A strong housing market prior to the pandemic and the subsequent coronavirus-related moratorium helped to pull foreclosure activity down to historic lows in the first half of 2020, though that could all change soon, according to Attom Data Solutions.

Some 60% of Ally’s auto originations in the second quarter were used-vehicle loans, the highest percentage in the company's history.

The coronavirus relief law allows forbearance plans for up to a year on federally backed mortgages, but House Democrats say homeowners have had difficulty getting relief.

Bankers had asserted in April that they could handle a slump in oil prices tied to the coronavirus pandemic. Continued volatility, combined with declining collateral values and a rise in bankruptcies for exploration companies, is denting their confidence.

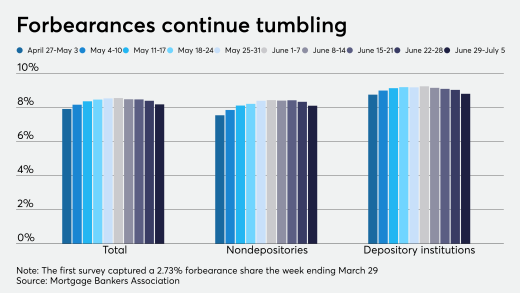

The number of loans going into coronavirus-related forbearance fell for the fourth consecutive week, as the growth rate plummeted 21 basis points between June 29 and July 5, according to the Mortgage Bankers Association.

The amount far surpassed that of any other servicer required to purchase Ginnie Mae-backed loans that were 90 days past due.

B. Riley FBR raised its ratings for both Fannie Mae and Freddie Mac to sell from neutral on the possibility the net worth sweep is declared illegal.

The Federal Reserve's extraordinary effort to keep credit flowing to companies during the COVID-19 pandemic is also shunting money to banks' bottom lines.

-

A strong housing market prior to the pandemic and the subsequent coronavirus-related moratorium helped to pull foreclosure activity down to historic lows in the first half of 2020, though that could all change soon, according to Attom Data Solutions.

July 17 -

Some 60% of Ally’s auto originations in the second quarter were used-vehicle loans, the highest percentage in the company's history.

July 17 -

The coronavirus relief law allows forbearance plans for up to a year on federally backed mortgages, but House Democrats say homeowners have had difficulty getting relief.

July 16 -

Bankers had asserted in April that they could handle a slump in oil prices tied to the coronavirus pandemic. Continued volatility, combined with declining collateral values and a rise in bankruptcies for exploration companies, is denting their confidence.

July 13 -

The number of loans going into coronavirus-related forbearance fell for the fourth consecutive week, as the growth rate plummeted 21 basis points between June 29 and July 5, according to the Mortgage Bankers Association.

July 13 -

The amount far surpassed that of any other servicer required to purchase Ginnie Mae-backed loans that were 90 days past due.

July 13 -

B. Riley FBR raised its ratings for both Fannie Mae and Freddie Mac to sell from neutral on the possibility the net worth sweep is declared illegal.

July 13