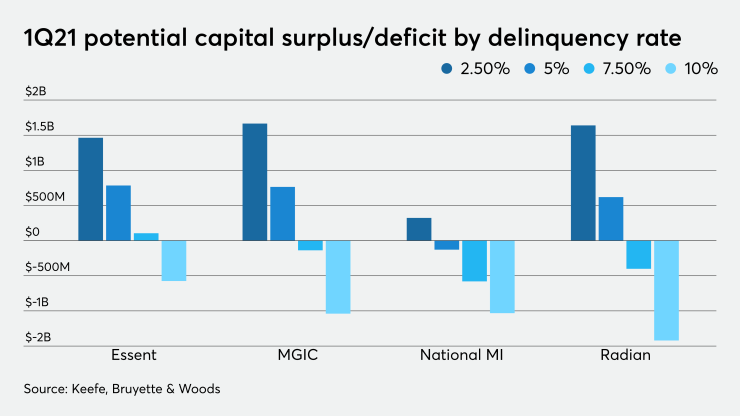

Keefe, Bruyette & Woods downgraded its stock ratings for the four stand-alone private mortgage insurers, noting that they could face a capital shortfall in the first quarter of 2021 in a rising delinquency scenario.

While KBW analyst Bose George said he has not changed his view that the private mortgage insurers

George projects that the four companies he follows — Essent, MGIC, National MI and Radian — should have enough capital surplus under the

"While it remains unclear when the FEMA disaster area designation will be lifted, there is a chance that it could be lifted later this year after most of the country is reopened," George said.

In determining possible PMIERs surpluses or deficits, KBW used an assumption that the natural disaster designation for the coronavirus will be lifted at the same time the

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

The two states' combined plans amount to over $1.5 billion of the Homeowner Assistance Fund included within the American Rescue Plan Act , which was passed a year ago.

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

As of March 31, MGIC had $1 billion of excess capital while Radian had $1.13 billion. Since

(Essent did a stock offering on May 27, while National MI did both stock and debt offerings during the first week of June; National MI also did a quota share reinsurance deal that will help with its PMIERs surplus.)

Taking that through to the first quarter of 2021 in a scenario in which the 70% haircut for the PMIERs no longer applied, at a 5% delinquency rate, only National MI would have a PMIERs deficit. But if delinquencies ramp up to 7.5% in the same scenario, Essent would be the only company at a surplus. All four would be at a deficit if the rate went as high as 10%.

Black Knight, which includes forborne mortgages in its calculations, said