-

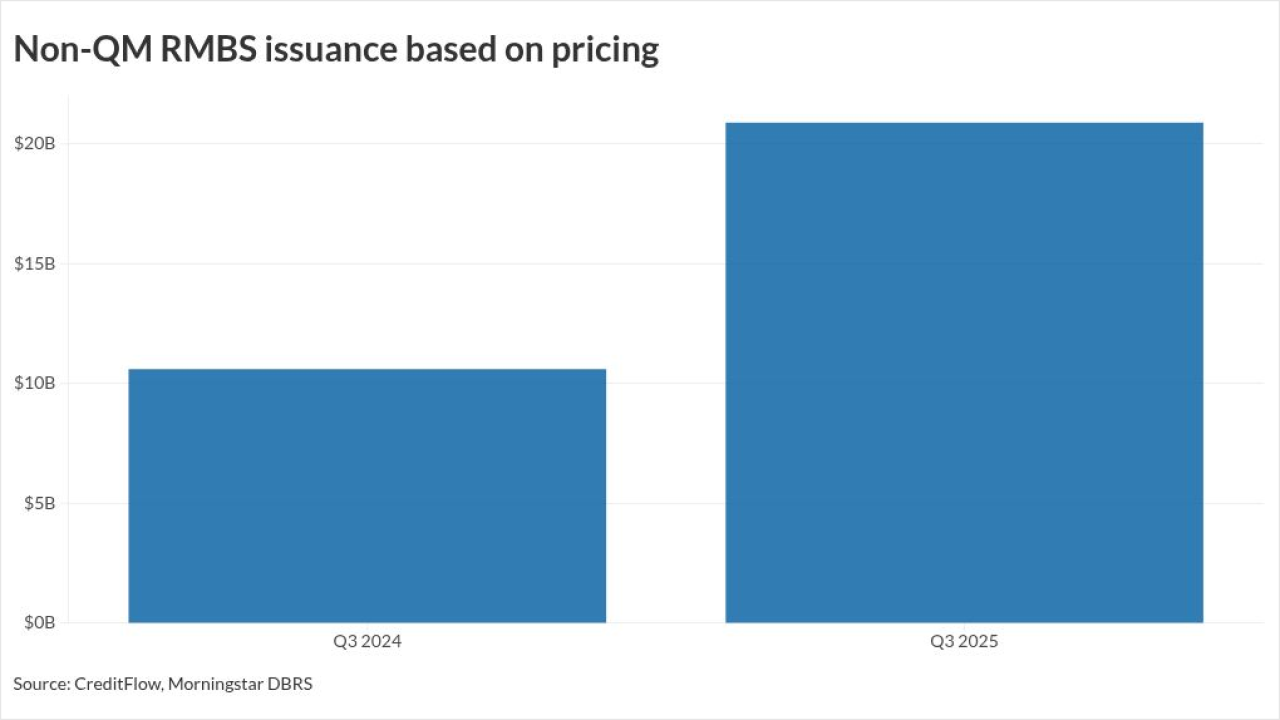

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

Fannie Mae and Freddie Mac's credit risk-transfers and some older private-label mortgage-backed securities have exposures to the Washington DC area.

October 14 -

The tests modeled how Fannie Mae and Freddie Mac would fare after absorbing losses like a total $36.1 billion provision in credit losses in a severe downturn.

August 18 -

Loans with alternative documentation and high combined loan-to-value ratios had more performance concerns, according to a new KBRA study.

June 6 -

As the risk of a recession rises, commercial real estate loans remain a major concern for banks and industry participants. One observer asked: "Is '25 the year where sellers start to capitulate, call a loser a loser, and move on?"

April 3 -

Only 5% of homeowners in designated disaster-assistance areas were required to hold flood insurance, according to the Federal Housing Finance Agency's dashboard.

December 27 -

The Federal Deposit Insurance Corp. and Texas banking regulators issued consent orders against Industry State Bank, Fayetteville Bank and Citizens State Bank, requiring major overhauls of their management, capital and risk controls.

October 25 -

Awareness of disaster risk has increased in the public and private sectors, and it appears to be prompting more interest in home improvements in particular.

September 24 -

As the commercial real estate industry sputters along, lenders, investors and analysts are putting less stock in loan-to-value ratios, a longtime bellwether of risk.

September 17 -

The regional bank has already seen a large reduction in "criticized" loans, and it expects that trend to pick up as lower borrowing costs alleviate the pain in the commercial real estate sector.

September 11 -

As corporate treasurers use the debt reorganization technique to head off disruptive defaults and bankruptcies, lenders seek more blockers and cooperation agreements to mitigate risks.

September 6 -

Sen. Jack Reed, D-R.I., asked the Federal Reserve to require public reporting of synthetic risk transfers — also known as credit risk transfers, or CRTs — through bank call reports and systemic risk reports.

August 5 -

A new Federal Reserve analysis finds rising debt-to-income and loan-to-value ratios over the past two years, while credit scores largely remained the same.

April 12 -

Former Trump administration officials Steven Mnuchin and Joseph Otting are headlining an investment group that's seeking to rescue the troubled Long Island lender. Otting is expected to serve as CEO, and Mnuchin will have a board seat.

March 6 -

New York Community Bancorp faced new questions Friday after a flurry of disclosures led to a steep sell-off in its stock. The embattled Long Island-based lender beefed up its risk leadership, but Fitch cut its rating to "junk" status.

March 1 -

Investors have hammered the New Jersey-based lender following the turmoil at New York Community Bancorp. But Valley executives say there are key differences between the two real estate-focused banks, and they express confidence that the bank's underwriting will hold up again this cycle.

February 16 -

The regional bank announced a leadership shakeup on Wednesday, capping a tumultuous week in which shareholders became spooked about its exposure to the commercial real estate sector.

February 7 -

Former Flagstar CEO Alessandro DiNello, who had been New York Community's nonexecutive chairman, was named executive chairman after the Long Island bank's stock price fell by more than 59% in a week. New York Community also issued updates on both its deposit situation and its search for a new chief risk officer.

February 6 -

A common concern in housing finance reactions has been the lack of accommodation for strategies routinely used to manage credit, rate and liquidity exposures.

January 19 -

FHA-insured and Department of Veterans Affairs-guaranteed mortgages bear watching next year, according to Intercontinental Exchange.

December 21