Private mortgage insurers should expect to feel the impact of currently forborne mortgages, which may not cure at the same rate as they had when mass payment relief was granted in the past, Fitch Ratings said in a research report issued this week.

When borrowers receive a forbearance following

"Fitch considers the current situation to be unprecedented," Don Thorpe, a senior director at the ratings agency, wrote in the report. "As a result, this historical tendency may not hold.

"There is considerable uncertainty about the ultimate economic disruption that will be caused by the coronavirus pandemic, and due to forbearance, there will be a significant time lag before ultimate insured losses are known."

The company issued a negative outlook on mortgage insurers because it anticipates that they will need to raise additional funds to meet the

On the other hand, "mortgage insurers have

Mortgage insurers have to set aside funds when they receive a notice of delinquency from the servicer and only pay claims if and when a loan is foreclosed upon.

Because of federal and state mandated

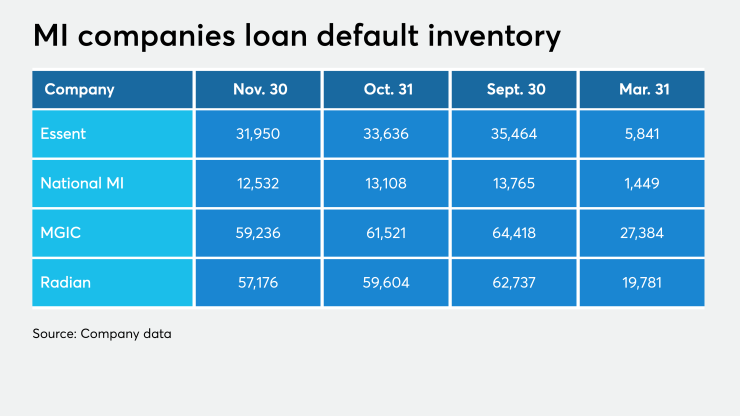

For their part, mortgage insurers have been reporting that their inventory has been declining in recent months, but they are nowhere near the pre-pandemic levels.

National MI's delinquent inventory went from 1,449 mortgages at the end of March to a peak of 14,236 on Aug. 31. As of Nov. 30, the inventory was down to 12,532 mortgages.

Essent Guaranty had 31,950 loans in its inventory on Nov. 30, down from 33,656 one month prior. At the end of the first quarter, Essent's inventory was at 5,841 loans.

At the end of June, Radian had 69,742 delinquent mortgages in the inventory. As of Nov. 30, it was down to 57,176 from 59,604 one month prior. On March 31, it was just at 19,781 mortgages.

Before the pandemic, MGIC's inventory consisted of 27,384 mortgages. The most recent data, as of Nov. 30, shows the inventory was at 59,236 loans, down from 61,521 on Oct. 31, 64,418 on Sept. 30 and 66,626 on Aug. 31.

Another factor that may mitigate possible losses for the mortgage insurers are

On the other hand, increased job loss could contribute to

"Economic indicators improved somewhat since the worst of the pandemic," Thorpe said. "However, uncertainty about the strength and timing of the economic recovery, unemployment, mortgage loan delinquency cure rates and housing prices drives considerable volatility in potential loss outcomes."