Mr. Cooper Group reported a second-quarter net loss of $87 million as the company took a $231 million fair value hit to its mortgage servicing rights portfolio.

"The originations segment made a major contribution this quarter, posting record pretax profits of $118 million on record funding of $10 billion," said Chairman and CEO Jay Bray in a press release. "This strong performance is the result of several years of operational focus and technology investments, as well as the

In the first quarter,

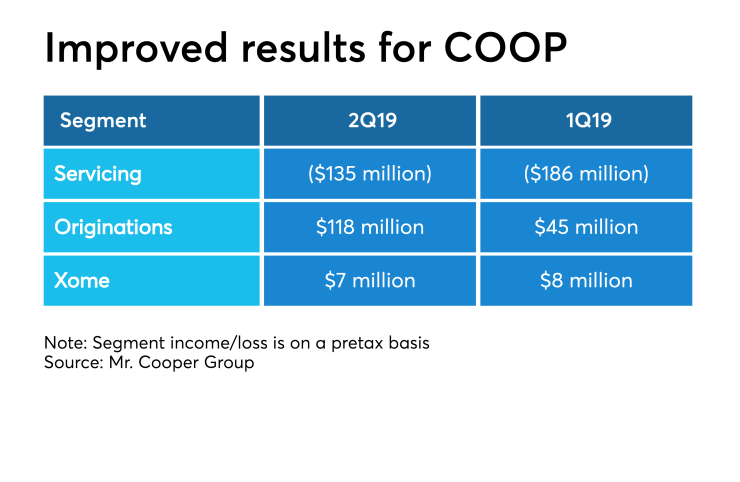

The mortgage originations segment had pretax income of $118 million for the quarter, as volume increased to just shy of $10 billion from $5.7 billion in the first quarter and $5.5 billion one year ago.

Xome's pretax income of $7 billion dropped slightly from $8 billion in the first quarter; that does not include $3 billion of intangible amortization in the second quarter.

However, the mortgage servicing unit took a pretax loss of $135 million, net of the mark-to-market valuation of the MSRs. Otherwise, it would have generated a pretax operating income of $96 million for the second quarter.

Separately, Radian Group earned $166.7 million in the second quarter, down from $208.9 million one year prior; but the year-ago results were enhanced by a $74 million tax benefit related to the company's settlement with the Internal Revenue Service.

"We wrote record-breaking levels of new mortgage insurance business which grew our in-force portfolio more than 9% to $231 billion, and we increased services segment revenues to $43 million," said Radian's CEO Rick Thornberry in a press release. "These results reflect the fundamental strength of our business model, the value of our customer relationships and the dedication of our entire team."

Radian's new insurance written totaled $18.5 billion, up 70% from $10.9 billion

Radian's mortgage insurance business had adjusted pretax operating income of $219.4 million, compared with $208.2 million in the first quarter and $

But its services business had a pretax operating loss of $3.5 million, an improvement over the $6.1 million loss in the first quarter and $6.4 million loss in the second quarter of 2018.

NMI Holdings, the parent of National MI, had net income of $39.1 million in the second quarter, up from $25.2 million one year ago.

Its NIW grew to $12.2 billion from $6.9 billion in the first quarter and $6.5 billion in the second quarter of 2018, a period that National MI elected to

"National MI again delivered record performance, including new insurance written of $12.2 billion, net premiums earned of $83.2 million, adjusted net income of $41.4 million and adjusted return-on-equity of 21.2%," said CEO

Arch Capital Group's mortgage insurance segment, which includes its U.S. primary MI business as well as its mortgage reinsurance operations, had underwriting income of $258.4 million, an increase of nearly 26% over $205.7 million one year ago.

However, unlike the other MIs that have reported so far, including