-

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

March 27 -

Now is not the time for the government to cut Federal Housing Administration premiums and enter new segments of the housing market.

December 27

-

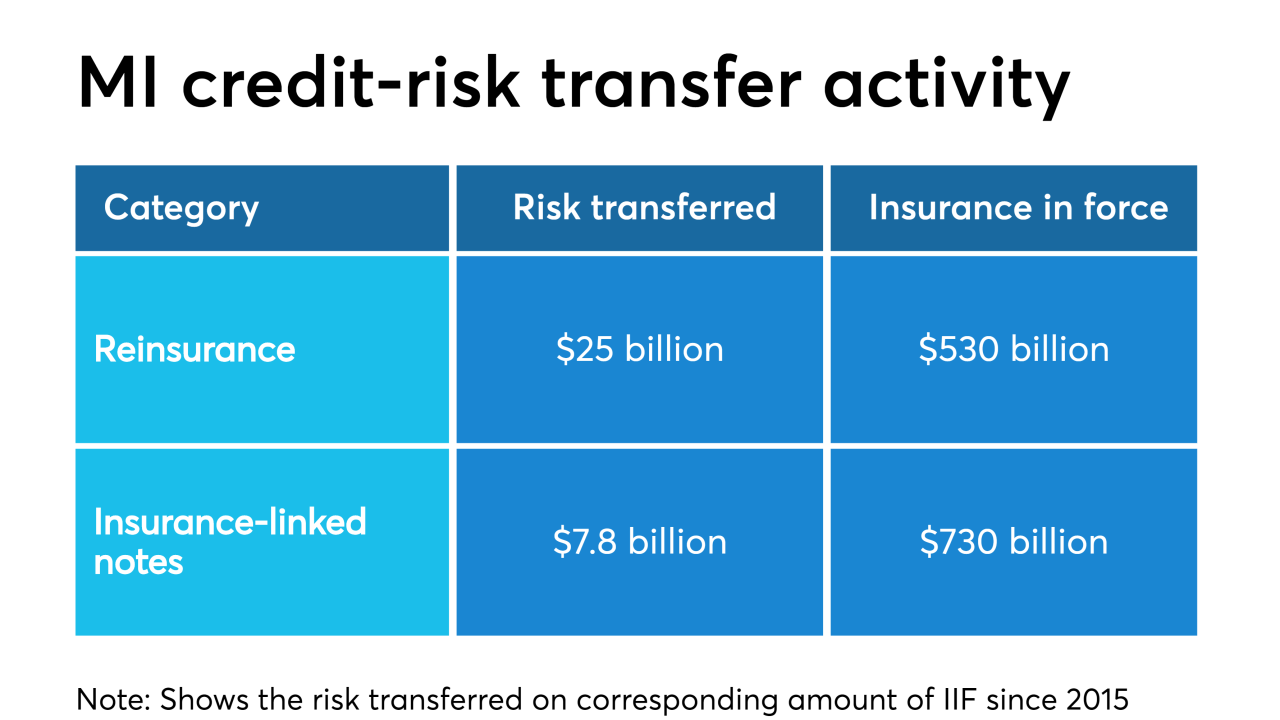

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

Mr. Cooper Group reported a second-quarter net loss of $87 million as the company took a $231 million fair value hit to its mortgage servicing rights portfolio.

August 1 -

Mortgage lenders might be feeling a little less stressed over False Claims Act actions being brought against them following recent headlines but there is still some work to be done before they can chill out.

July 2 -

The residential mortgages being reinsured are less risky, by several measures, than its previous deal; none of the borrowers have ever missed a payment.

April 11 -

This time, investors required Radian to hold on to the first 2.5% of losses it covers on the pool; by comparison, the insurer’s previous deal, Eagle Re 2018-1, had a lower “attachment” point of 2.25%.

April 3 -

Arch Capital’s next offering of credit risk transfer notes features heavy exposure to residential mortgages that have been modified by Fannie Mae or Freddie Mac.

March 1 -

Credit risk transfer does more than just reduce exposure to a downturn in the housing market. It also provides them with information about how others view mortgage credit risk.

February 27 -

The administration’s reported interest in having the White House aide run Fannie Mae and Freddie Mac's regulator signals a focus on constraining the mortgage giants’ role in the housing market.

December 10 -

The company’s first transaction, Eagle Re 2018-1, transfers a portion of the credit risk on approximately $36.3 billion of mortgages, according to Morningstar Credit Ratings.

November 2 -

Fannie Mae and Freddie Mac transferred a substantial amount of credit risk to the private sector through both single-family and multifamily market transactions in the first half of the year, with activity expected to rise in 2019, according to the Federal Housing Finance Agency.

November 1 -

The mortgages being reinsured are more seasoned than most other deals rated by Morningstar, which helps offset the risk of lower initial weighed average LTV.

October 17 -

Fannie Mae and Freddie Mac issued new capital requirements for private mortgage insurers that will create big swings in carriers' asset reserves.

September 27 -

Oaktown Re II is National Mortgage Insurance's first rated transaction, according to Morningstar; it reinsures $5.47 billion of policies on mortgages with a total balance of $30.12 billion.

July 18 -

A Fannie Mae test to handle the private mortgage insurance process for lenders may raise concerns that it's going outside the scope of its secondary market mission. But the effort reflects its mandate to explore new credit-risk transfer alternatives, a company executive said.

July 10 -

Freddie Mac and Arch Capital are testing a new form of risk-sharing deal to boost investor appetite for low down payment mortgages. But the pilot is raising concerns about "charter creep" because it dictates private mortgage insurance decisions typically made by lenders.

March 14 -

Essent Guaranty is marketing $360.75 million of notes linked to the performance of a pool of residential mortgages that it insures; its following in the footsteps of Arch Capital.

March 12 -

Participants at the Structured Finance Industry Group conference in Las Vegas say that future deals could be linked to the performance of jumbo, as well as conforming loans.

February 28 -

Fannie Mae's serious delinquency rate climbed to a high not seen since March 2017, but remained lower than it was 12 months prior.

January 2