The improving job market and economy pulled distressed mortgages to a new pandemic era low in December, according to CoreLogic.

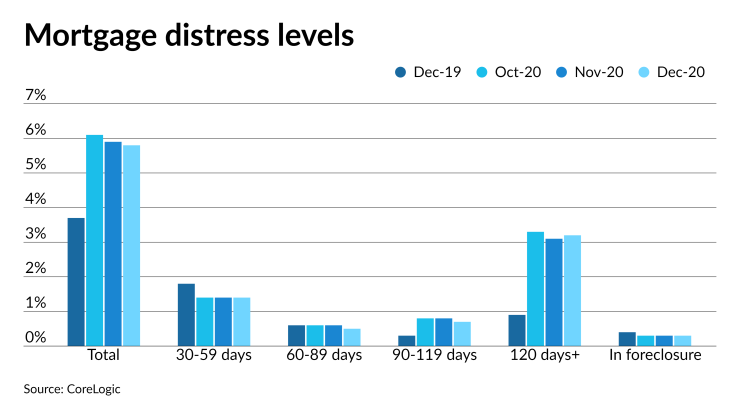

The month’s overall delinquency rate edged down to 5.8% from 5.9%

Although the can got kicked down the road, servicers will eventually

“What happens over the next few months will be critical to the process,” Sandy Jarish, president of Planet Home Lending, said in an interview. “We are trying to do more innovative outreach, using our website and build portals for the borrowers to access information and request extensions. We're finding out their financial impact and have they gained employment to determine best practices and next steps to manage the whole forbearance process.”

The foreclosure rate stayed steady at 0.3%, the level it’s held since April 2020, the Loan Performance Insights Report showed. The number dipped annually from 0.4%.

Serious delinquencies — loans 90 days or more past due, including foreclosures — remained at 3.9% from November, while more than tripled the year-ago rate of 1.2%. Mortgages past 120 days due but not yet in foreclosure rose monthly to 3.2% from 3.1% and spiked year-over-year from 0.9%.

The share of 30- to 59-day early-stage delinquencies held at 1.4% for the third month in a row while falling from 1.8% year-over-year. The rate for 60- to 89-day delinquencies dipped to 0.5% from 0.6% compared with both the month and year before.

The three states with the highest foreclosure rates remain unchanged from the last two months, with rates of 1.1% in New York and 0.8% in both Hawaii and Maine. A total of 15 states had rates of 0.1% or below.

The states that had the highest delinquency rates also held for a third straight month with Louisiana at 9.4%, Mississippi at 8.7% and New York at 8.3%.

Places with significant job losses during the pandemic accounted for the biggest changes in delinquent loans, according to CoreLogic chief economist Frank Nothaft.

“By state, Hawaii and Nevada had the largest 12-month spike in delinquency rates, both up 4.1 percentage points,” Nothaft said in the report. “They also had large increases in unemployment rates, up 6.6 percentage points in Hawaii and 5.5 percentage points in Nevada compared with 3.1 percentage points for the U.S.”

Iowa had the smallest year-over-year delta at 0.6 percentage points, followed by 0.8 points in Wisconsin and 0.9 points in both Maine and Michigan.