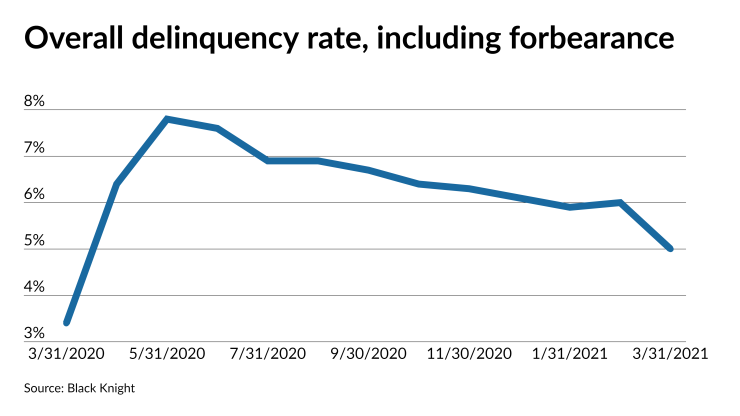

Late payments overall dropped slightly less than a full percentage point in March, but the numbers in one segment of the market aren’t falling quite as quickly as the others, a Black Knight report released Thursday shows.

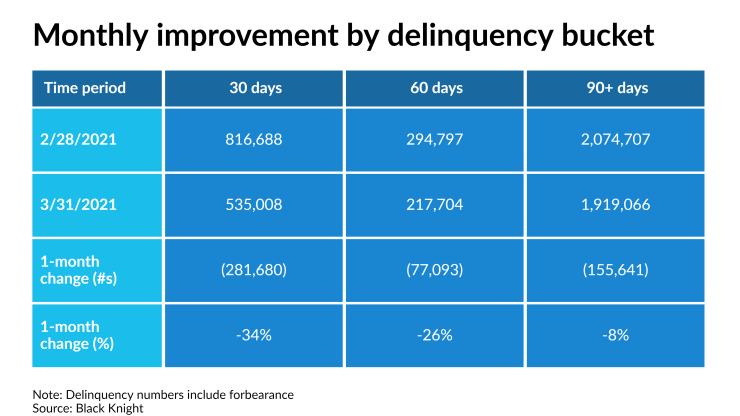

The overall delinquency rate fell to 5.02% from 6%. Driving the unusually steep 16.4% drop between Feb. 28 and March 31, was a 34% decline in 30-day delinquencies to 535,008 and a 26% falloff in payments 60 days late to 217,704. In contrast, 90-plus delinquencies fell just 8% to 1.9 million.

The persistently slow reduction in the number of borrowers at risk of default indicates that while loan performance overall is improving, there will be

“We still have a significant backlog of borrowers that are three or more payments behind on their mortgage,” said Andy Walden, economist and director of market research at Black Knight.

The number of 90-plus day delinquencies represents 1.5 million more loans in this category than there were in March 2020, and

While those delinquencies remain worrisome, overall loan performance improved significantly in April.

Late payments typically drop by about 10% on average in March due to the availability of tax refunds and bonuses, so the overall 16.4% decrease is striking. Several factors likely account for it, including the fact that March 31 was originally set as the end of forbearance period under the CARES Act, prior to an extension of the deadline. Also, government assistance recently extended to counteract the pandemic, and improvement in the economy as vaccinations roll out also played a role in improved loan performance, Walden said.