reported a second-quarter net loss of $87 million as the company took a $231 million fair value hit to its mortgage servicing rights portfolio.

August 1 -

Mortgage lenders might be feeling a little less stressed over False Claims Act actions being brought against them following recent headlines but there is still some work to be done before they can chill out.

July 2 -

The residential mortgages being reinsured are less risky, by several measures, than its previous deal; none of the borrowers have ever missed a payment.

April 11 -

This time, investors required Radian to hold on to the first 2.5% of losses it covers on the pool; by comparison, the insurer’s previous deal, Eagle Re 2018-1, had a lower “attachment” point of 2.25%.

April 3 -

Arch Capital’s next offering of credit risk transfer notes features heavy exposure to residential mortgages that have been modified by Fannie Mae or Freddie Mac.

March 1 -

Credit risk transfer does more than just reduce exposure to a downturn in the housing market. It also provides them with information about how others view mortgage credit risk.

February 27 -

The administration’s reported interest in having the White House aide run Fannie Mae and Freddie Mac's regulator signals a focus on constraining the mortgage giants’ role in the housing market.

December 10