-

Mortgage prepayment rates also fell to a new low for the third consecutive month in December, according to Black Knight.

January 25 -

Foreclosure starts also increased by over 19% between October and November but remain below pre-pandemic levels.

December 22 -

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

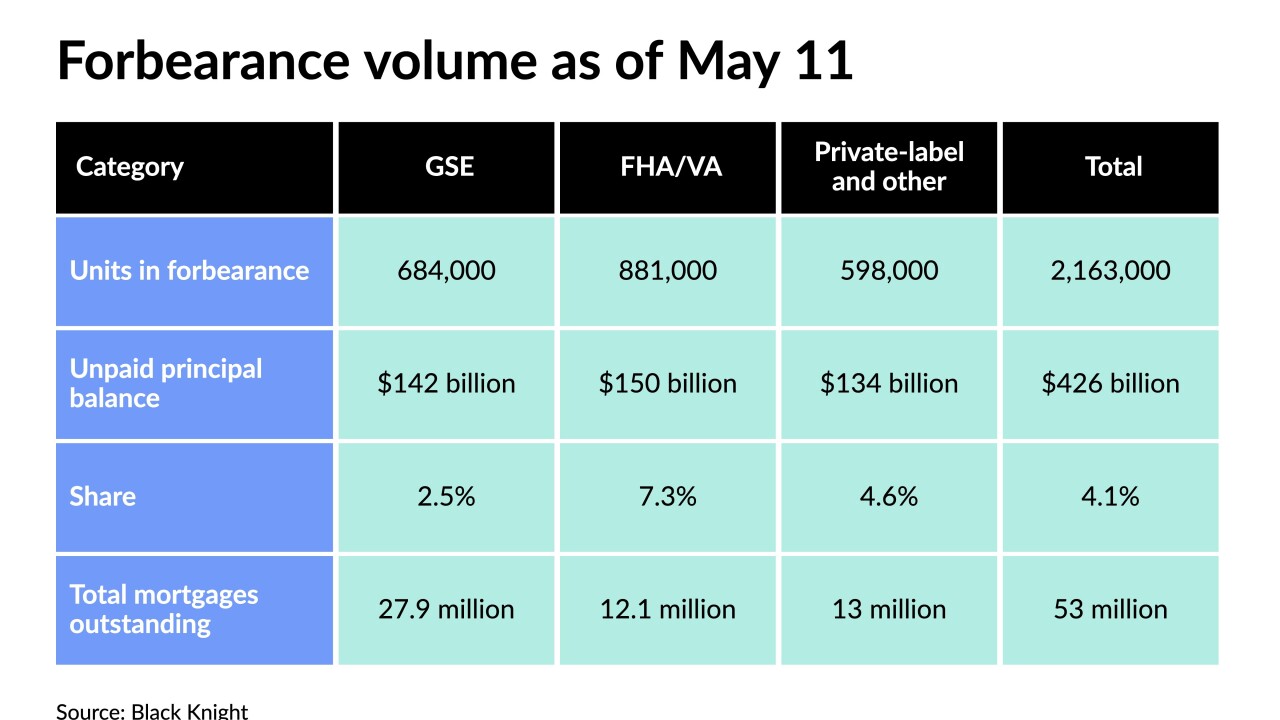

Numbers fell across the board, with private-label and portfolio loans declining most.

May 14 -

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10 -

The persistently slow reduction in the number of borrowers at risk of default indicates that while loan performance overall is improving, a substantial pool of mortgages will need workouts when forbearance ends.

April 22 -

But the percentage of weekly applications in that category was closer to 60%, the Mortgage Bankers Association found.

April 14 -

However, the decline in Black Knight’s numbers may stem from a previous deadline that policymakers have since extended.

April 9 -

Black Knight’s product is designed to assist mortgage lenders in performing due diligence while also preventing heightened risk of foreclosure losses.

January 26 -

With limited plan removals due to the holidays, mortgages in coronavirus-related forbearance rose by 15,000, according to Black Knight.

January 4 -

About 4,400 loans started the foreclosure process in November, alongside 176,000 mortgages in active foreclosure.

December 22 -

While 12,000 mortgages exited forbearance, the most borrowers entered forbearance protection in a week since early September, according to Black Knight.

December 11 -

Mortgage delinquencies dropped to the lowest level since March but, particularly at the seriously delinquent level, they're still much higher than pre-coronavirus rates, according to Black Knight.

November 23 -

There have been several extensions of the policy since it was put into place as a way to sustain originations amid a wave of forbearance allocated to borrowers with government-related loans.

November 13 -

As financial distress mounted, 12.4% of mortgagors missed payments across the second and third quarters of 2020 — and it could get worse, according to a study from the Mortgage Bankers Association.

October 16 -

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

October 2 -

The net share of mortgages in Ginnie Mae securitizations with suspended payments appears to be stabilizing, but the number of new requests creates doubt about whether it will subside.

September 29 -

The percentage of borrowers who have asked to temporarily suspend payments due to coronavirus-related hardships is down overall, but in the Ginnie Mae market, they're still inching up.

September 21 -

Only 18% of refinance borrowers returned to the same lender in the second quarter, the second lowest rate since 2005.

September 14