-

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

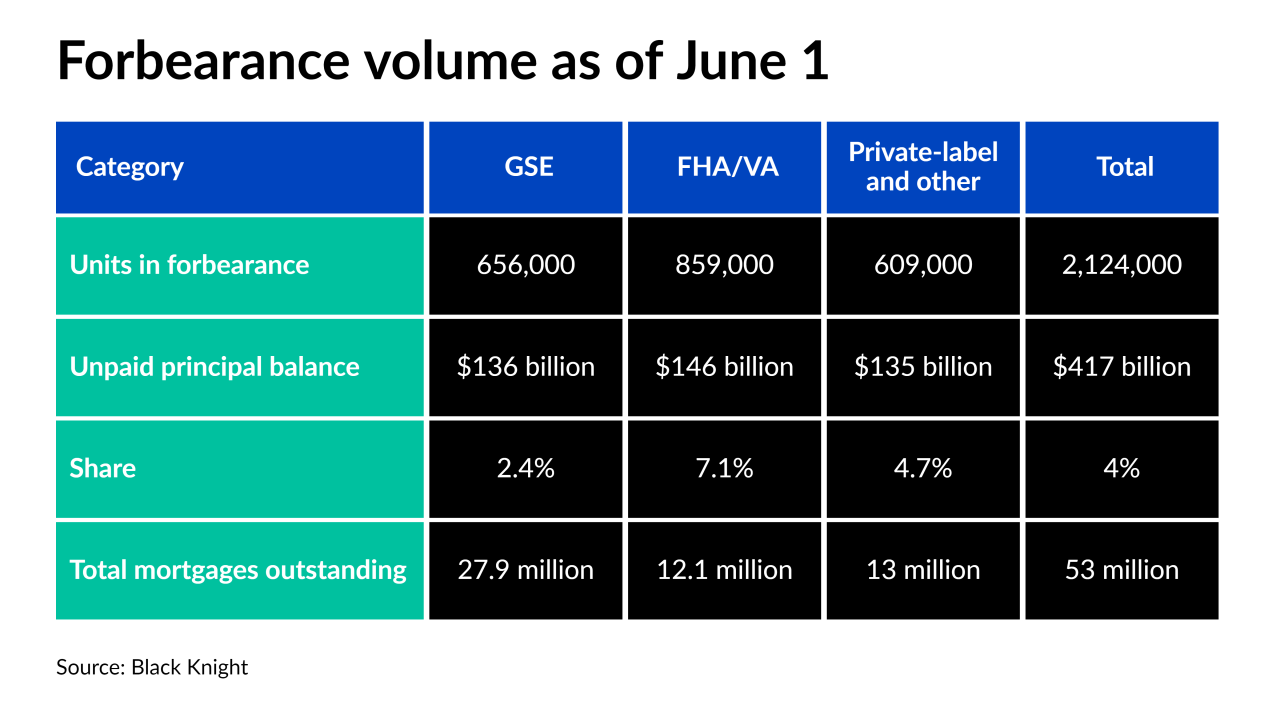

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10 -

The persistently slow reduction in the number of borrowers at risk of default indicates that while loan performance overall is improving, a substantial pool of mortgages will need workouts when forbearance ends.

April 22 -

Deals, trends and research in structured finance and asset-backed securities for the week of April 2-8

April 8 -

However, the number of borrowers who failed to remit payment but were not yet 30 days overdue increased.

April 1 -

As an improving job market aided financial stability for borrowers, 2020 ended with drops in delinquent home loans, a CoreLogic report found.

March 9 -

Servicers could be dealing with approximately 1.8 million distressed properties when the latest forbearance extension ends in June, Black Knight said.

February 24 -

While the Mortgage Bankers Association hailed the move, some experts say it could negatively impact housing inventory.

February 16 -

Gains in consumer financial stability helped to decrease the rates of distressed home loans, but job creation is needed to make recovery sustainable, a CoreLogic report found.

February 9 -

However, the share of new impairments increased, likely as a result of the high concentration of these loans given to self-employed borrowers.

February 3 -

The CARES Act-related forbearances could be “lulling us into a false sense of security” as 12-month expirations approach, according to Black Knight.

February 1 -

Black Knight’s product is designed to assist mortgage lenders in performing due diligence while also preventing heightened risk of foreclosure losses.

January 26 -

U.S. credit card delinquencies reached record-low levels in 2020, as Americans took advantage of stimulus checks and adjusted their spending habits, according to a new report.

January 22 -

Declining month-over-month delinquency levels and the rollout of COVID-19 vaccinations potentially give hope to more normalized economic activity.

January 20 -

Fitch and Trepp reported that overall commercial mortgage-backed security delinquencies were down, while the MBA reported a slight increase.

January 8 -

Deals, trends and research in structured finance and asset-backed securities for the week of Dec. 31-Jan.7

January 7 -

The largest U.S. shopping center became delinquent on its debt last year after its owner Triple Five Group began skipping mortgage payments, citing hardships from the COVID-19 pandemic.

January 6