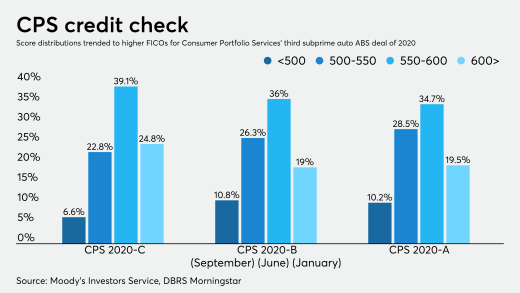

Both Moody's and DBRS Morningstar project elevated credit-loss levels for the auto lender, compared to prior deals, due to COVID-19 uncertainties

Fintech lenders that reported a surge in missed payments at the start of the pandemic have seen credit quality rebound substantially since. But credit performance could still deteriorate if high unemployment persists and Congress fails to enact more relief measures.

Global trade is sinking while the pandemic interrupts international port and shipping activity. But securities backed by marine-cargo container fleets and leases have bombarded the securitization market this summer.

Two bills — one providing relief from a loan accounting standard and another extending forbearance measures — would collectively contain credit losses.

The captive-finance arm of General Motors is the first automotive lender this year to launch a securitization to finance inventories as dealerships rebound from COVID-19-related economic stresses.

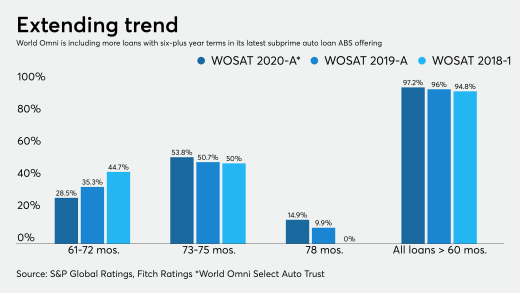

The share of 78-month loans is at 14.9%, compared to approximately 10% in World Omni's previous issuance from its subprime/nonprime shelf.

Individuals who received a coronavirus stimulus check earlier this year also qualify for the protection, as do couples who jointly file their taxes and expect to earn less than $198,000.

More than $1 billion in coronavirus relief went to small businesses that received multiple loans and a congressional subcommittee analyzing the Paycheck Protection Program says it has seen evidence of fraud in thousands more loans.

-

Both Moody's and DBRS Morningstar project elevated credit-loss levels for the auto lender, compared to prior deals, due to COVID-19 uncertainties

September 8 -

Fintech lenders that reported a surge in missed payments at the start of the pandemic have seen credit quality rebound substantially since. But credit performance could still deteriorate if high unemployment persists and Congress fails to enact more relief measures.

September 8 -

Global trade is sinking while the pandemic interrupts international port and shipping activity. But securities backed by marine-cargo container fleets and leases have bombarded the securitization market this summer.

September 8 -

Two bills — one providing relief from a loan accounting standard and another extending forbearance measures — would collectively contain credit losses.

September 4

-

The captive-finance arm of General Motors is the first automotive lender this year to launch a securitization to finance inventories as dealerships rebound from COVID-19-related economic stresses.

September 3 -

The share of 78-month loans is at 14.9%, compared to approximately 10% in World Omni's previous issuance from its subprime/nonprime shelf.

September 2 -

Individuals who received a coronavirus stimulus check earlier this year also qualify for the protection, as do couples who jointly file their taxes and expect to earn less than $198,000.

September 1