A new report on bank-held commercial real estate and C&I loans indicates troubled borrowers may be skipping payments on loans they won't be able to refinance or extend over the next year, leading to a potential wave of defaults over the next four to six quarters.

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

Legislation favorable to the industry would be unlikely to pass in a divided Congress, but the biggest benefit for banks and credit unions of Republicans' retaining control of the chamber would be defending against the disruption of a Democratic blue wave.

Liberty Lending, Upstart Network and Regional Management Corp. are looking to price bonds backed by pools of unsecured consumer loans, amid market worries about the sectors' potential challenges during the COVID-19 outbreak.

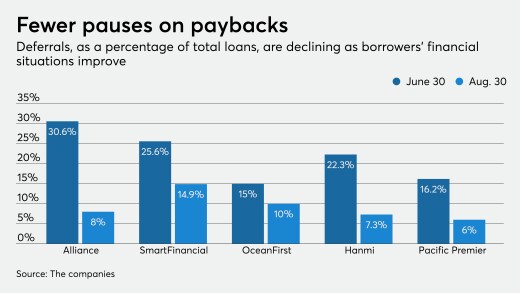

More consumer and commercial borrowers are paying their loans, increasing the likelihood that charge-offs will be manageable for banks despite the ongoing pandemic.

The Senate Banking Committee met Wednesday to review central bank lending facilities such as the Main Street Lending Program, which provides bank-issued loans to middle-market firms. But some lawmakers on the panel said the focus of pandemic relief has been misplaced.

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

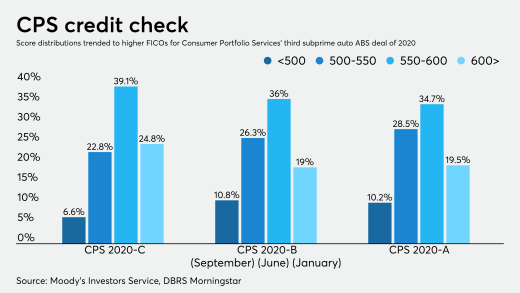

Both Moody's and DBRS Morningstar project elevated credit-loss levels for the auto lender, compared to prior deals, due to COVID-19 uncertainties

-

A new report on bank-held commercial real estate and C&I loans indicates troubled borrowers may be skipping payments on loans they won't be able to refinance or extend over the next year, leading to a potential wave of defaults over the next four to six quarters.

September 15 -

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15 -

Legislation favorable to the industry would be unlikely to pass in a divided Congress, but the biggest benefit for banks and credit unions of Republicans' retaining control of the chamber would be defending against the disruption of a Democratic blue wave.

September 14 -

Liberty Lending, Upstart Network and Regional Management Corp. are looking to price bonds backed by pools of unsecured consumer loans, amid market worries about the sectors' potential challenges during the COVID-19 outbreak.

September 14 -

More consumer and commercial borrowers are paying their loans, increasing the likelihood that charge-offs will be manageable for banks despite the ongoing pandemic.

September 11 -

The Senate Banking Committee met Wednesday to review central bank lending facilities such as the Main Street Lending Program, which provides bank-issued loans to middle-market firms. But some lawmakers on the panel said the focus of pandemic relief has been misplaced.

September 9 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8