For the fourth straight week, the rate of loans in forbearance diminished at nearly triple the pace

The rate of mortgages going into coronavirus-related forbearance plummeted 21 basis points — the largest drop by far since the pandemic started — between June 29 and July 5, according to the Mortgage Bankers Association.

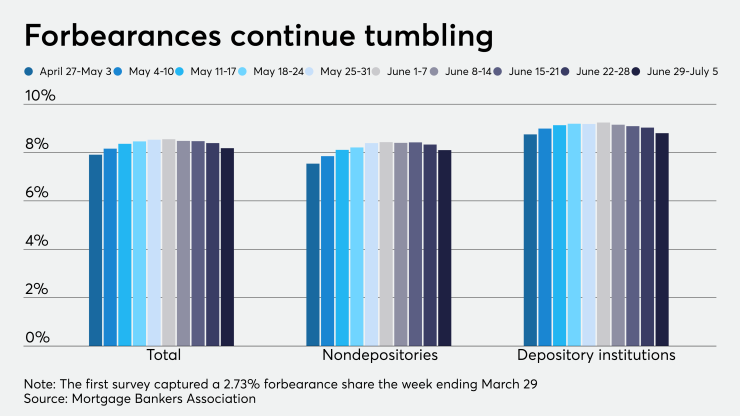

About 8.18% of all outstanding loans or an estimated 4.1 million mortgages sat in forbearance plans at the beginning of July, compared to 8.39% and almost 4.2 million in the MBA's report the week before.

The share of loans in forbearance at independent mortgage bank servicers dropped to 8.1% from 8.33% over that period. Depositories fell to 8.8% from 9.03%.

"The share of loans in forbearance continues to decrease, as more workers are brought back from temporary layoffs. However, our survey reveals a notable shift in the location of many FHA and VA loans, which have been

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

The two states' combined plans amount to over $1.5 billion of the Homeowner Assistance Fund included within the American Rescue Plan Act , which was passed a year ago.

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

The resulting drop in forborne

The share of conforming mortgages — those purchased by Fannie Mae and Freddie Mac — in forbearance decreased to 6.07% from 6.17%. Forbearance requests as a percentage of servicing portfolio volume inched up to 0.13% on July 5 from 0.12% on June 28. Call center volume as a percentage of portfolio volume increased to 7.8% from 6.8%.

"Forty-three percent of loans in forbearance are now in an extension following their initial forbearance term, while more than 10% of borrowers entered into a deferral plan to exit forbearance — down from 16% the week prior," Fratantoni said. "For those exiting forbearance over the next several months, we expect to see many of the borrowers with GSE loans to utilize the deferral option."

The MBA's sample for this week's survey includes a total of 50 servicers including 28 independent mortgage bankers and 20 depositories. The sample also included two subservicers. By unit count, the respondents represented nearly 76%, or 38.1 million, of outstanding first-lien mortgages.