-

In a tough quarter for the auto industry, the Detroit-based lender posted earnings that sped past Wall Street's expectations.

October 17 -

The digital-only bank has adopted machine learning to process loans faster, more accurately and with better fraud detection than in the past.

May 5 -

Executives from a half-dozen major financial institutions avoided detailed commercial lending forecasts and gave a mixed outlook on consumer credit at an industry conference. And they called on Washington to pass an aid package targeted at the most troubled business sectors as soon as it can.

November 5 -

The captive-finance arm of General Motors is the first automotive lender this year to launch a securitization to finance inventories as dealerships rebound from COVID-19-related economic stresses.

September 3 -

Over 236,000 prime and subprime vehicle-loan borrowers received payment deferrals of between 30 and 120 days during the early economic turmoil of the coronavirus pandemic, according to the ratings agency.

May 4 -

According to Moody's, Ally's latest auto-loan ABS will not require the issuer to repurchase loans with modified terms or maturities.

December 3 -

According to Moody's, Ally's latest auto-loan ABS will not require the issuer to repurchase loans with modified terms or maturities.

December 2 -

The $1.11 billion Ally Auto Receivables Trust (AART) 2019-2 deal has three classes of senior term notes with early AAA ratings by S&P Global Ratings and Fitch Ratings.

May 30 -

Both S&P and Moody's have cut expected losses on $732 million deal, yet credit enhancement on the senior tranches is unchanged from the prior deal.

October 22 -

The Series 2018-3 consists of five tranches of fixed-rate, two-year notes and the Series 2018-4 consists of five tranches of floating-rate, three-year notes.

August 3 -

The concentration of loans with terms of 73-75 months has breached 13%, after ranging from between 10-12% from five previous AART issues since 2016.

June 18 -

Record originations on "better-yielding" used-car loans helped drive a 14% increase in its first-quarter profit. But Ally's shares were down Thursday on concerns of rising deposit costs.

April 26 -

The performance of outstanding transactions issued via the Capital Auto Receivables Trust platform is weakening, so rating agencies are demanding additional investor protections.

March 8 -

The Detroit company recorded an 11% increase in car loans and leases originated during the fourth quarter, as well as a jump in yields. Ally appears to be benefiting from Wells Fargo's substantial retrenchment in auto lending.

January 30 -

The first prime auto-loan securitizations for Ally Bank and captive-finance lenders for Toyota and Ford total $3.5-$4B, according to rating agency presale reports.

January 18 -

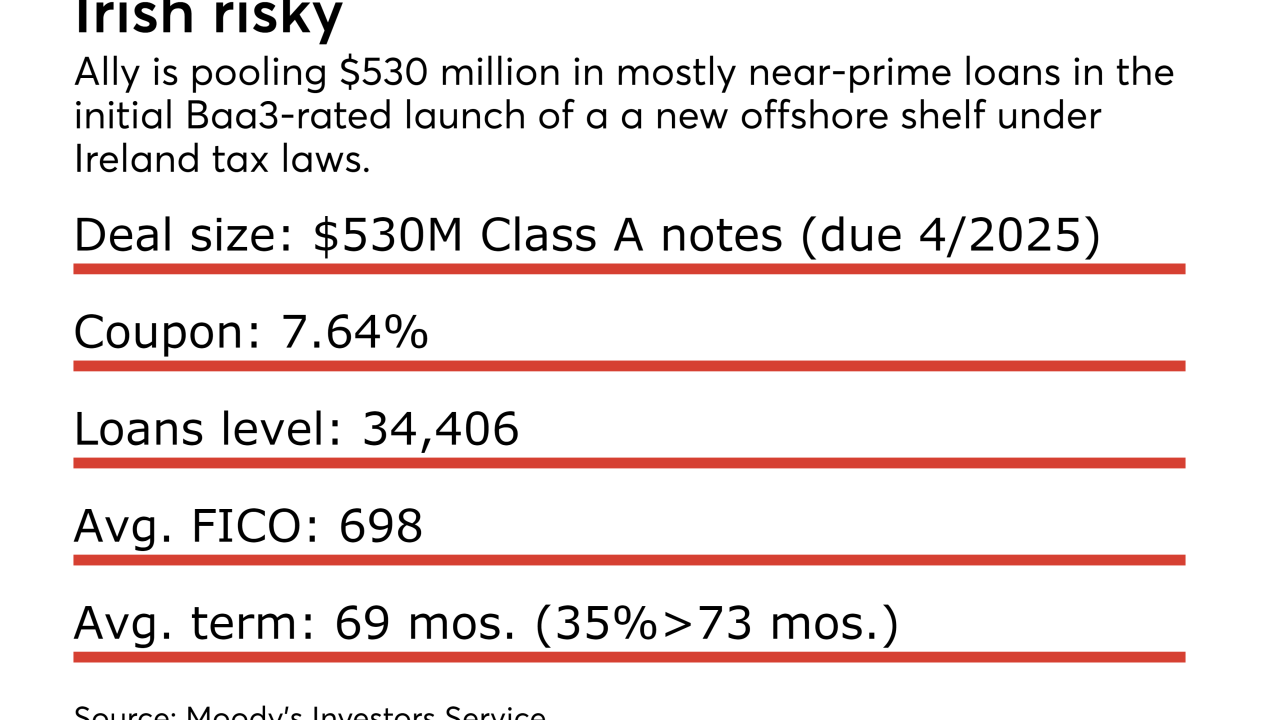

Juniper Receiveables DAC, a new offshore shelf for Ally U.S. auto-loan receivables, has received an early 'Baa3' rating from Moody's Investors Service on its initial $530 million issuance.

November 14 -

The commitments were the residue of restrictions that were placed on Ally in the wake of government bailouts in 2008 and 2009.

August 22