-

The delinquency rate that Kroll Bond Rating Agency tracks improved last month but JER's recent Chapter 11 filing and 2024 forecasts suggest it's still under pressure.

January 2 -

Income-producing loans secured by real estate are under pressure at banks, the government-sponsored enterprises, insurers, and in CMBS to varying degrees.

December 8 -

Stress tests suggest systemically important depositories could weather current risks. Meanwhile, single-family arrears remain low, but that business could be impacted.

November 27 -

The withdrawal of pandemic housing relief and high home prices have heightened consumer strain, according to nonprofit Money Management International.

November 6 -

The 51 basis point increase was inevitable after the late payment rate reached a record low in the third quarter, the Mortgage Bankers Association said.

February 16 -

Foreclosure starts also increased by over 19% between October and November but remain below pre-pandemic levels.

December 22 -

Recent reports highlight the question of how much wage growth can do to sustain loan performance as pandemic relief gets rolled back, consumer costs rise and the housing market cools.

August 12 -

Late payments on office loans have trended upward recently, but longer lease periods may mitigate the potential for distress in that sector, the Mortgage Bankers Association said.

August 5 -

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22 -

Consumers are booking rooms at levels not seen since early 2020 and loan delinquencies have fallen sharply as a result. Still, business travel remains sluggish and new COVID variants are spreading, threatening the hotel industry’s recovery.

July 19 -

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

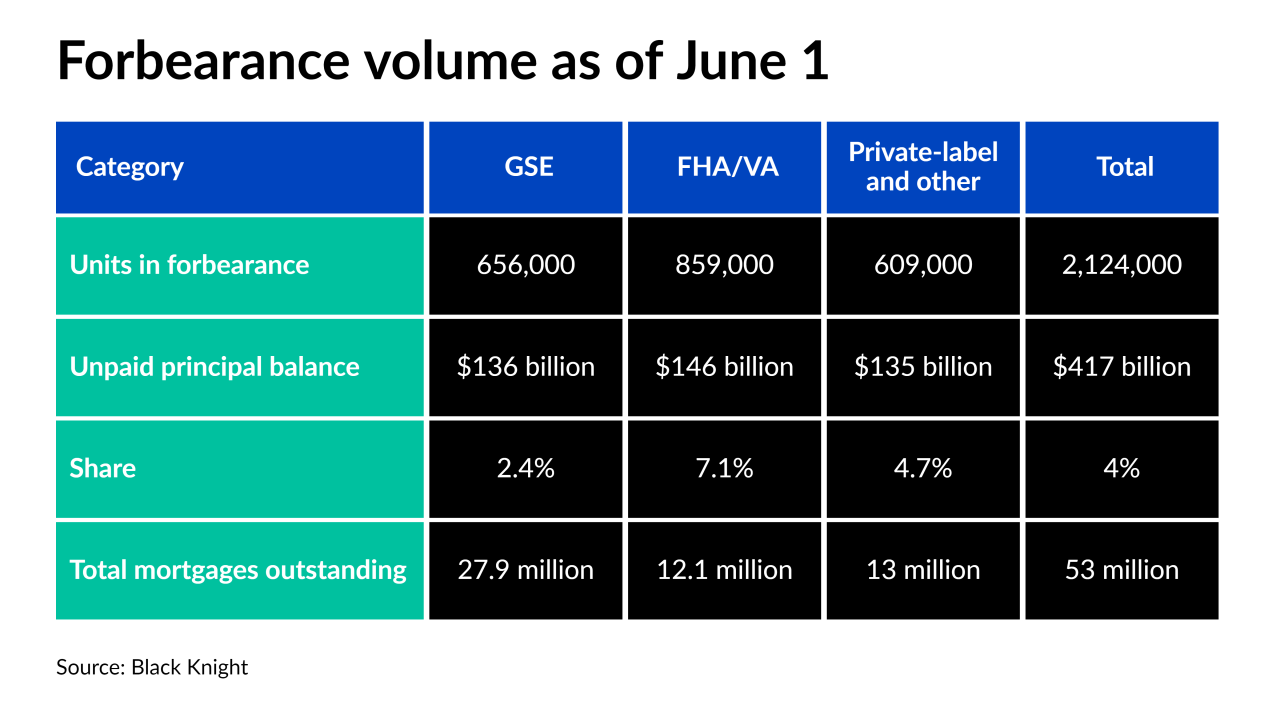

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10 -

The persistently slow reduction in the number of borrowers at risk of default indicates that while loan performance overall is improving, a substantial pool of mortgages will need workouts when forbearance ends.

April 22 -

Deals, trends and research in structured finance and asset-backed securities for the week of April 2-8

April 8 -

However, the number of borrowers who failed to remit payment but were not yet 30 days overdue increased.

April 1 -

As an improving job market aided financial stability for borrowers, 2020 ended with drops in delinquent home loans, a CoreLogic report found.

March 9 -

Servicers could be dealing with approximately 1.8 million distressed properties when the latest forbearance extension ends in June, Black Knight said.

February 24